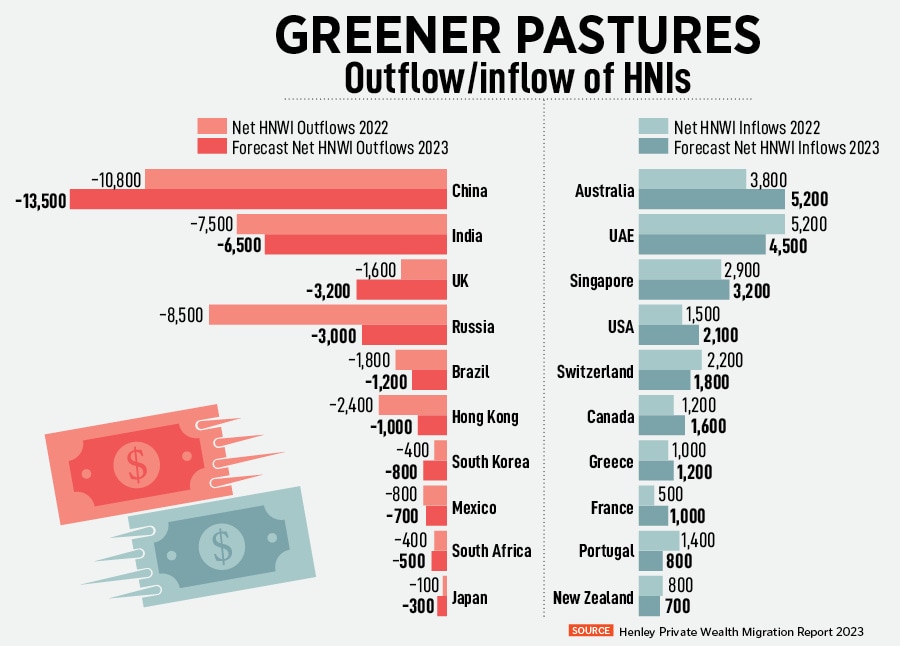

Why 6,500 millionaires want to leave India for Dubai and Singapore

The Henley Private Wealth Migration Report 2023 says Australia, US, and Switzerland are among the top investment destinations for affluent families

According to the report, Australia, US, and Switzerland are among the top investment destinations for affluent families

Image: Shutterstock

According to the report, Australia, US, and Switzerland are among the top investment destinations for affluent families

Image: Shutterstock

The Henley Private Wealth Migration Report 2023 points to an upsurge in India’s affluent population and projects its high-net-worth individuals (HNIs) to rise to 80 percent in 2031. It says around 6,500 HNIs are likely to leave the country this year in comparison to 7,500 in 2022 for greener pastures.

“Dubai and Singapore remain preferred destinations for wealthy Indian families. The former, also known as the ‘5th City of India’, is particularly attractive for its government-administered global investor ‘Golden Visa’ programme, favourable tax environment, robust business ecosystem, and safe, peaceful environment,” explains Sunita Singh-Dalal, partner, private wealth & family offices, at Hourani in the UAE.