Can India become the next China for the luxury market?

The face of global luxury is getting wiser to the potential of the East. India's luxury market could reach a staggering $200 billion by 2030, growing to 3.5 times its current size, a Bain & Co report says. And there are many triggers for it

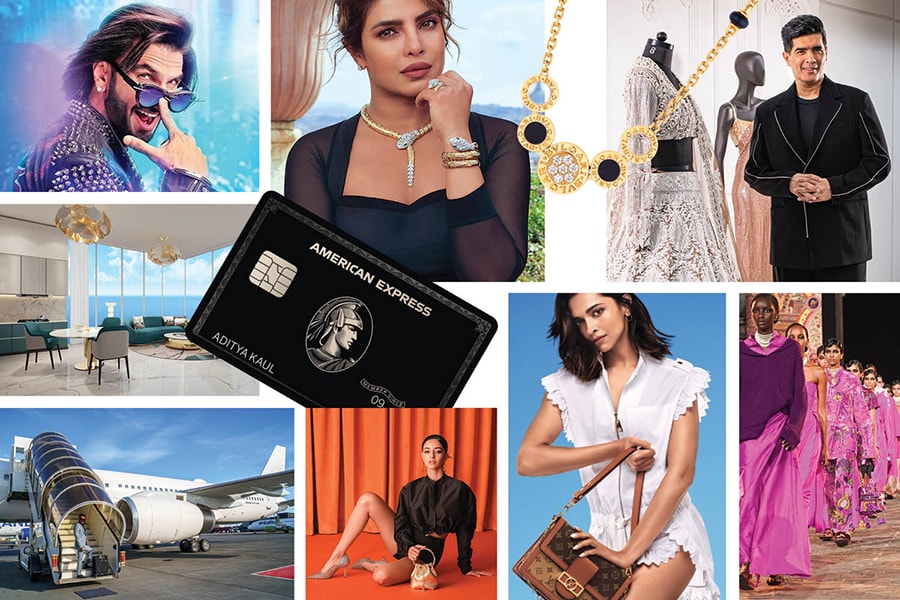

Image: Priyanka Chopra: Courtesy Chris Colls / Bulgari; Dior Show: Indranil Mukherjee / Afp; Manish Malhotra & Abhishek Agarwal: Bajirao Pawar For Forbes India; Deepika Padukone Courtesy Louis Vuitton

Image: Priyanka Chopra: Courtesy Chris Colls / Bulgari; Dior Show: Indranil Mukherjee / Afp; Manish Malhotra & Abhishek Agarwal: Bajirao Pawar For Forbes India; Deepika Padukone Courtesy Louis Vuitton

Alia Bhatt, Gucci. Deepika Padukone, Louis Vuitton. Ananya Panday, Jimmy Choo. Priyanka Chopra Jonas, Bulgari. Most recently: Katrina Kaif, Rado.

The face of global luxury is changing. It’s getting wiser to the potential of the East. When Ranveer Singh’s rambunctious Rocky Randhawa ‘wore both his heart and his Gucci on his sleeve’ in Karan Johar’s Rocky Aur Rani Kii Prem Kahaani, he represented a sizeable chunk of the Indian youth, unabashedly revelling in the fashion they see on runways, red carpets and their Instagram screens.

India’s luxury market could reach $90 billion by 2030, growing to 3.5 times its current size, a Bain & Co report estimates. This could be propelled by factors, including a growing number of ultra-high-net-worth individuals; more entrepreneurs and a stronger middle class; increased demand from Tier II and III cities; greater ecommerce penetration.

In fact, luxury accessories brand Jimmy Choo launched an India-exclusive Diwali collection this year, featuring sparkly gold heels and glittery bags. Louis Vuitton, last year, released a capsule India collection centred on the country’s festive season, with hues of rani pink, black and gold. Italian luxury brand Bulgari has options for mangalsutras, and Dior made a historic showcase at Mumbai’s Gateway of India earlier this year, with a Fall 2023 collection full of sari-inspired cuts and Indian embroidery, in partnership with the Chanakya School of Craft.

The Bain report also states that the luxury market has fully recovered from the Covid-19 crisis, having grown 8 percent to 10 percent over 2019. However, demand for luxury goods in China is still slow, owing to prolonged Covid-19 lockdowns and decreased consumer confidence.