Inside Zetwerk's ambition of becoming a global manufacturer

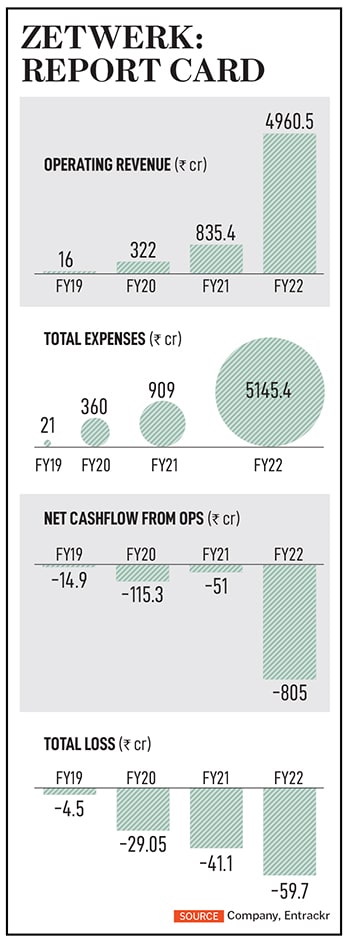

Over the last five years, manufacturing services firm Zetwerk has leveraged niche opportunities to grow its revenues 310 times. Now it is finetuning its business model to look beyond India

(From left) Ankit Fatehpuria, co-founder, Vishal Chaudhary, co-founder, Amrit Acharya, co-founder & CEO, Srinath Ramakkrushnan, co-founder & COO, Rahul Sharma, co-founder, Zetwerk

Image: Selvaprakash Lakshmanan for Forbes India

(From left) Ankit Fatehpuria, co-founder, Vishal Chaudhary, co-founder, Amrit Acharya, co-founder & CEO, Srinath Ramakkrushnan, co-founder & COO, Rahul Sharma, co-founder, Zetwerk

Image: Selvaprakash Lakshmanan for Forbes India

In 2018, four IIT graduates got together to build a marketplace for custom manufacturing to connect SMEs with mid-large original equipment manufacturers (OEMs) operating across a range of industrial sectors. Soon, the manufacturing services platform expanded its footprint to the US, Mexico, and the Middle East. About three years after it received seed funding of $1.5 million from Kae Capital and Sequoia Capital in August 2018, the company hit the $1 billion valuation mark to become the 25th unicorn of 2021.

This is the meteoric rise of Zetwerk and its five founders Amrit Acharya, Srinath Ramakkrushnan, Rahul Sharma, Vishal Chaudhary and Ankit Fatehpuria, a story that started with a shared interest for solving some of the imbalances in the largely unorganised manufacturing ecosystem.

Acharya, co-founder and CEO, had enjoyed the experience of handling supply chains at ITC for four years, and his friend Ramakkrushnan, co-founder and COO, had a small family-owned manufacturing unit and was familiar with the ins and outs of the industry. “We basically explored what we had done before. It came together organically even though it was an unusual venture,” says Acharya.

The founders started out from a one-bedroom apartment in Bengaluru. Zetwerk was initially conceptualised as a SaaS platform, but within months switched to become a manufacturing marketplace to leverage opportunities better. This move helped the company tap into niche openings arising from the disruption of global supply chains due to the pandemic and the rising hostility between China and the US. In a way, again, there is an underlying shift as the company seems to be transitioning from a “manufacturing services platform” to a “global manufacturer”.

Zetwerk declined to share order book, global and domestic supply chain partners, customers, and specific financial details requested. Its website lists six partners and customers including Bhel, Tata Steel, and Sterling & Wilson, but it claims to have over 1,800 active customers in more than 20 countries. It says it has manufactured over nine million parts for a wide range of industries comprising transportation, industrial machinery and equipment, consumer products, electronics, apparel and textiles, construction and infrastructure, energy and utilities, aerospace and defence. In April 2022, it won the contract to supply fabricated girders for the bullet train project.

The company’s steepest growth curve came about around the pandemic as the company quickly regrouped to address gaps in supply linkages for manufacture of industrial and consumer goods. “So, while initially it was a little bit challenging, I think the business definitely became sharper and better. We have almost done 15 to 20 times more business. I think it was because we were at the right place at the right time and also because the business model was extremely efficient and streamlined at all times,” reflects Acharya on how they turned a crisis into an opportunity.

The company’s steepest growth curve came about around the pandemic as the company quickly regrouped to address gaps in supply linkages for manufacture of industrial and consumer goods. “So, while initially it was a little bit challenging, I think the business definitely became sharper and better. We have almost done 15 to 20 times more business. I think it was because we were at the right place at the right time and also because the business model was extremely efficient and streamlined at all times,” reflects Acharya on how they turned a crisis into an opportunity. “For customers, it is a Zetwerk seal of assurance on quality, price, and timely delivery. Customers like us because they find us reliable. When they give an order to us, it gets delivered on time with no issues with quality and there’s a very strong customer service in terms of providing transparent updates similar to how you order stuff on ecommerce platforms like Amazon,” he adds.

“For customers, it is a Zetwerk seal of assurance on quality, price, and timely delivery. Customers like us because they find us reliable. When they give an order to us, it gets delivered on time with no issues with quality and there’s a very strong customer service in terms of providing transparent updates similar to how you order stuff on ecommerce platforms like Amazon,” he adds. An M&A expert who did not want to be identified says the company is scouting for new buyouts in the US, but he is worried if Zetwerk’s growth trajectory is sustainable.

An M&A expert who did not want to be identified says the company is scouting for new buyouts in the US, but he is worried if Zetwerk’s growth trajectory is sustainable.