One Billion People, One Billion Opportunities

Indian economy has been rapidly growing over the past decade or so, and along with those of other BRICS nations, is poised to account for a significant share of global economic growth going forward

Maintaining a heady growth rate in one of the world’s three largest economies is proving to be a formidable challenge. This author describes the forces that have powered India’s economy over the last 20 years, and as readers will learn, he also explains how a new business model and innovative thinking can re-charge what appears to be an economy that has plateaued.

It is a well-known fact that the growth of an organization is closely linked not only with the life cycle of the industry in which it operates but also with its economic environment. However, more than the “quantum” of growth, it becomes imperative to understand the “context” of growth. The context of growth extends beyond the economic domain to the social environment and is directly related to the lifecycle of the economy. Only when the latter is understood and factored into the “crystal ball gazing” process can an organization create a roadmap for it’s future.

This is especially true for India. It is generally well known that the Indian economy has been rapidly growing over the past decade or so, and along with those of other BRICS nations, is poised to account for a significant share of global economic growth going forward. Two questions, however, have been relatively under-explored: Just what is the context of this growth, and what does it mean for your particular industry? This article will seek to answer these questions.

India’s two phases of growth

India’s growth since independence can be divided into two distinct phases, the pre 90’s era and the post 90’s era.

The Pre 90’s

During this phase the Indian economy was highly controlled, and wealth and power were concentrated in the hands of a few large family-business houses. We lived in a socially restrictive society governed by the license Raj, which was characterized by excessive bureaucracy and demanded that an organization obtain several licenses and approvals before it could do business. Any import that entailed an outflow of foreign exchange was intensely scrutinized, which in turn lead to a huge focus on self-reliance and import substitution. There was a shortage of even basic necessities such as food and routine activities such as getting a telephone connection or cooking gas; even buying a car was considered a “luxury” that involved a waiting period that could run into years. Moreover, consumerism was an alien concept for Indian society.

Such was the context in which corporate India operated for decades. The economy witnessed what is commonly called the “Hindu” rate of annual GDP growth of ~ 3.5 percent. The rate of growth of organizations was determined not by skill, opportunity, risk taking or resources, but by relationships and connections, which were the most important currencies for conducting business.

The result was inevitable. Per-capita income growth averaged 1.3 percent. In 1991, just before the dismantling of the Raj regime, India faced a balance of payments crisis. It was on the verge of defaulting on its loans and had to sell 67 tons of gold to the International Monetary Fund (IMF) as part of a bailout deal.

Post 90’s

This period saw a rebirth of sound, dynamic Indian economic policy. The Licence Raj was eliminated, the government initiated reforms and the concepts of Glasnost and Perestroika were no longer frowned upon. The primary focus shifted from import substitution to export promotion, as India adopted liberal and free-market- oriented policies and opened its doors to international trade. Interest rates were reduced and public monopolies were ended, allowing Foreign Direct Investment in many sectors. A process for Single Window Clearance was set up and though not comparable to international standards, it was a far cry from the days of the Licence Raj.

Suddenly, it seemed, having a population of one billion went from being a liability to being seen as a huge market. As of 2009, an estimated 390 million Indians belonged to the middle class, all of the major brands of consumer goods began setting up shop. There was a huge focus on improving education, which enabled almost two-thirds of the population to become literate.

In this context, growing an organization took on a completely different meaning. Now it was all about opportunity, resources, first-mover advantage and risk-taking capability. New industries were started and companies began following new business models, something that was unthinkable even a decade back. Globally competitive organizations emerged and there were several success stories of organizations moving beyond their core competence and making it big.

Let us look at a few examples of industries that saw explosive growth post 90’s.

India IT and ITES Industry

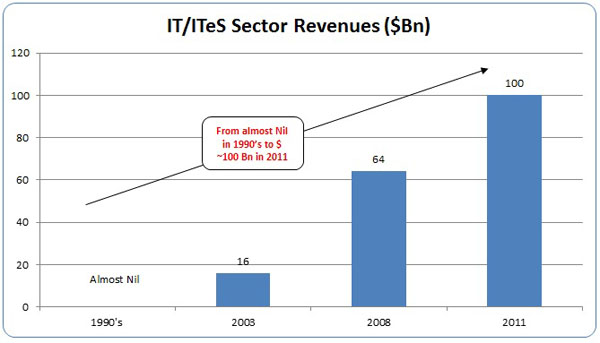

From almost nothing in 1990, revenue for the Indian IT and ITES (Information Technology Enabled Services) industries has grown to more than $US100 B in 2011. As is well known, India has been a major driver and “the largest player” in the offshore delivery world.

