Tata Technologies wants to diversify into EVs and semi-conductors. Will competition and pressure play spoilsport?

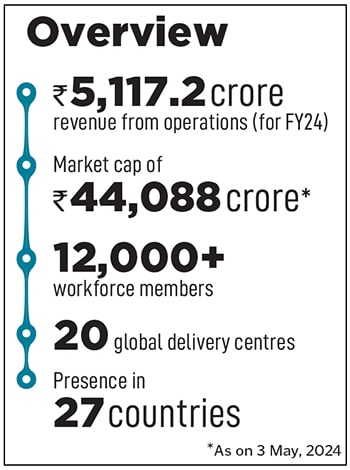

Over the last 35 years, Tata Technologies has been pushing the boundaries of innovation, and turned into a global engineering research and development (ER&D) powerhouse. Now with eyes on new sectors, will it continue its blockbuster run?

![Tata Technologies wants to diversify into EVs and semi-conductors. Will competition and pressure play spoilsport? “We feel that we offer something different to the [ER&D] sector, given the focus on complexity and

turnkey product development.” Warren Harrism, CEO & Managing Director, Tata Technologies. Image: Mexy Xavier](https://images.forbesindia.com/media/images/2024/May/img_234397_warrenharris_bg.jpg) “We feel that we offer something different to the [ER&D] sector, given the focus on complexity and

turnkey product development.” Warren Harrism, CEO & Managing Director, Tata Technologies. Image: Mexy Xavier

“We feel that we offer something different to the [ER&D] sector, given the focus on complexity and

turnkey product development.” Warren Harrism, CEO & Managing Director, Tata Technologies. Image: Mexy Xavier

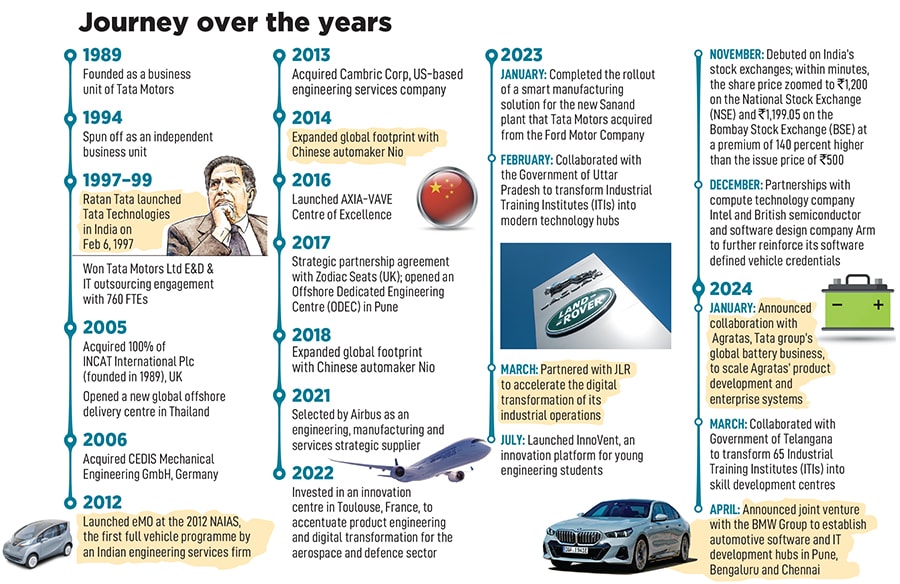

In 2010, Ratan Tata met Warren Harris, then the chief operating officer of Tata Technologies, at his fourth-floor office in Bombay House, soon after the launch of the Nano. On a white board, the then chairman of Tata Sons drew a rough sketch of a four-wheeler and asked Harris to develop an electric vehicle (EV) which would be as frugal in terms of pricing as the Nano. The manufacturer’s suggested retail price (MSRP) target for the team was $20,000, at a time when the battery pack alone cost $12,000 to $13,000.

Despite what seemed like an impossible task, in just a few months the team put together a demonstrator. In 2012, it unveiled the electric MObility (eMO) engineering study concept at the North American International Auto Show, where the Tesla Model S was also unveiled. “Over the last 10 years, we’ve taken the IP from there and used it on client vehicles,” says Harris.

