Tailor-made SaaS will emerge from India for the world: Blume Ventures' Anirvan Chowdhury

The time has come for vertical SaaS, with custom-made software that has marketplaces and fintech built in, the vice president of Blume Ventures writes

Software has come a long way from the client-server model, to ASPs, to cloud-hosted software-as-a-service (SaaS).

Software has come a long way from the client-server model, to ASPs, to cloud-hosted software-as-a-service (SaaS).

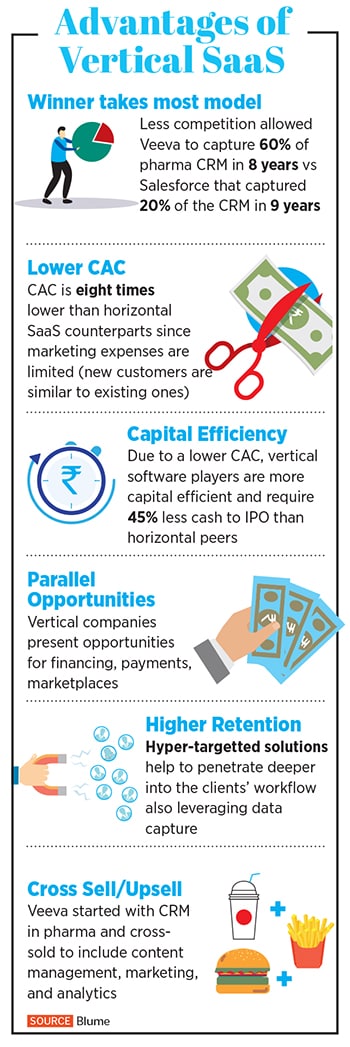

We have all heard how “software is eating the world” and I think it is time for us to recognise that vertical software is capable of, and is already eating up, chunks of horizontal software.

At Blume Ventures, we have been investing in vertical software for the past 10 years, and in the past few years we have doubled down on the space through multiple investments in vertical SaaS companies across the beauty, education, shipping, mobility, and entertainment industries.

Software has come a long way from the client-server model, to ASPs, to cloud-hosted software-as-a-service (SaaS). And, in more recent years, cloud-hosted SaaS tailor-made to the needs of particular industries have emerged. We strongly believe that with wider adoption of SaaS, the new breed of vertical-focussed SaaS companies that started around a decade back are not just here to stay, but could very well be the future of SaaS.