The context of this growth was the huge labour cost advantage between India and the developed world. India always had a talented pool of human resources and when global markets opened, it provided the human capital for IT / ITES. Indian organizations went ahead and pro-actively pitched global corporations on the inherent cost savings in outsourcing their IT needs to India. The industry grew rapidly for over a decade and achieved scale, as can be seen from the chart below.

Source – CII and Indian Brand Equity.

Today, as the industry reaches maturity, the context of growth has changed again. As wage rates have been steadily increasing in India, the labour cost advantage has steadily been eroding. From plain-vanilla outsourcing of basic voice or work (for BPO space) and back-office type of work, many of the IT majors are moving up the value chain to offer higher-margin services. Recent acquisitions by Indian majors signal their intent to get into consulting and niche service offerings, wherein the labour arbitrage can be maintained.

Telecom in India

What happened in the IT / ITES space in India in the 90s repeated itself in the telecom space in the first decade of the new millennium. From a virtually non-existent subscriber base, India has become one of the largest telecom markets in the world, with over 800,000,000 subscribers and more than 18 million subscribers added every month. Telecom has emerged as the prime engine of economic growth, contributing to nearly 2 percent of the Indian GDP. The industry now has an annual growth rate of 26 percent and revenues of US$68 Billion.

Source – Source -http://www.businessreviewindia.in/technology/software/-telecom-industry–indias-success-story

Note – 2011 Numbers are till April 2011

Growth in the telecom sector is also the result of the successful adaptation of the Henry Ford Growth Model. It is commonly believed that Ford mass produced so that he could cut prices. In reality, he cut prices first, betting that such a move would create a massive working class who would then rush to buy the iconic horseless carriages, which would subsequently enable mass production.

In the Indian context, Bharti Airtel (India’s largest service provider) did something similar by drastically reducing prices, and taking the offering to the middle class and even those below. The intent was to capitalize on the reality that having a cell phone was no longer a matter of convenience; it had become a source of income- generation opportunity for hundreds of millions of Indians, the mechanics, drivers, handymen and other itinerant workers who no longer needed a fixed destination where they could be reached. They could be contacted on their cell phone, whose call charges were kept at rock bottom prices, thereby increasing penetration levels. The result was an unprecedented adoption of the cell phone as the primary means of communication.

As the industry approaches maturity (after all there is only so many new subscribers you can get), the context of growth is changing once again. In place of subscriber / month, metrics such as average revenue / user have become important. Service providers are vying with one another to move their customers up the value chain and are developing newer applications, offering new services to retain customers and gain share.

But just the way the 90s belonged to IT / ITES and 2000s belonged to the telecom sector, the question today is whether or not the context of growth is ripe for the emergence of another sunrise sector, namely solar.

Solar in India

India’s economy is growing at a rate of 6 percent, with GDP standing at an impressive $1.9 trillion. The only impediment to India’s growth is the power scarcity in the country. India faces a peaking power deficit (a shortage of available power versus actual demand) of ~10-16 percent, which is expected to grow in the medium to long term. More than 60 percent of rural households don’t have access to electricity. To continue the growth story, power-generation capacity needs to be increased substantially, from the present 200 Gigawatt to more than 400 Gigawatt by 2020. In this context, solar energy offers a unique proposition

A possible solution?

India has 300+ clear, sunny days and on average receives 70 percent more solar radiation than Germany, a world leader in solar energy. Yet Germany has an installed base of ~ 25 Gigawatts of solar vs. only 1 Gigawatt in India.

Against this backdrop, the government launched a very ambitious solar policy in January 2010. Since then, the market has grown exponentially.

Source – Ministry of New and Renewable Energy India

Note – 2012 Numbers are till July 2012

As the solar industry takes a breather from the scorching pace set over the last 2 years, and as India’s growth slows down to ~ 6 percent from the over 8 percent witnessed in the later part of the last decade, the questions that face the solar industry are these: Is the context of solar industry growth still relevant? Is the current breather just an aberration or does the industry need to find newer business models to build on the growth momentum?

