Amazon-enabled exports from India set to touch $20 billion by 2025

The Amazon Global Selling programme has seen remarkable adoption across the country with sellers from over 200 Indian cities, according to the Exports Digest 2024 that released on Thursday. Tools and technologies introduced for logistics and payments have reduced obstacles in cross-border ecommerce

The Amazon fulfilment centre in Rugeley; Image: Nathan Stirk/Getty Images

The Amazon fulfilment centre in Rugeley; Image: Nathan Stirk/Getty Images

Since the 1960s, Aaqib Bhat’s family was in the rugs and carpet manufacturing business. Eventually, the business became a major player in handmade Kashmir silk rugs. At the time, their products were sold to pan-India wholesalers or international tourists visiting Kashmir.

Bhat was working in Dubai at a consulting firm prior to the pandemic. When the pandemic hit in 2019-2020, he returned home and saw how the family business continued to flourish despite the challenges. That inspired him to stay back and take the entrepreneurial plunge. That’s how Pashwrap was launched in 2021. Pashwrap is a high-end luxury brand that celebrates the rich history and timeless beauty of pashmina. Six months into the launch, it had a fully functioning Amazon Global Selling seller account for exports.

“We have now delivered to almost 3,000 customers via Amazon Global Selling. Our average sales per day is $500-600, and during sale events like Black Friday and Cyber Monday, we have seen our numbers jump 5x to 10x. Through Amazon, we now export to the US, Canada, Mexico and Australia. Next year, we want to also try entering the European market,” says Bhat, who is only one of the 1.5 lakh Indian exporters who have been selling over 40 crore ‘Made in India’ products to customers worldwide since 2015, enabled by Amazon’s Global Selling programme. On September 5, Amazon Global Selling unveiled the Exports Digest 2024 and announced that it is on track to enable Indian businesses to surpass $13 billion in cumulative ecommerce exports from India by end of 2024.

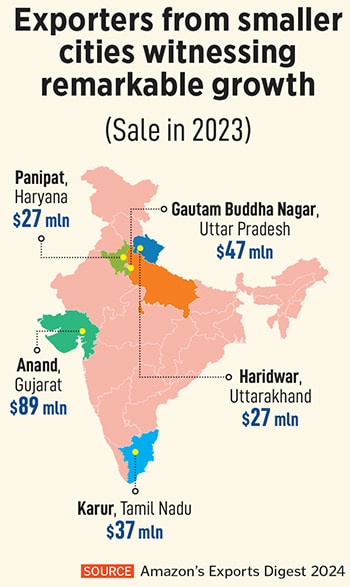

The company’s flagship ecommerce exports programme, Amazon Global Selling, was launched in 2015. The total seller base on the programme has grown by close to 20 percent in the past year. The programme has seen remarkable adoption across the country and has sellers from more than 200 Indian cities. Bhupen Wakankar, director, global trade, at Amazon India speaks to Forbes India about how the programme is growing in India, strategies to reach the $20 billion target and more. Edited excerpts:

Q. How are Indian sellers engaging with the idea of ecommerce exports?