Free phones to shares: Christmas comes early for RIL stakeholders

Reliance Industries Ltd marks the 40th anniversary of its IPO by announcing the country's largest bonus share issue to reward shareholders; promises next wave of disruption in the telecom market

RIL chairman Mukesh Ambani speaks at RIL’s 2017 AGM

While the oil-to-retail and telecom conglomerate’s shareholder meetings are never short of significant announcements, RIL chairman and India’s richest billionaire Mukesh Ambani outdid himself this year by showering gifts on shareholders and customers alike. Though never devoid of colour, the mood at the Birla Matoshri auditorium in South Mumbai, the traditional address for RIL’s shareholder meetings, was one of especial euphoria and jubilation. The assembled audience that packed the venue cheered every other sentence by Ambani with frenzy – often accompanied by standing ovations and slogans of encouragement.

The two key highlights of RIL’s 2017 AGM were the announcement of a 4G-enabled feature phone that will effectively cost users nothing, which Reliance Jio – the conglomerate’s broadband wireless and digital services arm – will be launching shortly; and a 1:1 bonus issue of shares as a gift to shareholders to mark the company’s 40th anniversary.

JioPhone

Jio, which disrupted the Indian telecom market by launching 4G mobile broadband services that offer subscribers free voice calls and data services at rock-bottom tariffs, is also set to shake up the telecom sector – this time at the bottom of the pyramid – yet again with the launch of its new feature phone, called JioPhone.

The jaw-dropping moment came when Ambani announced that the 4G-enabled feature phone, the first of its kind, will effectively cost customers nothing. They will only have to pay Rs 1,500 as a security deposit to procure the device, which is fully refundable after three years.

Once a user has bought the device, the features are endless and super affordable. JioPhone is voice-enabled that supports 22 Indian languages. It allows users to speak into a microphone to perform a variety of functions including making calls, reading messages, and accessing content ranging from movies and music to TV shows and even Prime Minister Narendra Modi’s weekly radio podcast, ‘Mann ki Baat’. Moreover, the phone can also be used as a mirroring device with the help of a specially designed transfer cable, which will allow users to watch video content from the phone on their TV sets – even if they run on the old cathode ray tubes.

RIL’s AGM on Friday also doubled up as the kind of interactions organised by large technology companies like Apple and Google to showcase their latest technology with Akash Ambani and Isha Ambani – both directors of Jio and Ambani’s children – along with another colleague, giving shareholders a live demo of the JioPhone’s capabilities. JioPhone’s unlimited data services will be available to its subscribers for a monthly tariff of Rs 153.

Declaring that the new device will lead to “digital freedom” for millions of Indians who can’t afford smartphones and have been buying feature phones that cost at least Rs 3,000, while shelling out a few thousand more for data, Ambani announced that JioPhone will commercially launch on August 15, India’s 70th independence day. After trials, pre-bookings for the JioPhone will open on August 24 and the product will be available to users in September.

“This breakthrough and revolutionary device, along with Jio’s disruptive tariff will unleash the power of Digital Life in the hands of 1.3 billion citizens of the largest democracy in the world,” Ambani said during his speech.

Out of the 780 million mobile phones in India, 500 million are feature phones and that is the market in which Ambani and Jio want to make a big dent. The market’s reaction to listed telecom stocks appeared to suggest that the Street believed JioPhone would have the impact that Ambani hopes it will. Within 10 months of launching its 4G services, Jio has already managed to notch up 125 million subscribers, 100 million of whom are paid users, Ambani stated.

At 1:50 pm, RIL’s shares were trading at Rs 1,575.45 per share, up 3.06 percent. At the same time, Bharti Airtel’s shares were trading at Rs 406.40, down 3.18 percent, while Idea Cellular’s stock price declined as much as 5.6 percent at Rs 89.55.

Remembering Legacy

RIL, which started off as a manufacturer of textiles has completed, over the last four decades, a process of backward integration, which saw it enter associated business such as petrochemicals, crude refining, and hydrocarbons exploration and production. The other two businesses that RIL is present in – retail and telecom – stem from the conglomerate and its current chairman’s belief that consumer-facing businesses are the future.

In the buildup to the announcement of his mega future plans for Jio, Ambani passionately recounted the 40-year-long journey that RIL has traversed to become India’s most valuable company that reports record revenues and profitability each year.

Towards this end, an ambience was sought to be created where RIL’s late founder chairman and Ambani’s father Dhirajlal Hirachand (Dhirubhai) Ambani would appear to be speaking directly to shareholders, as he often did when he was alive through rally-styled congregations. Through audio-visual means, relevant and archived video clips of Dhirbubhai’s past speeches to shareholders were aired, accompanied by visuals of RIL’s endeavours to create large-scale assets.

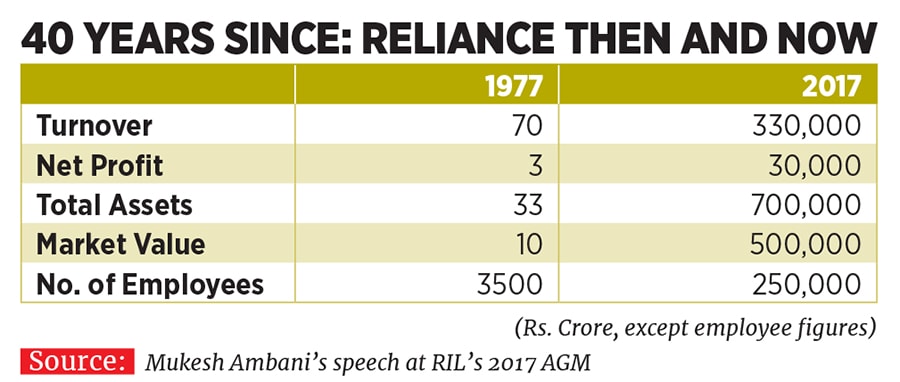

“This year marks the 40th anniversary since our IPO. In just four phenomenal decades, Reliance has grown from a small startup to becoming one of the largest and most admired companies in the world,” Ambani said. “No Indian corporate, and few global corporates, have expanded so much and so fast in scope, scale, size and service to the nation. From a textiles company, we have created multiple growth engines in energy, materials, consumer and digital businesses. Each one is global scale and world class.”

Gift to shareholders

To celebrate this creation of wealth, commemorate the achievements of his father, and reward shareholders at the end of an investment cycle that saw RIL invest Rs 3.30 lakh crore over the last five years across businesses such as refining, petrochemicals, retail and telecom, Ambani surprised shareholders by announcing a bonus issue of RIL’s shares whereby each shareholders will get one share for every share held in the company.

The decision to reward shareholders with free shares was, according to Ambani, approved by RIL’s board of directors even as the AGM was in progress and while shareholders were watching the video package on the company’s journey.

The bonus issue, which needs to be formally approved by shareholders, will see the company’s total number of outstanding equity shares increase from 325.15 crore to 650.30 crore shares. It will also help bring RIL’s share price, which has skyrocketed in recent times (gaining around 50 percent in the last one year), to a more reasonable level (after the price adjusts itself post the bonus issue) that will allow new investors to enter the stock.

(Reliance Industries is the owner of Network 18, publisher of Forbes India)

X