Indian Entrepreneurship And The Challenges To India’s Growth

How the Indian Family Business and its entrepreneurial spirit play an important role in India’s growth

The Indian state makes Indians entrepreneurial, as to overcome basic constraints and succeed with what we have we have to innovate and improvise. This article will describe how the Indian Family Business and its entrepreneurial spirit play an important role in India’s growth. In the first part of the article, I discuss its characteristics and survivability in the global environment. In the second section, I discuss the challenges – corruption, terrorism, and unfinished economic reforms — that India faces and their impact on foreign businesses that want to invest in the country.

Indian entrepreneurship

Before 1991, Indian business success was a function of ambition, licenses, government contacts, and an understanding of the bureaucratic system. Decisions were based on connections, rather than the market or competition. Business goals reflected a continuation of the ‘Swadeshi’ movement, which promoted import substitution to attain economic freedom from the West. Pre-1991 policies were inward looking and geared towards the attainment of self-reliance. During this era, entrepreneurship was subdued, capital was limited and India had very few success stories. As well, society was risk averse and the individual looked primarily for employment stability.

In 1991, the Indian government liberalized the economy, thus changing the competitive landscape. Family businesses, which dominated Indian markets, now faced competition from multinationals that had superior technology, financial strength and deeper managerial resources. Thus, Indian businesses had to change their focus and re-orient their outlook outward. A few existing Indian business families adapted to the new economic policy while others struggled. Importantly, a new breed of business was born, one that focused on ICT (Information and Communication Technology) and created wealth for owners and employees.

For the old business houses, success had come from the close-knit joint family structure that fosters family values, teamwork, tenacity and continuity. Under this structure, generations lived and worked together under one roof, reaffirming the Weberian values and trust that have built successful businesses. Wealth from the businesses supported the joint family by providing a social safety net for members. In the structure, businesses and families were intertwined though they were also distinct entities with separate rules. Hence, survival of the family became synonymous with the survival of the business.

Liberalization, however, changed the very nature of the joint family. If large Indian businesses were to succeed, the family would have to re-orient itself to compete in a global, competitive environment.

Post liberalization, IT businesses succeeded because they were customer focused and professionally managed. The old, family-managed businesses, which formed the backbone of the economy, needed to evolve and become more institutional, if they were to extend their life cycle. Below, using the Indian mythology trinity of creation, preservation and destruction, I explain the changes that family businesses would have to make below.

Brahma: Creation Cycle

After liberalization, business opportunities in India were manifold. A good number of entrepreneurs seized them and grew from small-scale contractors to large real estate developers, and from distributors to manufacturers. Success became the result of efficient capital allocation, strong execution and a customer orientation.

Today, businesses have access to venture and growth capital, provided that their stories and business models are reasonable. In the pre-1991 License Raj era, abilities such as manufacture and deliver products to the market were the Key Success Factors, without regard for the customer and other efficiencies. Liberalization also brought in the age of Saraswati [Goddess of Learning in Indian mythology]; businesses would now grow because they had knowledge, , not because of whom they knew.

One example is N.R. Narayana Murthy, who co-founded Infosys Ltd. in 1981, with an initial capital of INR 10,000 (CDN$ 250.00). At Infosys, he and his team designed the Global Delivery Model, which also laid the foundation for the knowledge industry. Narayan Murthy’s vision gave a fillip to the IT services industry, creating and encouraging the entry of several new IT businesses.

Vishnu: Preservation Cycle

To maintain business growth, Indian entrepreneurs need to segregate operating control of the business from beneficial ownership, mitigating business and family succession risks. But, in a male-centric culture, people are reluctant to relinquish operating control and institutionalize processes. Consequently, there are few large, structured and professionally managed institutions in India.

Indian businesses need to move from an entrepreneurial-driven, unstructured culture to one dominated by professional managers. Management control should rest with professionals, as they are able to perform more efficiently; beneficial ownership can continue to rest with the owners, who can still provide the vision and connections, and enjoy the fruits [increase in firm valuation] of efficient management.

If a younger generation wishes to take over the business, then clear criteria can be defined to determine their eligibility to succeed their elders. These criteria could include requirements to work in middle management, work across divisions, work in audit, and have a first-class education. Succession must also take into account the changing role of women and their desire to be involved in the business. If a proper succession plan is not developed and implemented, nepotism and stagnation will result.

