Jet take off faces Etihad hurdle

With Etihad Airways accumulating losses of over $3 billion, there is growing doubt about whether it would want to pilot Jet Airways

Image: Shutterstock

Image: Shutterstock Naresh Goyal, 69, who is synonymous with commercial aviation in India with his full-service airline Jet Airways, has his back against the wall. Reason: Abu Dhabi-based Etihad Airways, which owns 24 percent stake in Jet Airways and is believed to be looking to infuse more money in the Indian carrier, is in financial distress. “Everybody is talking about Etihad [Airways] this and Etihad that, but nobody is talking about the fact that the airline declared a $1.5 billion loss [in 2017],” says Devesh Agarwal, editor, bangaloreaviation.com.

Etihad Airways, which in terms of size and scale of operations is smaller than neighbouring rivals Emirates and Qatar Airways, had in 2016 posted a loss of nearly $2 billion. Besides the losses, its investments in European airlines such as Air Berlin and Alitalia failed to deliver returns.

Talks of infusing capital into Jet Airways between Goyal, Etihad Airways and the consortium of lenders led by State Bank of India are going on, but confidential.

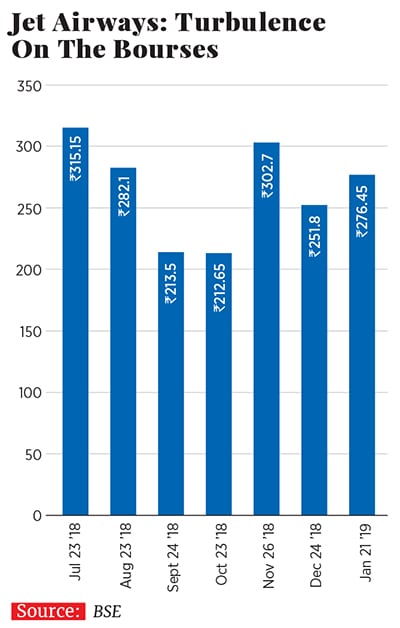

Reports suggest Etihad Airways is willing to invest in Jet Airways by purchasing additional shares of the airline at ₹150 apiece, which is a 43 percent discount on the airline’s current share price of ₹265 and 51 percent discount on its six-month average share price.

In an email statement to Forbes India, a spokesperson of Etihad Airways said the airline “does not comment on rumour or speculation”. Jet Airways declined to comment on the talks.

“The chauffeur service [for premier class travellers] has gone away and small things such as pyjamas in the business class have gone. The lounge experience is no more the same, with cutbacks to catering and facilities, and in many cases them selling out the whole lounge to a different operator,” Awtaney tells Forbes India. The airline has also cut down on its flights to key US cities such as New York and San Francisco and trimmed its operations to Southeast Asia.

Given Jet Airways’ debt of ₹8,000 crore, its piling losses, inability to pay interest on loans, fully pay the salaries to key staffers like pilots and engineers, would Etihad Airways want the pilot’s seat? “Etihad is in a severe containment mode,” says Agarwal. “Gulf carriers aren’t cash rich that they can easily bail out Jet Airways.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

X