Budget 2024: Higher taxes for markets investors, F&O clampdown

The finance minister has proposed an increase in LTCG and STCG for a few asset classes, including a rise in STT for F&O. How will it impact trade volume?

The proposals on taxation for various asset classes are expected to fetch additional revenue for the government but is feared to impact investor sentiment.

Image: Ashish Vaishnav/SOPA Images/LightRocket via Getty Images

The proposals on taxation for various asset classes are expected to fetch additional revenue for the government but is feared to impact investor sentiment.

Image: Ashish Vaishnav/SOPA Images/LightRocket via Getty Images

Even as stock markets are relieved that a major overhang of the Union Budget is over, Minister of Finance Nirmala Sitharaman loaded investors with a higher taxation burden. In the first Budget of the coalition government led by Prime Minister Narendra Modi, proposals regarding taxation of various asset classes are expected to fetch additional revenue for the government, amid apprehensions that they might impact investor sentiment.

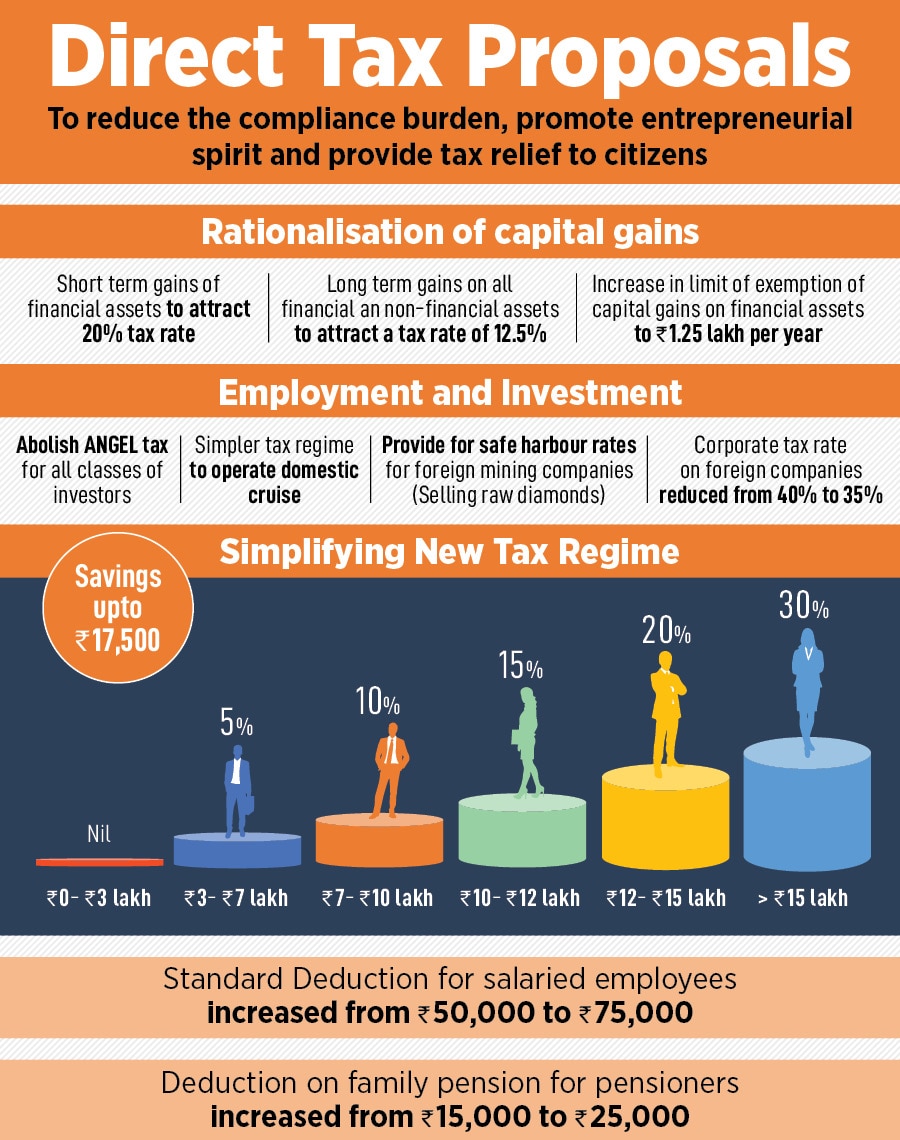

The finance minister (FM) has proposed to increase long term capital gains (LTCG) by 2.5 percent, short term capital gains (STCG) by 5 percent and levy higher securities transaction tax (STT) on the futures and options (F&O) trade. “Capital gains taxation is also proposed to be hugely simplified,” said Sitharaman in her Budget speech.