Essentially, corporate governance with a lucid ownership structure that blends effectively with the professional decision makers [e.g. CEO] can reap benefits for all stakeholders. This will allow entrepreneurs to build larger institutions.

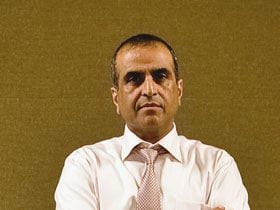

Sunil Mittal, a first generation entrepreneur, indentified an opportunity in mobile telecom. In 1994, Mr. Mittal successfully bid for a telecom license , and services were launched under the brand name AirTel. The business model was innovative –IT management services and hardware (telecom towers) were outsourced to vendors. Fixed costs were converted to variable costs. Mr. Mittal was able to professionalize the organization early, something that helped him build a larger institution. As a result, India now has one of the lowest-priced telecom services in the world.

The Burman Family, which owns Dabur Ltd. (consumer goods company), has is a good example of a family company that segregated management from ownership. It has a separate Family Committee that provides the vision and direction, but the day-to-day management rests with the professionals. The family has a formal structure for communicating with management.

As Indian businesses became professional, opportunities to acquire global businesses increased. In 2006, Corus, an Anglo-Dutch steelmaker accepted an US$7.6B bid by Tata Steel, the Indian steel company. This allowed Tata Steel to become a global leader in the steel business instead of continuing to remain a large domestic steel manufacturer. Once an acquisition target, Tata Steel has itself grown into an acquirer.

Shiva: Destruction (Exit) Cycle

Owners should exit their business if it is not efficiently managed or if it receives exceptional valuations. A control-and-hold behavior will simply not enable success. We have seen that a few owners, Malvinder & Shivinder Singh, and Ajay Piramal, for example, both in the pharmaceutical industry, have successfully sold their businesses.

As businesses grow, entropy will only increase. The discontinuity will be difficult to manage if a formal family structure is not in place to meet the needs of the next generation. However, if roles and responsibilities of the next generation are defined, and professional management (wherever necessary) takes over, closure of the business can be avoided. As it is said, a lack of liquidity can bankrupt a firm; similarly, the lack of an appropriate family structure can force a business to close after the first generation exits. Thus, Indian owners have to make the transition from being owners to shareholders.

As shareholder value increases, the free cash flow can be invested in new initiatives that enable the new generations to apply their skills. We need not throw away the characteristics of the joint-family business – work ethic, ability to deal with diversity, customer focus — but to blend what has been learned about customer focus and diversity, for example, into a performance-driven structure. Only then can the investment cycle of creation, preservation and destruction continue.

Risks to India’s growth: Real but overstated

The Indian entrepreneurial spirit can only develop and grow if the Indian economy continues to grow on a sustainable basis. The risks to India’s continued growth are terrorism, political corruption/stalemate, non-inclusive growth that focuses only on the urban rich, and stalled reforms. What then is India’s risk premium?

As the investment cycle strengthens, foreign businesses can invest in India independently or through partnerships. The businesses factor the political, economic and family risks in their analysis. From an academic’s perspective, the businesses can either decrease the expected cash flows or increase the discount rate to reflect risk premium, though the adjustments are complex. However, I view investments in India as a strategic decision. Below I discuss the risks and my understanding of them.

Terrorism: India is a stronger state because of its culture

As per Wikipedia, “Terrorism in India is primarily attributable to religious communities and Naxalite [militant Communist Group] radical movements.” I am not going to elaborate on the causes of terrorism but I do want to ask if India as a country will survive and remain united despite the nefarious activities of the insurgents. It can be stated unequivocally that terrorism creates uncertainty and delays investments in any country. However, we need to comprehend a country’s culture, constitution and its past response to terrorism to consider and assess its fate.

Culture is a broad-based word but a powerful concept. Culture is rooted in myths, institutions, television, globalization, upbringing, religion and history. Foreigners have invaded India, but we have learnt to absorb and assimilate them into our society. India has the second-largest Muslim population in the world. Buddhism and Jainism had their roots in India but only traces exist today, as Hinduism absorbed their teachings. The Indian culture is tolerant and can deal with differences. The difference between Europe and India is that Europe is a continent with independent countries while India is one country that has united many divergent countries.

