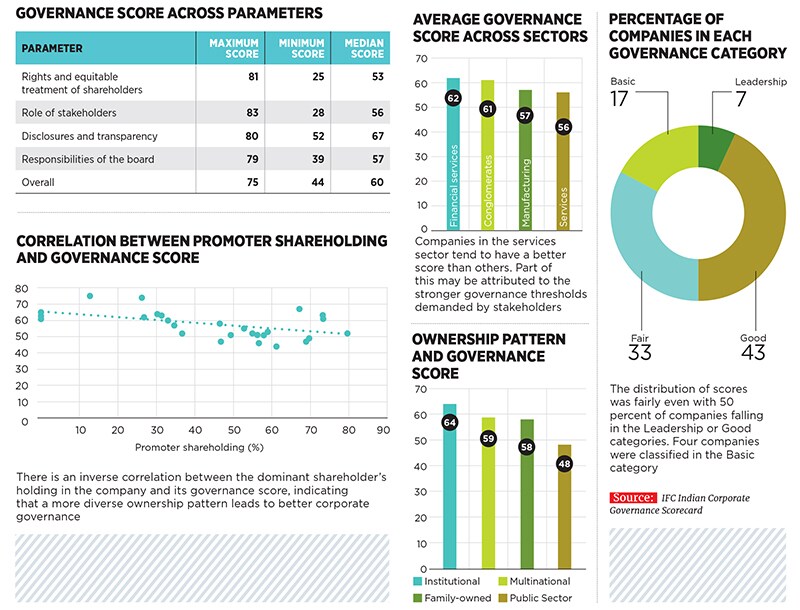

IFC's Indian Corporate Governance Scorecard

IFC study finds that the higher a promoter's stake, the lower its score

Image: Getty Images

The maturing investment landscape in India has seen the rising importance of corporate governance in the minds of investors. The proliferation of proxy firms—which advise minority shareholders on which way to vote on business decisions—is testimony to the importance investors are giving to the values a company represents.

To help companies evaluate their own standard of corporate governance and devise strategies to improve it, International Finance Corp (IFC)—a member of the World Bank Group—in collaboration with proxy firm Institutional Investor Advisory Services (IIAS) and BSE launched an Indian Corporate Governance Scorecard in December 2016. Using this tool, companies can evaluate themselves on various parameters; this evaluation can be verified by an independent third party as well.

Between March and November 2016, IFC conducted a preliminary evaluation of the 30 largest companies (by market value), which form the Sensex. The evaluation was conducted in association with BSE and IIAS.

Its key finding is that a company’s governance score is inversely related to the dominant shareholders’ equity holding. To put it simply, the higher a promoter’s stake in a company, the lower its governance score.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

X