How the Rs 1,000-crore Paramount Cables is rewiring its strategy

Once tripped by its high-voltage global ambitions and unforeseen hostile macro headwinds, Paramount Cables has found its mojo in the American market. The third-gen is geared up to take it into the future

(From left) Sandeep Aggarwal, MD, Sanjay Aggarwal, chairman & CEO at Paramount Cables with third-gen scions Dhruv, Tushar and Parth

Image: Amit Verma

(From left) Sandeep Aggarwal, MD, Sanjay Aggarwal, chairman & CEO at Paramount Cables with third-gen scions Dhruv, Tushar and Parth

Image: Amit Verma

September 2007, New Delhi. An innocuous exclamation mark summed up the historic moment: No way! Sanjay Aggarwal takes us back to 2007. It was September 3 and Paramount Cables—the flagship cable brand of the listed entity Paramount Communications—was set to make an electrifying move, and announcement. “The date is indelibly etched in my memory,” recalls the second-generation entrepreneur, who joined the family business of cables and wires after graduating from Shri Ram College of Commerce in 1983.

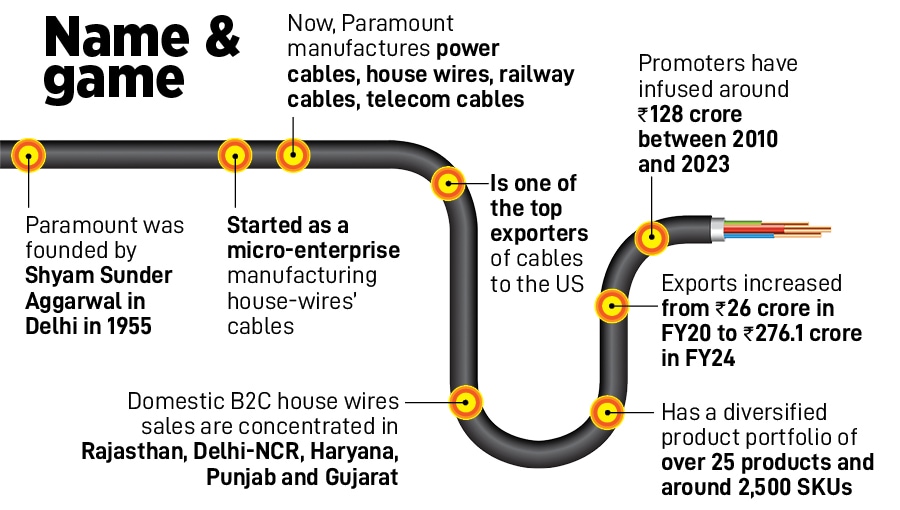

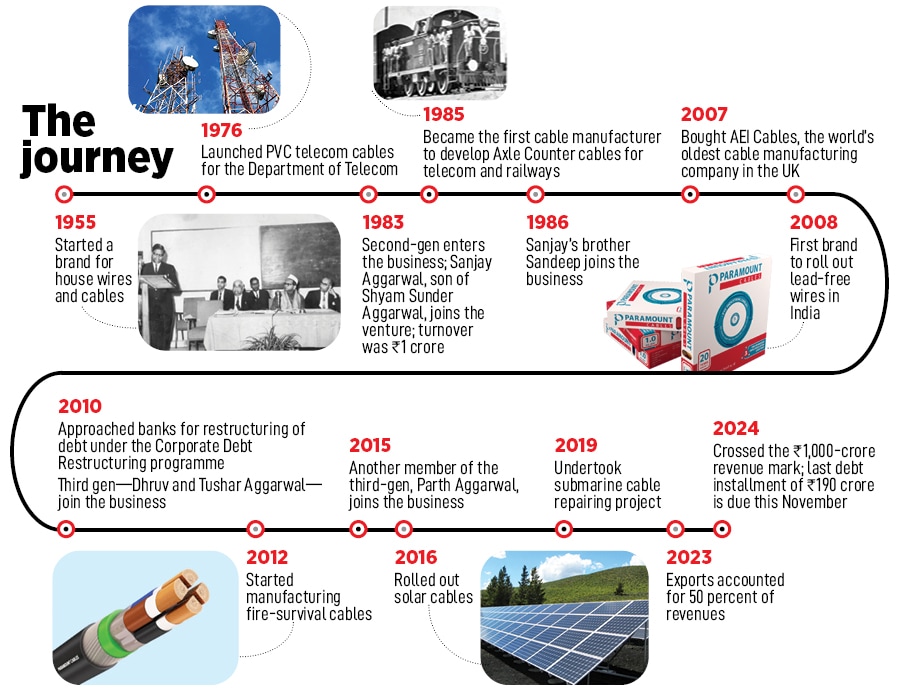

Meanwhile, in 1955, a first-generation entrepreneur was busy building the family’s motherboard from scratch. Aggarwal’s father, Shyam Sunder Aggarwal, started Paramount as a consumer brand for house wires, plodded on for years to take the fledgling venture to a modest scale, and finally embraced a B2B way of building the brand by the 70s. Reason? The patriarch was singed by a sea of copycats and fake brands that flooded the market, played price warriors, and threatened to elbow Paramount out of the consumer market. Consequently, Paramount gravitated to institutional businesses to insulate the brand. Though a B2C venture donned a B2B avatar, the business meandered, and Paramount had to contend with a tiny scale.

