Are hybrids better than EVs?

Hybrids are changing India's automotive industry for the better. Though expensive compared to EVs, they help improve fuel efficiency, reduce emissions, and cut oil imports

A hybrid vehicle such as the Maruti Suzuki Invicto uses two or more power sources, mostly an internal combustion engine and an electric motor

Image: Anis Shaikh / Overdrive

A hybrid vehicle such as the Maruti Suzuki Invicto uses two or more power sources, mostly an internal combustion engine and an electric motor

Image: Anis Shaikh / Overdrive

For a few years now, the global automotive world has been obsessed with electric vehicles (EVs).

Much of that, of course, was led by the phenomenal growth of Tesla over the past decade, pushed harder by its Chinese compatriots such as BYD, leaving legacy automakers such as Mercedes and Volkswagen to chase electric ambitions as the world looks towards moving away from fossil fuels. That’s also why, in the last few years, automakers have made a beeline to shift to an all-electric plan, with many envisaging the transition as early as 2030.

Back home, the likes of Tata Motors and Mahindra are betting heavily on EVs, with both automakers lining up more than 10 electric models in the next five years. However, even as the transition seemed fast-paced, there were a few other automakers, particularly the Japanese, who held back, focusing instead on alternative fuels at a time when range anxiety and charging infrastructure continue to cause concern for EVs.

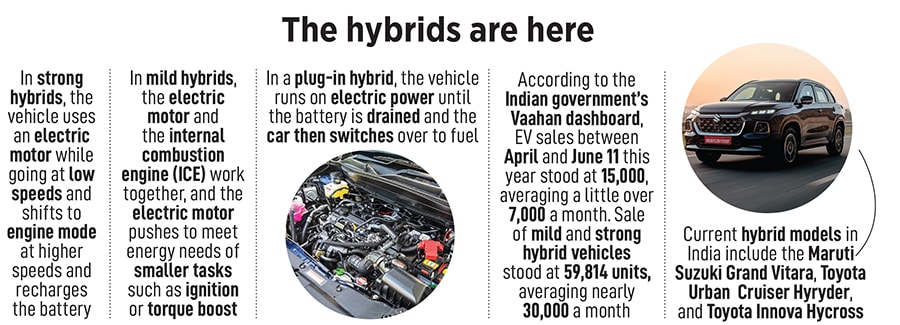

Today, their gamble seems to be paying off. Over the last few months, India’s automobile landscape has witnessed some churn, with hybrid vehicles from Maruti Suzuki and Toyota taking on EV sales, which saw wide traction during Covid-19. According to data from the government’s Vaahan dashboard, EV sales between April and June 11 stood at 15,000 vehicles, averaging a little over 7,000 a month. Mild hybrid and strong hybrid vehicles, however, stood at 59,814 units, averaging nearly 30,000 a month.

A hybrid vehicle such as the Maruti Suzuki Grand Vitara or Toyota Hycross basically uses two or more power sources, mostly an internal combustion engine (ICE) and an electric motor. The move helps in improving fuel efficiency and reducing emissions by using the electric motor while going at low speeds; the vehicle shifts to engine mode to power the vehicle at higher speeds and recharges the battery. This technology is often referred to as strong hybrids. According to Vaahan, strong hybrid sales stood at 7,183 units between April and June 11.

(This story appears in the 28 June, 2024 issue of Forbes India. To visit our Archives, click here.)