The context of growth for the solar sector till now has been built on two pillars — policy-driven growth wherein the sector is provided a subsidy, and access to long-term bank financing, since solar assets typically have a residual life of 25 years or so. The latter is especially relevant as the Indian fiscal deficit continues to reach new highs, forcing the industry to decide if a program which is a cost to the exchequer, such as capital subsidies or generation-based incentives, is acceptable as a long-term solution. Will banks continue to provide project-based finance to solar farms or given the recent policy imbroglio over power-sector financing, will access to solar finance also get curtailed?

Does solar have a future?

Will the solar industry in India continue to witness the hockey-stick-shaped growth it has seen this decade or has the context of growth shifted again, thereby necessitating the adoption of newer business models?

The answer again lies in segmenting the market and examining the context of growth. At one end of the spectrum are the large, multi-megawatt, grid-connected solar farms. The cost of solar power generation today has come down drastically and is around ~ Rs 8/unit (~ 15 cents/unit), or at par with conventional fossil fuel- based power in many provinces. Therefore, many organizations are developing plans to target state governments where solar is already competitive with fossil-based power, which is independent of policy support. Fossil-fuel based power is only going to get more expensive in the future, and therefore solar can and will sell without policy support.

This brings me to the other end of the spectrum. Is there life for solar in the non-ground mounted, non-grid connected segment, a hitherto under-explored segment? Are there any business models that are interesting in this space?

Solar, worldwide is about substitution. It’s about substituting fossil-fuel-based power with clean power. In India, it’s as much about substitution as it is about access, since two-thirds of rural households don’t even have access to electricity. Imagine the opportunity and revolution this can spark if economically viable business models are created to cater to this bottom-of-the-pyramid segment. Imagine the changes in quality of life, education and even business opportunities that will emerge for rural India once it has access to power.

Some organizations are taking a very serious look at this segment and developing tailor-made solutions. Let’s look at a few.

Community-owned Micro Grid: In this example, a village / community can co-own a small 25 KW mini-grid system to provide basic lighting and also spare some energy for commercial use. This system could power the basic needs of 150 households for 5 hours. Can a solar operator train and build capacity at grass roots level for the sale of such system to the community (~ $90,000)? Various pricing models, depending upon the ability to pay can be worked out here.

Pay-per-use model: This is the equivalent of a solar-in-a-sachet model. Electricity could be commoditized with small charges available for recharge, as per usage norms. The intention here is to lower the ticket size and offer packs of, say, 20 /Rupees (about 35 cents), 50 / Rs , 100/Rs per unit. When the balance is drawn down, power would be shut down, forcing the customer to visit his or her local retailer for a recharge.

Rental model: Here, a local village entrepreneur or businessman can own a small charging station plus, say, 10 solar lanterns. He or she could rent a lantern out on a daily charge of Rs 5 (~ 9 cents), and when the charge runs out, the customer returns the lantern and rents out another fully charged lantern. This could also be similar to the Netflix model, wherein a customer pays a monthly amount, returns the old film and borrows a new one.

Standardization of applications. Here, an attempt can be made to pre-configure solar offerings for several standard applications such as telecom tower, petrol pumps, etc. so that installation time and cost can be reduced. Essentially this becomes a plug-and-play model.

In each of the above cases, the key question that needs to be borne in mind is this: “What is the cost of the next best alternative?” Since most of these rural areas don’t have access to electricity — and even those that do have access face hours of power outages — there is no next, best alternative. And even when there is, the next best alternative is diesel, which is not only an expensive proposition (diesel-based solutions cost anywhere between Rs 20/unit to Rs 40/unit, depending upon location and usage) but is also not environmentally friendly. The only advantage that diesel has is that it’s easily available. But while the upfront cost is low, on-going costs are high.

Similarly, there are dozens of business models that are in various stages of infancy and will be scaled up by various industry incumbents over the next several years. There will be a process of change, wherein the solar sector will see some consolidation, some new entrants will come in and a few large players will emerge.

The organizations that will make the most of this opportunity are those that are able to see the context of the growth opportunity and able to create economically viable and scalable business models around that. Similar opportunities exist not just in solar, but in several other sectors as well. One billion people equal one billion opportunities. Only two things must be in place for this equation to work: The growth context must be clearly understood and appropriate business models must be created.

Reprint from Ivey Business Journal

Reprint from Ivey Business Journal

[© Reprinted and used by permission of the Ivey Business School]