GFF 2024: A regulatory window, disruptions, and ULI

The recently-concluded Global Fintech Fest saw banks, fintechs, regulators and governments speak the same language: Of building robust frameworks for fintechs, and easing access to credit

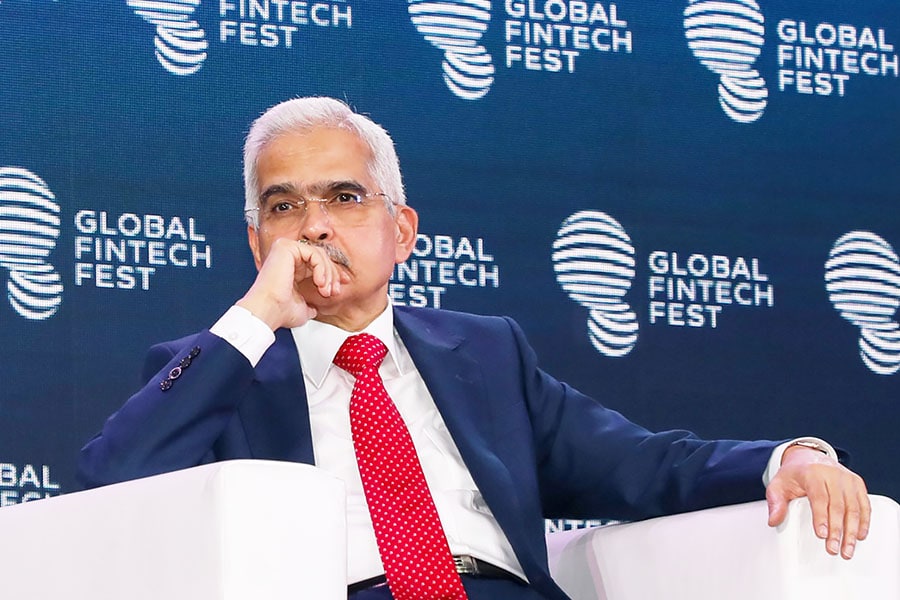

RBI Governor, Shashikanta Das at the three-day Global Fintech Fest (GFF) 2024'

Image: Niharika Kulkarni/NurPhoto via Getty Images

RBI Governor, Shashikanta Das at the three-day Global Fintech Fest (GFF) 2024'

Image: Niharika Kulkarni/NurPhoto via Getty Images

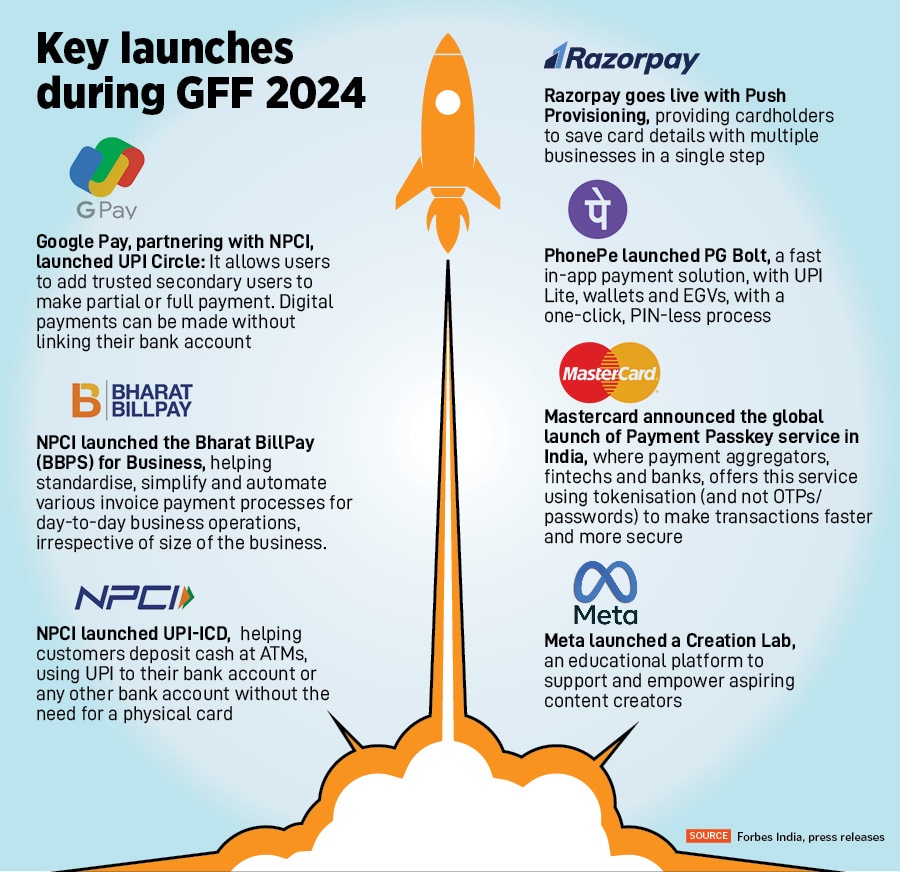

In an era of aggressive credit lending to spur economic growth, India’s fintech sector is in a space of massive overcrowding, an openness to collaborate with the old-economy lenders and a thirst to innovate. The three-day Global Fintech Fest (GFF) 2024—which ended on August 30 and was jointly organised by the National Payments Corporation of India (NPCI), the Payments Council of India (PCI) and the Fintech Convergence Council (FCC)—reflected all of this.

Over 800+ speakers, 350 sessions and delegates from over 100 countries attended GFF 2024.

There were some never before happenings: The regulator, Reserve Bank of India (RBI), had a booth of its own; it had nothing to sell but there were central bank personnel ready to talk to fintechs, banks, whoever was keen.

“We were most impressed by the fact that the RBI had its innovation hub personnel present at the GFF 2024 booth, besides the department of payment systems and CBDC department personnel too. They were very proactive and ready to guide founders,” GFF participant Moin Ladha, a partner at Khaitan & Co, told Forbes India. Startup founders and promoters can exercise this option to meet the regulator regularly.