The Indian culture is also resilient and able to respond sensibly to any terrorist activities. As evidence, Indian’s response to the November 26th 2008 terrorist attack in Mumbai was balanced and restrained. I am confident that, given India’s history and behavior, we will remain united as a country.

At the same time, Indian businesses have shown the entrepreneurial skills and flexibility to grow despite the challenges. For instance, an Indian entrepreneur in Afghanistan is assisting the government to develop that country’s infrastructure. C&C Construction Ltd, incorporated by a group of professionals in 1996, ventured into Afghanistan in 2002. It has built 700 km of roads, and works closely with USAID, the World Bank and the Asian Development Bank. C&C Construction will also work closely with the Indian Government to build the Afghan parliament building.

Political risk: Uncertainty will remain

India is a complex country with myriad castes, religions and languages. The political parties have evolved to address their needs and give the minority groups a platform and a voice that are heard at the national level. The foreseeable future will be characterized by coalition politics. It is unlikely that either of the two major political parties – BJP or Congress – will win a majority. This is a reality, but India has the experience to manage the political processes and differences

It is evident that a coalition government slows the reform process. However, it is a positive development, that, irrespective of the coalition government (lead by either BJP or Congress), we have stayed the path of liberalization. There are no major differences between Congress and BJP as far as economic policies are concerned, and both favor economic reforms. And, as India’s middle class grows, the importance of religion and caste will diminish; the focus will be only on growth. Economic progress will change India’s political landscape for the better and further improve political stability.

Economic reforms need to continue

Growth needs to continue and India needs “… another dose of reform, aimed at markets for inputs, from electricity to labor and land … They [1991 reforms] freed markets for products.” [The Economist, July 2011]. If we are to continue to maintain the growth trajectory, the market for inputs needs to be liberalized. These are difficult political decisions and coalition politics will make the process slower and difficult.

It will be easier for the government to address and repair old infrastructure through public private partnerships. India is going through a structural — not a cyclical — change; hence, the process is slow and driven by the political process. We need investments in power, roads, ports and bridges. An important area of reform is the power sector, as no industry can achieve a successful transformation without sufficient power. This is why the Indian government needs to push through the reforms on power generation, transmission and distribution.

Corruption could be viewed as one of the reasons for the slow pace of economic reforms. Overspending on the Commonwealth Games and the Department of Telecom’s under-pricing of 2G spectrums resulted in heavy losses for the exchequer. Indians’ frustrations were channeled through the Gandhian leadership of Anna Hazare. The peaceful protests were successful and the country will get an independent ombudsman, the Lokpal (protector of the people), who will investigate alleged corrupt practices of politicians and bureaucrats. This demonstrates the fact that we have the institutions, leadership and most importantly, the grass root activism to effectively mould decision-making at a national level. This will create a positive environment for further economic reforms.

We also have the positive experience of the past decade, for which both political parties, the BJP and Congress, were responsible. However, future reforms have to be inclusive and supportive of the economically disadvantaged. The Left parties do not support economic reforms. Their thoughts are focused inward on how India can continue to grow economically on its own. As the Left parties are a minority on the Indian political scene and the Congress and BJP political parties are supportive of the economic reforms, it is unlikely that the reform process will be derailed.

What then is India’s risk premium? I believe that it varies according to one’s viewpoint. Politics is an important factor that impacts the investment cycle. Hence, it is essential that the Indian government address issues of corruption and continue with the next phase of reforms to accelerate the decision-making process. Reform will continue but at its own pace. I have observed that companies that have taken risk and stuck to a sound business plan succeed in India. They have both sold their wares domestically and exported talent and products.

It is difficult to dampen the Indian entrepreneurial spirit. It has grown and competed in the global market despite the controls of the Indian government. Entrepreneurs have shown their ability to adapt to the changing economic environment and deal positively with the uncertainties in the market place. Yes, the joint family structure – the spawning ground for entrepreneurs – continues to evolve and compete effectively in the world market. But if that success is to be sustained, the economic reforms will also have to continue.

Vishal Jain is a Managing Director, Barclays Wealth, India, which provides private investment banking services to the ultra-high net worth community. He graduated from Ivey with an MBA from in 1993

Reprint from Ivey Business Journal

[© Reprinted and used by permission of the Ivey Business School]