Cut to 2019. The Tata Technologies engineering team was entrusted with yet another Herculean task. Instead of building an electric vehicle (EV) from ground up—which would take about four years—Tata Motors decided to turn existing internal combustion engine (ICE) vehicles into EVs. In theory, it was as simple as replacing the existing parts with those of an EV. In reality, things were a lot more complex. For instance, consider placing the 300 kg lithium-ion battery pack at the rear end of the car, while still maintaining its balance. This is only one of the many challenges, the team faced. Despite which, within a record time of 18 months, they managed to have Tigor’s EV version ready for production.

Over the last 35 years, Tata Technologies has been pushing the boundaries and innovating fiercely. It has turned into a global engineering research and development (ER&D) powerhouse.

Over the last 35 years, Tata Technologies has been pushing the boundaries and innovating fiercely. It has turned into a global engineering research and development (ER&D) powerhouse.

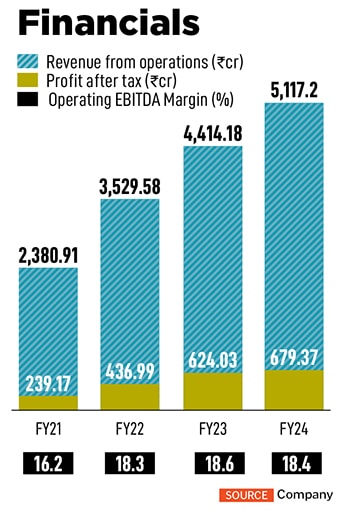

While the company traces its roots back to 1989, it was only on November 30, 2023 that the company got listed on Indian stock exchanges. The first public issue by a Tata company in almost two decades saw a blockbuster listing, with a premium of 140 percent to the issue price of ₹500. The company currently has customers including Honda, Ford, Airbus, VinFast and Jaguar Land Rover.

(This story appears in the 17 May, 2024 issue of Forbes India. To visit our Archives, click here.)

Tata Motors has been the company’s oldest and key client. “We rely on Tata Technologies for their vast and extensive global expertise, and support on various aspects of engineering, which makes them an integral part of our business growth journey,” says Anand Kulkarni, chief products officer, head of HV programs and customer service, Tata Passenger Electric Mobility. “As partners, we leverage their technical expertise when it comes to engineering in the mobility domain. Their dependable support is crucial to our business, enabling us to innovate and refine our mobility solutions to meet the fast evolving market demands.”

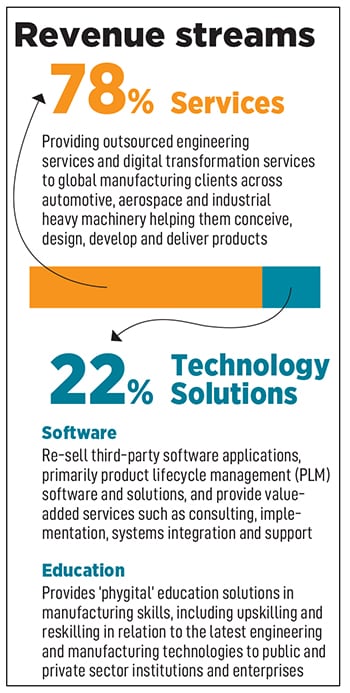

Tata Motors has been the company’s oldest and key client. “We rely on Tata Technologies for their vast and extensive global expertise, and support on various aspects of engineering, which makes them an integral part of our business growth journey,” says Anand Kulkarni, chief products officer, head of HV programs and customer service, Tata Passenger Electric Mobility. “As partners, we leverage their technical expertise when it comes to engineering in the mobility domain. Their dependable support is crucial to our business, enabling us to innovate and refine our mobility solutions to meet the fast evolving market demands.” The company expects Airbus to be among its top five customers in the next three years and the sector’s revenue contribution to increase to 25 percent.

The company expects Airbus to be among its top five customers in the next three years and the sector’s revenue contribution to increase to 25 percent. As a services player, growth tends to be limited to 15-20 percent, says Saraf of Tusk Investments. “In order to see exponential growth, the company should continue looking at joint ventures outside the Tata group—as with BMW—where they co-invest with clients. I think that is going to be a big game changer.”

As a services player, growth tends to be limited to 15-20 percent, says Saraf of Tusk Investments. “In order to see exponential growth, the company should continue looking at joint ventures outside the Tata group—as with BMW—where they co-invest with clients. I think that is going to be a big game changer.”