Explained: Why are gold prices rising?

India, the second largest importer of gold, has seen demand fall in the last three months on account of a rise in prices

Between April and December, 2023, the price of gold was largely stable, at an average of Rs 63,000 per 10 grams. This resulted in strong demand, and imports rose 26.7 percent to $36 billion during this period.

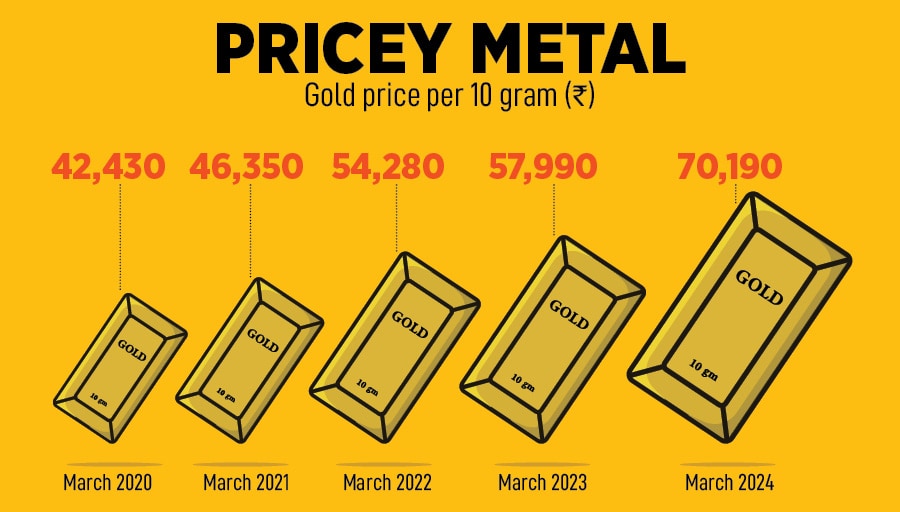

Image: Indranil Aditya/NurPhoto via Getty ImagesSince the start of 2024, gold prices are up 9 percent in rupee terms. The yellow metal trades at Rs 71,000 per 10 grams and is up 69 percent in rupee terms since the start of the Covid-19 pandemic in March 2020. Compare this with a 43 percent rise in the Sensex (if one excludes the month-long dip in March 2020) and it becomes clear why the metal is looked at as a currency and inflation hedge by Indian families. Its allure is hard to beat. (Gold’s performance would be even better in dollar terms as the rupee has depreciated 12 percent since the start of the pandemic.)

Between April and December, 2023, the price of gold was largely stable, at an average of Rs 63,000 per 10 grams. This resulted in strong demand, and imports rose 26.7 percent to $36 billion during this period.

Image: Indranil Aditya/NurPhoto via Getty ImagesSince the start of 2024, gold prices are up 9 percent in rupee terms. The yellow metal trades at Rs 71,000 per 10 grams and is up 69 percent in rupee terms since the start of the Covid-19 pandemic in March 2020. Compare this with a 43 percent rise in the Sensex (if one excludes the month-long dip in March 2020) and it becomes clear why the metal is looked at as a currency and inflation hedge by Indian families. Its allure is hard to beat. (Gold’s performance would be even better in dollar terms as the rupee has depreciated 12 percent since the start of the pandemic.)

The recent rise is primarily on account of investors seeing gold as a hedge against inflation, rising geopolitical uncertainty in both Ukraine and the Middle East (Gaza). There is also an expectation that the dollar may not be the best bet for a country’s foreign exchange reserves on account of too much printing and the easing of US interest rates. The former would have long-term consequences for the value of the dollar, while the latter could cause the dollar to weaken in the short term.

What does this mean for Indian imports?

Between April and December, 2023, the price of gold was largely stable, at an average of Rs 63,000 per 10 grams. This resulted in strong demand, and imports rose 26.7 percent to $36 billion during this period. Data for the first three months of 2024 has not been released as yet, but according to a report in Reuters, gold demand is expected to be down 90 percent in March on account of a 10 percent rise in prices. Expect India to retain its position as the second largest consumer, but demand may fall short of the 900 tonne that the World Gold Council had forecast earlier this year.

India savers and gold

With under-developed capital markets, Indians have always looked at gold (and real estate) as a savings instrument. This continues, and the advent of fractional ownership platforms have made it easier to save as little as Rs10 in gold. One such app is Jar. Its CEO Nishchay Ag points out that Indian retail savers typically don’t look at the value of their holdings as often as stock investors. Instead, they put in money periodically and are more prone to upping the amount invested when the price is rising. (He declined to disclose numbers.) Investments in Jar are backed by an equivalent quantity of physical gold.