“The FM has done a comprehensive review of the capital gains structure, whereby several changes have been proposed relating to limiting class of holding periods, tax rates and removal of indexation benefit for different classes of capital assets,” says Poorva Prakash, partner, Deloitte India.

For listed equity shares and equity-oriented mutual funds, LTCG is increased to 12.5 percent from 10 percent. LTCG on all financial and non-financial assets will also attract a tax rate of 12.5 percent. However, the exemption limit has been raised from Rs 1 lakh to Rs 1.25 lakh. The FM said that STCG on certain financial assets will now attract a tax rate of 20 percent, while all other financial and non-financial assets will continue to attract the applicable tax rate.

Listed financial assets held for more than a year will be classified as long term, while unlisted financial assets and all non-financial assets will have to be held for at least two years to be classified as long term. Unlisted bonds and debentures, debt mutual funds and market-linked debentures, irrespective of their holding period, will attract tax on capital gains at applicable rates.

“For other long-term capital assets like gold and property, which were taxed at 20 percent with indexation, the tax rate has been reduced to 12.5 percent but indexation benefit has been removed,” Prakash explains.

There will now be only two holding periods of one year and two years for different classes of assets, as against three holding periods of one, two and three years. STCG for equity shares and equity-oriented mutual funds is increased to 20 percent from 15 percent. “The change will increase the tax outlay for equity investors,” adds Prakash.

The FM also proposed to allow credit for tax collected at source (TCS) while computing the amount of tax to be deducted on salary incomes. This is a welcome move as it will benefit employees of MNCs who participate in stock incentive benefits of foreign parent companies and were required to pay 20 percent TCS at the time of making payment for acquisition of shares, says Prakash.

The LTCG rate increase is estimated to fetch Rs 2,000 crore and STCG Rs 6,000 crore for the full year, says Deepak Jasani, retail research head, HDFC Securities. However, he feels that the taxation burden may dampen sentiments.

Also read: Budget 2024: A clear path to fiscal consolidation

F&O clampdown

With the Securities and Exchange Board of India (Sebi) raising concerns over the rapidly rising volume of trade in the F&O section and the increasing number of investors incurring losses, it came as little surprise when the Budget proposed a clampdown measure by way of higher taxation. “I have a couple of proposals for deepening the tax base. First, security transactions tax on futures and options of securities is proposed to be increased to 0.02 percent and 0.1 percent respectively,” said Sitharaman. Recently, Sebi Chairperson Madhabi Puri had also said that the surge in F&O trade volumes has become a macro issue and not just a micro issue about investor safety.Ashish Nanda, president and head-Digital Business, Kotak Securities, says while STT has been increased on both F&O from October 1, 2024, this is the same date when exchange turnover charges will be reduced. “The net impact of this will be largely net neutral for the customer. For example, STT on options will increase by Rs 3.75 per Rs 10,000 round trip premium turnover while exchange turnover charges will reduce by about Rs 3.5 to Rs 4,” he adds.

Taxation on fixed deposits, debt mutual funds, bonds and market-linked bonds has been kept unchanged. “This is a bit of a damper for fixed income investors. That said, we don't expect significant change in investor sentiment,” says Dhawal Dalal, president and chief investment officer-Fixed Income, Edelweiss Asset Management Limited.

At closing, markets recovered losses with both the Sensex and Nifty marginally lower. The India VIX was down around 17 percent, indicating the markets may surge further.

According to Rahul Singh, CIO-Equities, Tata Asset Management, the Budget has surprised positively on fiscal consolidation, negatively on capital gains and at par on the focus on infra spending and supporting rural and agricultural economy. “While the budgeted spending on infrastructure, rural and agriculture has remained the same as the interim budget, it maintains a fine balance between improving efficiency in agriculture, supporting rural economy and keeping the focus intact on infrastructure spending given limited time left in the current fiscal year,” he says.