India Inc is bullish on GST

India Inc is optimistic about the impending bill which is expected to be the country's most vibrant tax reform

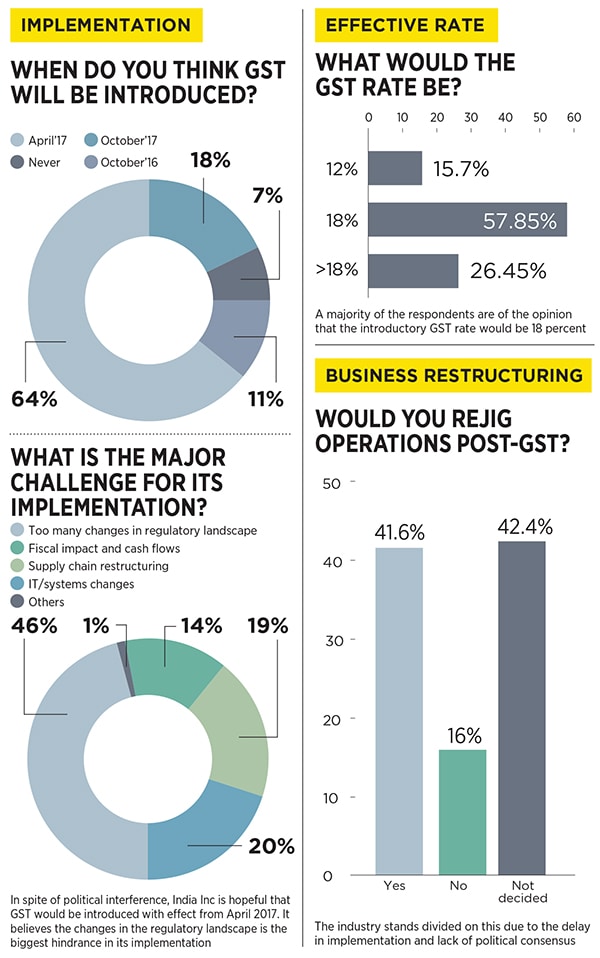

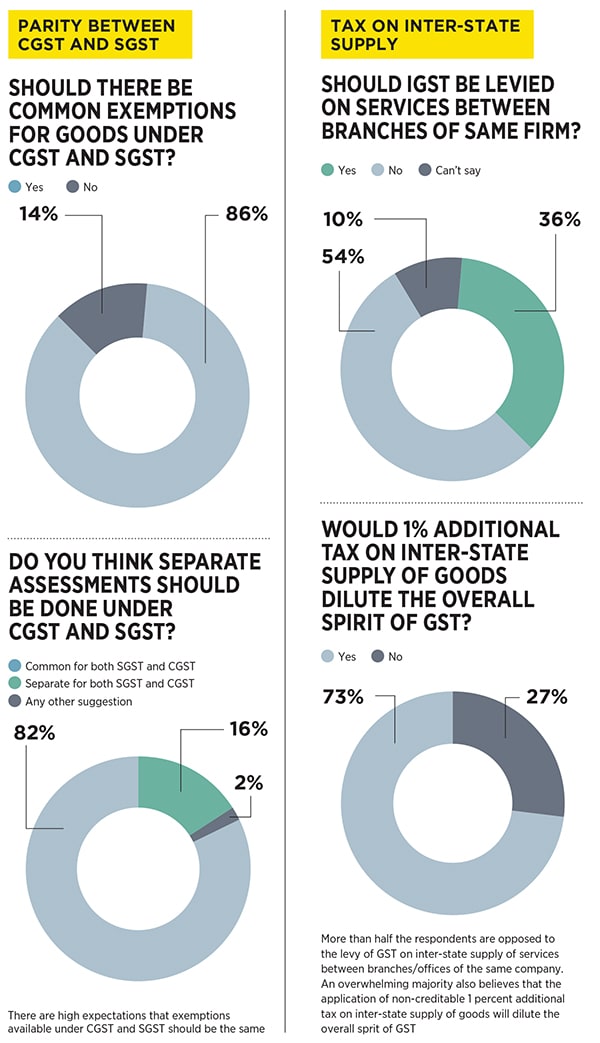

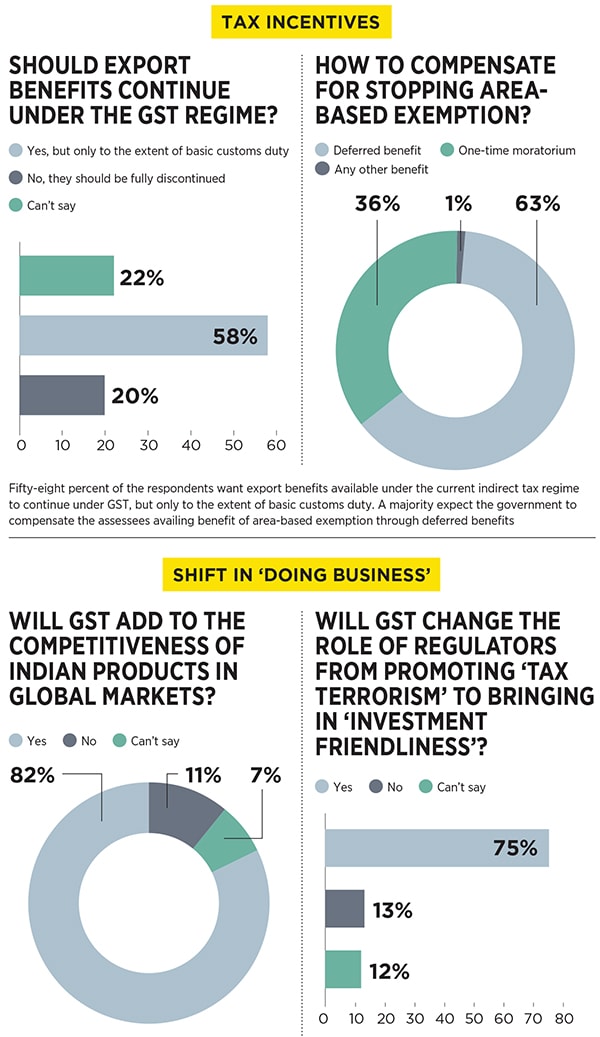

The proposed Goods and Services Tax (GST) has been in the making for a decade now. It is a destination-based consumption tax that aims to end economic distortions and develop a common national market. The government has been working towards building consensus on various aspects of the tax reform, and, to keep the industry informed, has been issuing draft reports on business processes in relation to GST registration, returns, refunds and payments. Forbes India and Grant Thornton have conducted a survey that aims to analyse and understand what various industries and sectors expect from this landmark reform. Here are the key findings.

METHODOLOGY

The survey was conducted recently by Grant Thornton for Forbes India by sending an online questionnaire to 250 individuals, including promoters, chief executives, fi nancial controllers and tax managers, who represent some of India’s leading public and private sector companies across various sectors.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)