Sony terminates merger talks with Zee, Zee considers legal action

Punit Goenka, Zee Entertainment CEO and MD, who faces a regulatory probe and whose leadership was cause for concern to Sony, says that the deal has 'fallen through, despite [his] best and most honest efforts'

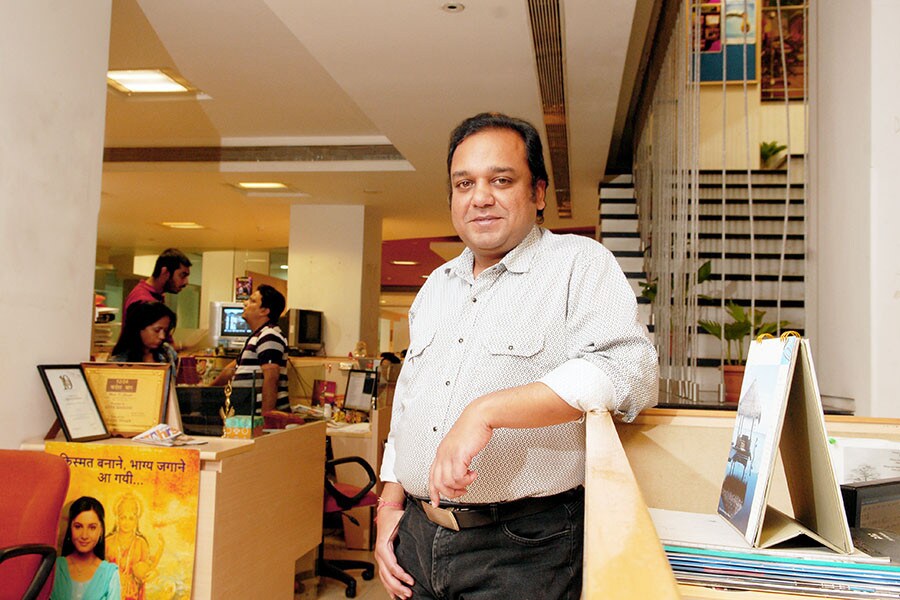

(File) Punit Goenka, MD and CEO of Zee Entertainment Enterprises Ltd. Image: Hemant Mishra/Mint via Getty Images

(File) Punit Goenka, MD and CEO of Zee Entertainment Enterprises Ltd. Image: Hemant Mishra/Mint via Getty Images

After more than two years of talks, a merger deal between media and entertainment companies Sony Group Corp and Zee Entertainment has been terminated, according to a statement by Sony. The merger would have made the new entity India’s largest company in the space.

The statement read:

“Sony Pictures Networks India Private Ltd (SPNI, now known as Culver Max Entertainment Limited), a wholly-owned subsidiary of Sony Group Corporation, today issued a notice terminating the definitive agreements entered into by SPNI and Zee Entertainment Enterprises Ltd (ZEEL), relating to the merger of ZEEL with and into SPNI, which was previously announced on December 22, 2021.

Although we engaged in good faith discussions to extend the end date under the merger cooperation agreement, we were unable to agree upon an extension by the January 21 deadline. After more than two years of negotiations, we are extremely disappointed that closing conditions to the merger were not satisfied by the end date.