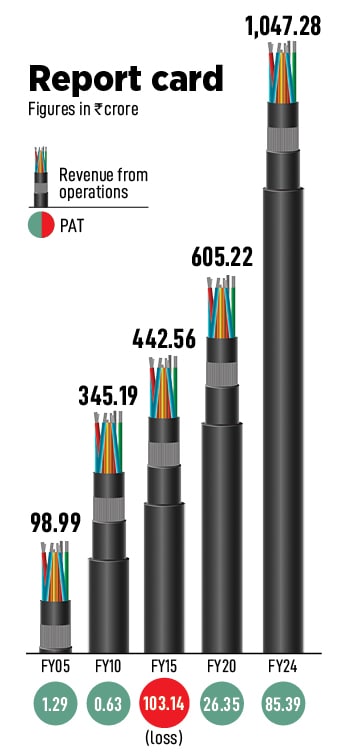

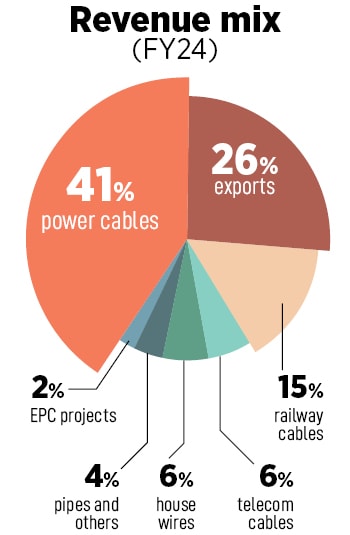

Many moons later, in 1983, nothing much changed. When the young Aggarwal took his entrepreneurial plunge, Paramount had a puny revenue of ₹1 crore. Business, however, metamorphosed over the next two decades. Paramount galloped at a furious pace and closed FY07 at an operating revenue of ₹313.33 crore and a PAT (profit after tax) of ₹37.59 crore. The young blood in the family—Aggarwal’s brother Sandeep had joined the business since 1986—had made Paramount a formidable name in telecom, power and railway cable. The brothers now dared to dream of a global play.

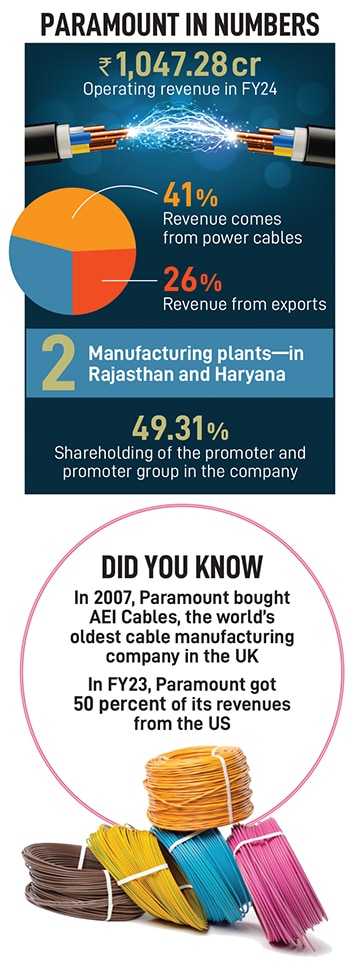

Back in Delhi, on September 3, 2007, the siblings unfolded their audacious gambit. Paramount bought AEI Cables—the world’s oldest cable manufacturing company in the UK—reportedly for ₹130 crore. The news triggered a unanimous reaction from friends, foes and industry observers: No way! A major supplier of cables to defence, rail, power and mining sectors, AEI Cables had a turnover of around ₹533 crore. The company with a net asset size of around $53 million was being sold at a 50 percent discount. “No way,” cried baffled analysts in the UK. Back home, in India, there was wide consternation. And rightly so. In one go, the AEI acquisition had pole-vaulted Paramount Communications as the largest listed Indian company in the cable industry with an annual turnover of over ₹900 crore. “No way,” screamed sceptics, who admired the chutzpah of the Aggarwal brothers, but stayed cynical in their verdict.

The siblings, for their part, were elated with their bold play. And they had reasons to feel jubilant. First, the desi hustlers were getting access to the product development and technical knowhow of AEI Cables in the defence sector, which was tipped to be a sunrise industry in India and globally. Second, the buyout was set to beef up Paramount’s product portfolio for infrastructure segments such as railways, mining, power and defence.

