There's a $1 trillion value-creation opportunity in Saas for India: Eka Software's Manav Garg

Thanks to a convergence of long-standing trends and pandemic-driven conditions, the Indian software-as-a-service community is poised to attain global leadership position—but only if these companies play their cards right, the founder and CEO of Eka Software writes

The path ahead for Indian SaaS companies will be difficult, but the future is very bright, writes Manav Garg, CEO of Eka Software. Illustration: Sameer Pawar

The path ahead for Indian SaaS companies will be difficult, but the future is very bright, writes Manav Garg, CEO of Eka Software. Illustration: Sameer Pawar

There is a sleeping giant in the SaaS industry: India

Thanks to a convergence of long-standing trends and pandemic-driven conditions, the Indian software-as-a-service (SaaS) community is poised for a rapid growth period that could land it in a global leadership position—but only if these companies play their cards right.

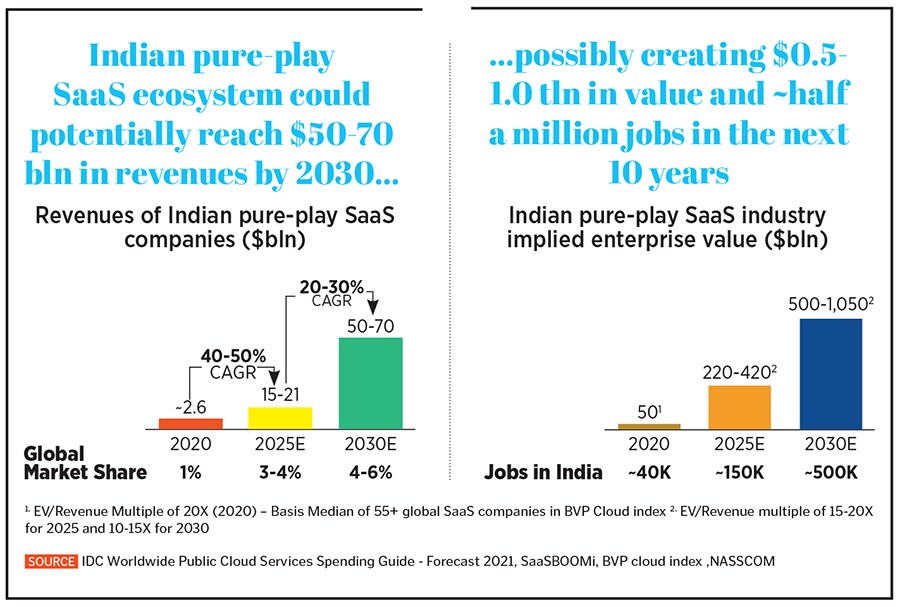

The Indian SaaS market has been remarkably active, with roughly a thousand companies launching in recent years. With exemplars like Freshworks and Zoho leading the way, Indian SaaS companies now generate $2-3 billion in total annual revenues and represent roughly 1 percent of the global SaaS market, according to data from SaaSBOOMi/Nasscom and analysis from McKinsey.

These numbers are compelling in a vacuum, but the circumstances of the pandemic have created unprecedented opportunity. Over the last two years, six new Indian SaaS unicorns have emerged—Postman, Zenoti, Innovaccer, HighRadius, Chargebee and BrowserStack. Any apprehensions on the possibility of building world-class software businesses out of India were put to rest by Freshworks’ initial public offering (IPO).