A strategic board can help companies out of the growth curse: Yves L Doz

Doz, the emeritus professor of strategic management at INSEAD, draws up a blueprint for long-term corporate sustainability that benefits all stakeholders

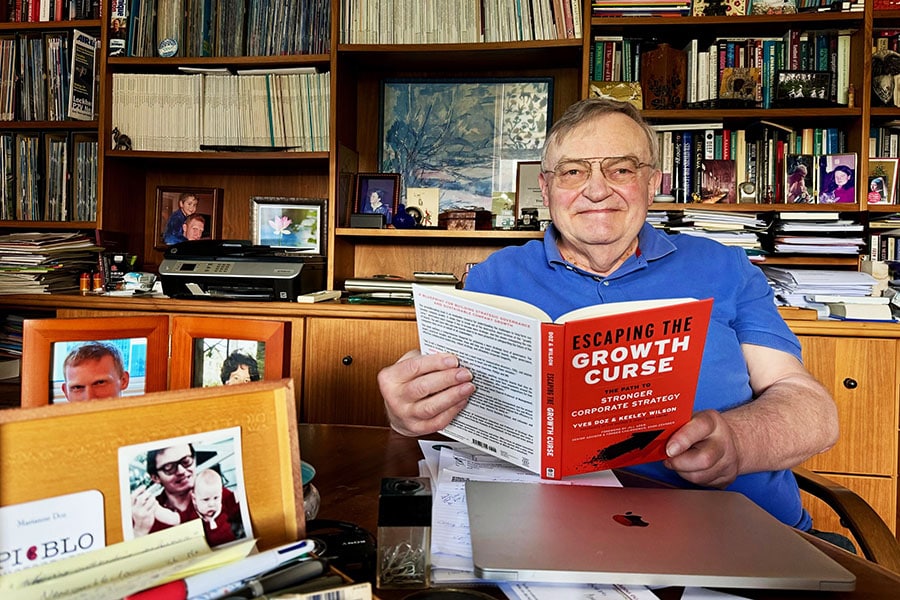

Yves L Doz, Emeritus professor of strategic management, INSEAD

Yves L Doz, Emeritus professor of strategic management, INSEAD

Yves L Doz is emeritus professor of strategic management, INSEAD and the Solvay Chaired professor of technological innovation, emeritus. He is also co-author of Escaping the Growth Curse: The Path to Stronger Corporate Strategy. In an interview with Forbes India, he talks about the potential that boards hold for safeguarding a company’s future. Edited excerpts:

Q. What is the ‘growth trap’ companies in which companies get caught?

Managements often nurture expectations among investors, analysts, and even the board that growth (in value, earnings, sales) can, and will, continue unabated from quarter to quarter. But a company’s growth cannot last forever. Markets mature, new competitors enter the markets, breakthrough innovations create new means of providing similar value to customers, etc. Expectations meet reality, and the company’s performance in a growth stall is bound to disappoint investors.

Q. What’s the vicious cycle this leads to?

The growth trap turns into a vicious circle we call a “growth curse” when management keeps promising growth, even when such growth is no longer feasible (and new growth avenues have not been found or pursued successfully) and engage in “window dressing” -- still showing growth but at the cost of further compromising the company's longer-term future. Cutting strategic expenditures, such as R&D or brand promotion, is an obvious temptation as is using share buybacks to inflate the stock price artificially. Under growing pressure, management may engage in increasingly borderline or downright fraudulent accounting practices. Business unit heads and middle managers are put under growing performance pressures and fear top management demands against which they can’t deliver. This often leads them to optimistic – and inaccurate – reporting. The management reporting system stops being reliable, and fear, lies, and corruption spread.