The siblings, for their part, were elated with their bold play. And they had reasons to feel jubilant. First, the desi hustlers were getting access to the product development and technical knowhow of AEI Cables in the defence sector, which was tipped to be a sunrise industry in India and globally. Second, the buyout was set to beef up Paramount’s product portfolio for infrastructure segments such as railways, mining, power and defence.Also read: Anil Rai Gupta: Staying in the game to build an institution at Havells

AEI indeed came as an electrifying opportunity. It was set to widen and deepen Paramount’s play in markets such as the Middle East, Far East and Africa where the company already had a presence. “AEI was a great bet, there were tremendous synergies, and we were confident that it would open floodgates for us on the export front,” confesses Aggarwal. Sandeep, too, sounded buoyant. “We thought we would get to sell cables at first-world prices,” he recalls, adding that back in the 90s and noughties (2000-2009), Indian products were not warmly embraced by foreign countries. “AEI was set to change the game and perception for us,” he adds.

AEI was indeed a meaty bet. But did the enormity of the purchase make the brothers anxious? AEI had a headcount of over 320, a 25-acre factory, and in terms of revenue, it was almost the same size—if not a tad bigger—than Paramount. Were the new buyers not overwhelmed by the amplitude of the acquisition? The upsides, it seems, were too enormous to even think of the flip side. “We didn’t have any nerves,” confesses Aggarwal, who adds another big positive of pocketing the Durham-based iconic company that was founded in 1837: A qualitative edge over rivals.

AEI upgraded the new owner’s image in the domestic market. Paramount rolled out lead-free wires in India, the first in the country to do so. The brothers tom-tommed the heritage of the new brand in their maiden television campaign. “British technology wale Paramount Cables ke saath lead nahin, health-free milta hai, (backed by British technology, Paramount Cables gives you free health and not free lead),” the tagline read. The cables became the talk of the town.

Six months after the buyout, Paramount’s turnover jumped from ₹313.33 crore to ₹437.81 crore in March 2008. Though power and railway cables constituted 72 percent of the gross turnover, the company made rapid inroads in the B2C market. The brothers painted a bigger outlook for the next fiscal on the back of rising exports: From ₹8.26 crore in FY07 to ₹43.17 crore in FY08. “The company can now target a wide export market through AEI Cables,” the company outlined in its 2007-08 annual report. The address ended on an optimistic and triumphant note. “The year 2007-08 was historic for Indian businessmen as there were record takeovers of iconic international companies by Indian corporates across the globe,” underlined the note to shareholders.

2007 and 2008 were indeed years of big, bold buyouts. Take, for instance, Kumar Mangalam Birla-controlled Hindalco, which bought Atlanta-based Novelis for $6 billion in 2007. Interestingly, Novelis was almost four times bigger than its new Indian owner. The same year, Essar bought Canada’s Algoma Steel. A year ago, Tatas bought Corus in October 2006. One-and-a-half years later, the Indian salt-to-steel conglomerate bought Jaguar Land Rover in March 2008. So, Indians were shopping overseas, and Paramount too joined the party by acquiring AEI in September 2007.

2007 and 2008 were indeed years of big, bold buyouts. Take, for instance, Kumar Mangalam Birla-controlled Hindalco, which bought Atlanta-based Novelis for $6 billion in 2007. Interestingly, Novelis was almost four times bigger than its new Indian owner. The same year, Essar bought Canada’s Algoma Steel. A year ago, Tatas bought Corus in October 2006. One-and-a-half years later, the Indian salt-to-steel conglomerate bought Jaguar Land Rover in March 2008. So, Indians were shopping overseas, and Paramount too joined the party by acquiring AEI in September 2007.A year later, in September 2008, the party crashed. The world was rocked by the collapse of Lehman Brothers, companies across the globe scrambled for cover, and Paramount found itself strangled with cables. “It was a double whammy for us,” recounts Sanjay. The company was spread across two geographies—India and the UK—and both regions grappled with a unique set of problems triggered by the global financial crisis of 2008.

Let’s start with the UK. Aggarwal explains what ‘disappeared’ and what ‘remained’. The demand for the biggest cable brand suddenly vanished, AEI was besieged with massive stock inventory, and dues from traders and retailers ballooned. “We were buried under a huge outstanding,” he recounts. Back in India, the business came under severe stress on another front. Globally, the commodities market, and prices, crashed. Copper dipped from $9,800 a tonne to $2,800, aluminium eroded more than 50 percent, and buyers faded away.

