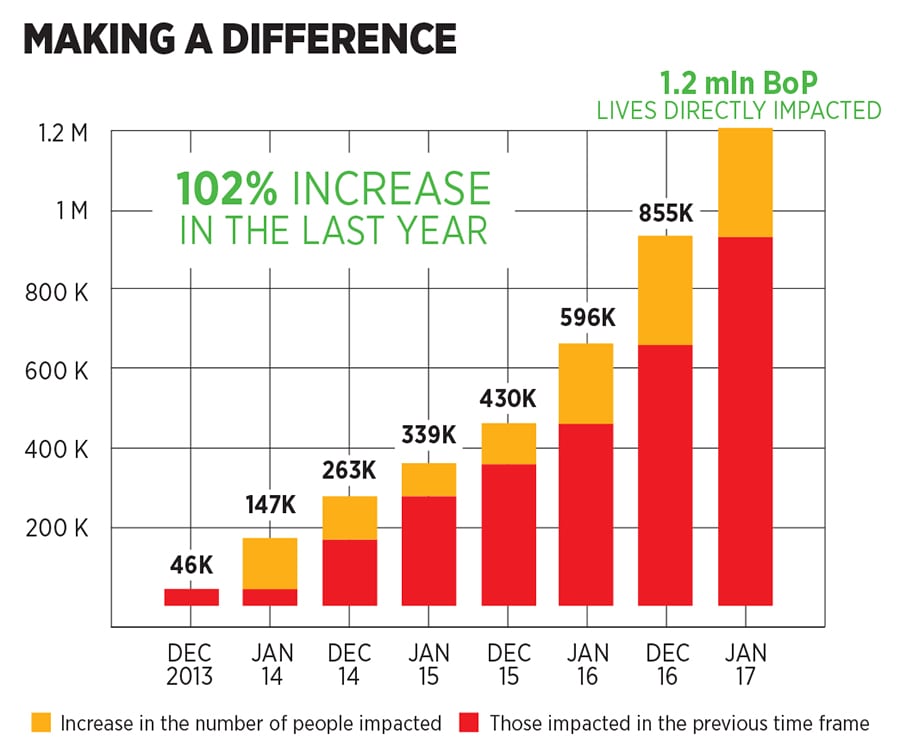

Unitus Seed Fund's investees touch 1.2 million lives in India

The social impact investment firm's first fund, of $23 million, helped 14 investee startups create real jobs, find financial stability and expand the ecosystem

Image: Shutterstock

With its investments in the 14 startups in its active portfolio, Unitus Seed Fund, a leading social impact investment firm, has improved the lives of over 1.2 million people at the bottom of the pyramid (BoP).

In a mid-year report released in September, the firm—led by Dave Richards, Will Poole, both co-founders and managing partners, and Srikrishna Ramamoorthy, partner—revealed that over four-and-a-half years (from 2013 when Unitus started its investments), its 14 active investee companies have impacted people across 29 states, creating over 6,200 sustainable, quality jobs. In doing that, the companies have registered a 106 percent year-on-year growth in revenues and raised 3.6x additional capital since Unitus’s initial investments. Unitus had initially invested $23 million in 23 companies (selected from a long list of 2,500), of which nine are off the portfolio due to exits and write-offs.

“The one million landmark is significant for the entire investing ecosystem: We’ve now shown the scale of impact a seed-level fund can achieve in a short span of four-and-a-half years,” Poole writes in the report.

The report also says that Unitus has aligned its outcomes with some of the Sustainable Development Goals (SDGs) laid down by the United Nations (UN), calling it a “first-of-its-kind move within the Indian investment ecosystem”.

Aligning with UN goals means that investors get a standardised framework for any participant—donors, traditional or impact investors, non-profits, philanthropists and social-impact businesses—to track cumulative progress against targets. That, in turn, makes it easier to channelise money to meet the twin objectives of maximum impact and market-rate financial returns.

Among the companies are grassroots interventions such as Hippocampus Learning Centres, which has recruited and trained local teachers to impart formal kindergarten education in villages, and mobile internet-based services such as DriveU, a driver-on-demand business for people who’d rather be driven in their own cars.

Unitus has also backed hi-tech innovation in health care, with ventures such as UE LifeSciences, which is commercialising a highly portable non-invasive breast scan device to help detect signs of breast cancer. UE LifeSciences has also won the backing of Kiran Mazumdar-Shaw, founder of biopharma company Biocon.

The firm is currently raising its second fund of $50 million and plans to back between 25 and 30 startups in education, health care and financial technology by 2021.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

X