SBI: What keeps India's largest PSB relevant even today

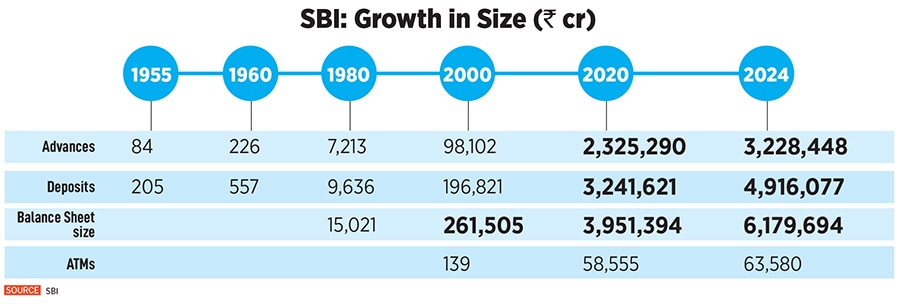

State Bank of India came into existence in 1955, nearly a century and a half after it was founded as The Imperial Bank of India under the British rule. It has since pioneered rural credit and small business lending

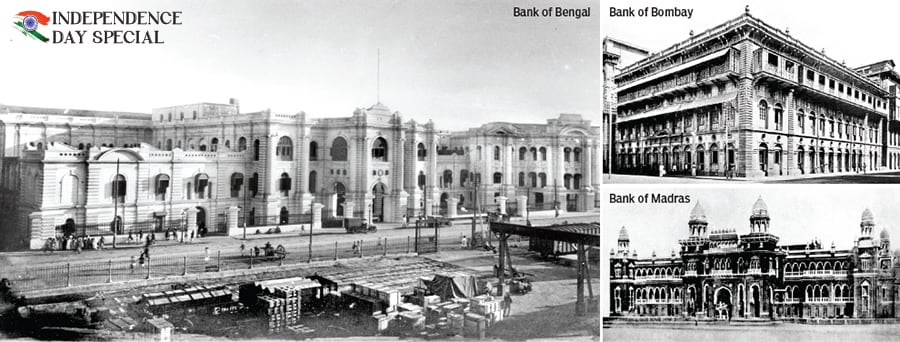

Imperial Bank of India was the result of an amalgamation of three Presidency Banks of colonial India: The Bank of Bengal, the Bank of Bombay and the Bank of Madras in 1921.

Imperial Bank of India was the result of an amalgamation of three Presidency Banks of colonial India: The Bank of Bengal, the Bank of Bombay and the Bank of Madras in 1921.

A lending institution whose origin can be traced back 218 years, to 1806, could lead one to misjudge the State Bank of India (SBI) as a weighty and slow-to-adapt organisation, where ‘largest’ and ‘oldest’ are the only qualifications that could be attached to describe its banking reach. But this is far from the truth.

In the buzzing space of aggressive, competitive and innovative lending by private banks, new-age lenders and fintech companies to a technology-savvy young Indian, SBI’s relevance is intact.

SBI finds its roots from the Imperial Bank of India, which carried out all commercial banking activities as a central bank in British-ruled India till 1935, after which the Reserve Bank of India (RBI) was founded to tackle economic troubles, post World War I.

Imperial Bank of India, which was headed by two governors—British bankers Norcot Warren and Robert Aitken—was, in 1921, the result of an amalgamation of three Presidency Banks of colonial India: The Bank of Bengal, the Bank of Bombay and the Bank of Madras.

Post-Independence, on July 1, 1955, the Imperial Bank of India was rechristened the State Bank of India, under the State Bank of India Act, 1955, with the RBI holding majority stake. (This stake was acquired by the government in 2008, to prevent conflict of interest).

Post-Independence, on July 1, 1955, the Imperial Bank of India was rechristened the State Bank of India, under the State Bank of India Act, 1955, with the RBI holding majority stake. (This stake was acquired by the government in 2008, to prevent conflict of interest).