Meanwhile, back in the UK, the dynamics of the market changed. The house-wire business was hit by a huge influx of sub-standard imports. Metals crashed, plastics melted, payments got stuck, and Paramount was staring at an existential crisis. “No way! This just can’t be true,” was how the brothers reacted to the chaos around them. The financials of the company went south. While the revenue increased a tad to ₹457.94 crore in FY09, the company slipped into a loss: ₹29.36 crore. There was no respite in the next fiscal. The operating revenue slipped to ₹345.19 crore in FY10.

There was a problem on another front as well. Debt repayment—the company had reportedly raised a debt of ₹100 crore to buy AEI—became challenging. Soon, the group was sucked into a whirlwind of a financial crisis. Over a year later, towards the end of 2010, the company opted for CDR (corporate debt restructuring) with banks. The next few years were traumatic. “We became untouchable for banks,” recalls Aggarwal.

The financial turmoil coincided with the induction of the third generation into the family business. In 2010, Dhruv and his cousin Tushar joined the venture. The next-gen couldn’t leave the seniors, family and the business in turmoil. “It was trial by fire for us,” recalls Dhruv, who did his engineering in the US. The world was crashing, Paramount was staring at an uncertain future, and the family business didn’t have anything to offer to the next-gen in terms of cushion, comfort or money. Along with Tushar, who graduated in international business from the UK, Dhruv started to explore all possible options to salvage the business and the family pride.

The financial turmoil coincided with the induction of the third generation into the family business. In 2010, Dhruv and his cousin Tushar joined the venture. The next-gen couldn’t leave the seniors, family and the business in turmoil. “It was trial by fire for us,” recalls Dhruv, who did his engineering in the US. The world was crashing, Paramount was staring at an uncertain future, and the family business didn’t have anything to offer to the next-gen in terms of cushion, comfort or money. Along with Tushar, who graduated in international business from the UK, Dhruv started to explore all possible options to salvage the business and the family pride.Over the next four years, things stabilised a bit. By March 2014, Paramount’s global dream ended in a nightmare. “We exited AEI at zero value,” rues Aggarwal. What, however, hurt the most was the damage perpetrated by a series of crises after 2008. Look at the numbers. In FY09, Paramount had an operating revenue of ₹457.94 crore. Five years later, in FY14, the company had a revenue of ₹408.92 crore.

The pain continued. In terms of finances, Paramount hit a new low in FY16: Revenue crashed to ₹306.2 crore, and loss jumped to ₹122.82 crore. The business needed cash to grow, the group was still servicing its debts, and there were no ways to raise money. Something had to be done to end the vicious circle. The family started selling its silver. From farmhouses to offices to insurance policies to greenfield projects and provident funds, everything was sold to generate cash. “That was the only way to survive after 2011,” recalls Aggarwal, who credits the tenacity and bonding of the family members in tiding through the crisis. “Things could have gone horribly wrong, but we stayed together. We had each other’s backs,” he says, adding that the promoters kept infusing money.

Fast forward to August 2024. The company crossed ₹1,000 crore in revenue in FY24, continued with its sharp focus on exports to the US—which accounted for 50 percent of revenue in FY23—and posted stellar numbers for the first quarter of FY25. The board has approved raising funds through equity shares or other securities by issuing a qualified institutional placement for ₹400 crore.

Fast forward to August 2024. The company crossed ₹1,000 crore in revenue in FY24, continued with its sharp focus on exports to the US—which accounted for 50 percent of revenue in FY23—and posted stellar numbers for the first quarter of FY25. The board has approved raising funds through equity shares or other securities by issuing a qualified institutional placement for ₹400 crore.The market has started taking note of the rebound in performance. “Paramount Communications will continue to report steady revenue growth, driven by constant capacity addition and continued de-bottlenecking and modernisation capex at existing plants, as well as healthy demand prospects,” underlines credit rating ICRA in its recent note in April. The DSCR (debt service coverage ratio) is expected to moderate in FY24 and FY25 due to sizeable debt repayments. “The company has sufficient liquidity post equity infusion to comfortably meet debt obligations in FY25,” ICRA points out. "We have cleared all our debts," claims Sanjay.

Interestingly, the turnaround in fortune was triggered by changing global dynamics. Tushar, the third from the third-gen of Aggarwals, joined the business in 2015, and started rewiring the export strategy with help from family members. The young blood reinforced the need to take risks and tap the US market. Frequent trips to the States helped in assessing the risk-opportunity dynamics. America was looking to find a replacement for China, and Paramount saw an opportunity in its quality products. “We are a B2C player in the US, and the consumers vouch for our quality,” says Aggarwal, who is impressed with the next-gen’s role. “They have passion, hunger and determination,” he says.

Parth, the youngest from the third-gen, tells us what has kept the family and business together. “Trust, transparency, love and confidence in each other… these are the secret sauces,” the 31-year-old signs off.

(This story appears in the 06 September, 2024 issue of Forbes India. To visit our Archives, click here.)