Ananya Birla: From a singer, an entrepreneur to a business leader

The eldest daughter of Kumar Mangalam Birla, is focussed on driving the consumer-facing businesses, as the group pivots from largely being a commodity-driven family-run business

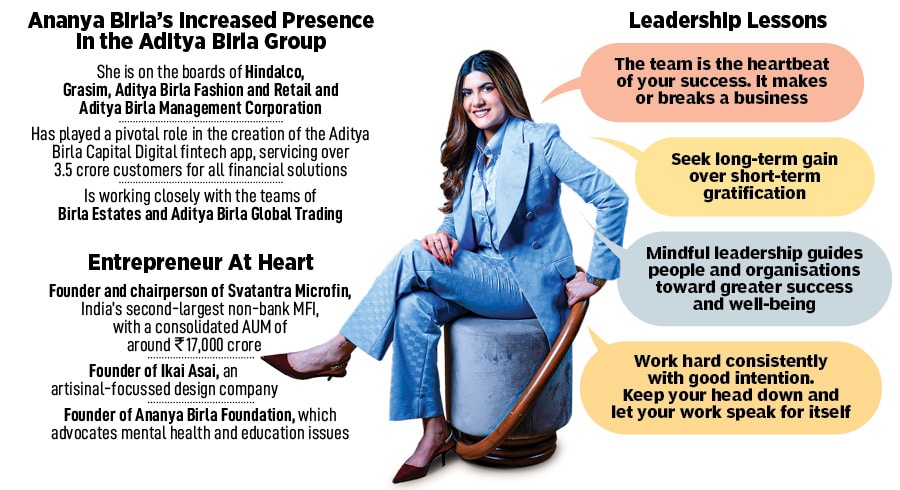

Ananya, Director of Hindalco, Grasim, Aditya Birla Fashion and Retail and Aditya Birla Management Corporation

Image: Neha Mithbawkar for Forbes India

Ananya, Director of Hindalco, Grasim, Aditya Birla Fashion and Retail and Aditya Birla Management Corporation

Image: Neha Mithbawkar for Forbes India

Very rarely do two transitions happen at the same time. And when the timing for such a change appears to be right, it borders on serendipity.

In recent years, the Aditya Birla Group—whose interests range from commodities-based cement and metals manufacturing to financial services and telecom—has launched new-age consumer facing businesses which include dining, retail jewellery and paints.

Ananya Birla, the eldest daughter of group chairman and billionaire industrialist Kumar Mangalam Birla, is undergoing a pivot, too: From a pop music singer and entrepreneur to a business leader.

Contrary to several Indian business houses, which have struggled to deal with a normalised succession planning of family-run businesses, Birla—a fourth-generation business scion—appears to have got the prospect right by getting Ananya and her younger brother Aryaman to play a bigger role in the consumer-facing businesses.

Birla is the world’s 90th richest and India’s seventh, with a net worth of $22.6 billion, according to the 2024 Forbes Billionaires List.

(This story appears in the 06 September, 2024 issue of Forbes India. To visit our Archives, click here.)

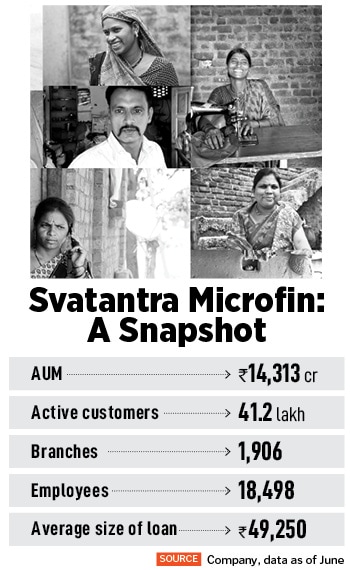

Svatantra started business at a time when banks were—and still are—reluctant to expand operations deep into India’s hinterland to provide loans and financial services to the unbanked. More than a decade on, Svatantra is now India’s second-largest non-banking microfinance company, after listed leader CreditAccess Grameen that has an AUM (assets under management) of ₹26,304 crore serving nearly 50 lakh borrowers.

Svatantra started business at a time when banks were—and still are—reluctant to expand operations deep into India’s hinterland to provide loans and financial services to the unbanked. More than a decade on, Svatantra is now India’s second-largest non-banking microfinance company, after listed leader CreditAccess Grameen that has an AUM (assets under management) of ₹26,304 crore serving nearly 50 lakh borrowers.