Print advertising expenditure grows in India, bucking global trend: GroupM report

Total advertising investment in the country is expected to grow by 10 percent in 2017

Image: Shutterstock

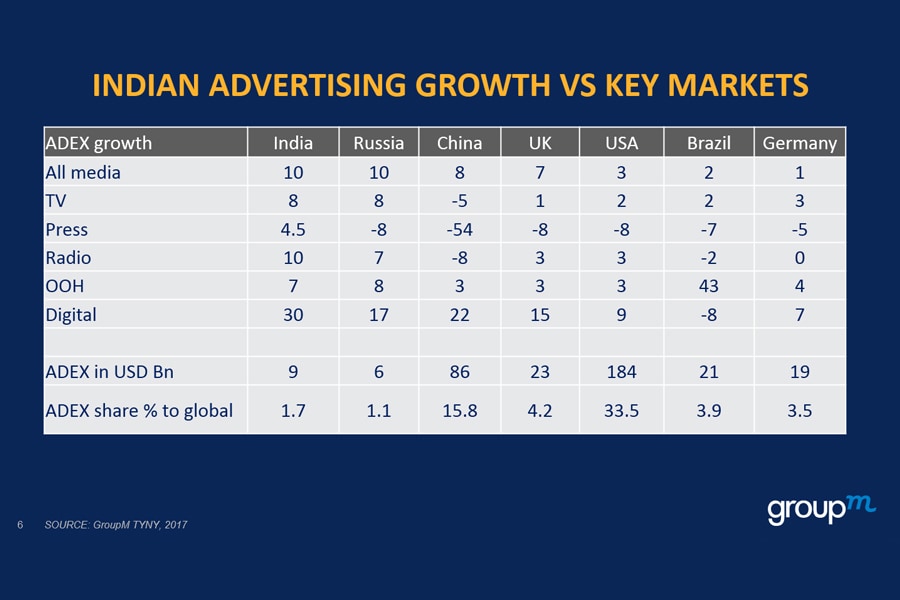

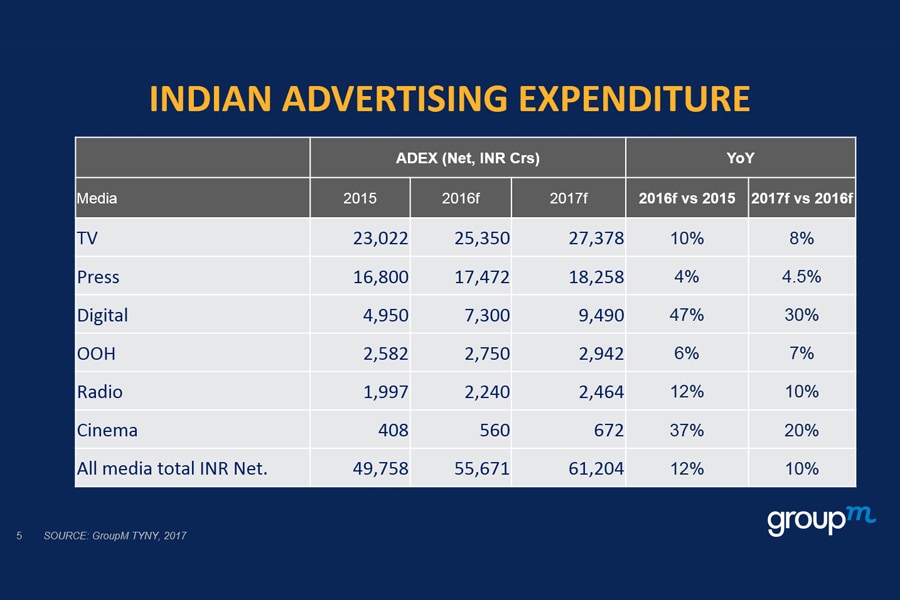

Growth in advertising expenditure (AdEx) in India is not only among the highest in the world, but the country is also the only large market where AdEx in the print media is growing. While AdEx in print media grew by 4 percent year-on-year in 2016, it is pegged to grow by 4.5 percent in 2017—from Rs 17,472 crore in 2016 to Rs 18,258 crore in 2017.

These findings are part of the global media management investment conglomerate Group M’s biannual advertising expenditure futures report ‘This Year Next Year’ (TYNY) 2017, which was released on February 14.

Source: Group M TYNY 2017 report

Source: Group M TYNY 2017 reportThe total advertising investment, across media, in India is projected to grow by 10 percent to reach Rs 61,204 crore in 2017 from Rs 55,671 crore in 2016. Global AdEx is expected to grow by 4.4 percent and Asia-Pacific will grow by 6.3 percent. This makes India one of the fastest growing ad markets globally.

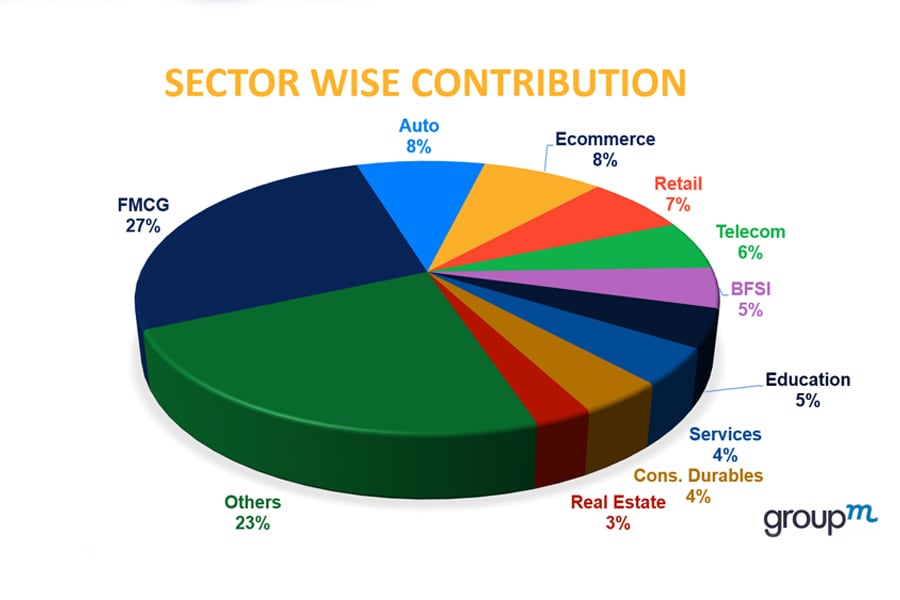

Despite beginning on an optimistic note, the overall AdEx in 2016 took a hit owing to lower-than-expected ad spend growth from sectors like FMCG, traditional retail, telecom and irregular spending in categories like ecommerce. Additionally, demonetisation in the last quarter had a negative impact of about 2 percent on the total AdEx in 2016.

“The first quarter will give a slow start to the year, with the market picking up from March-April, fuelled by a stable recovery process post demonetisation…In addition to auto, media and e-wallets, government and political parties will also increase spending with elections in several states this year,” says CVL Srinivas, CEO, GroupM South Asia.

However, growth projections for most mediums are lesser than in the previous year. Out-of-home, which is expected to grow by 7 percent (grew by 6 percent in 2016), and print are the only mediums where the growth projection has been increased over the previous year.

Source: Group M TYNY 2017 report

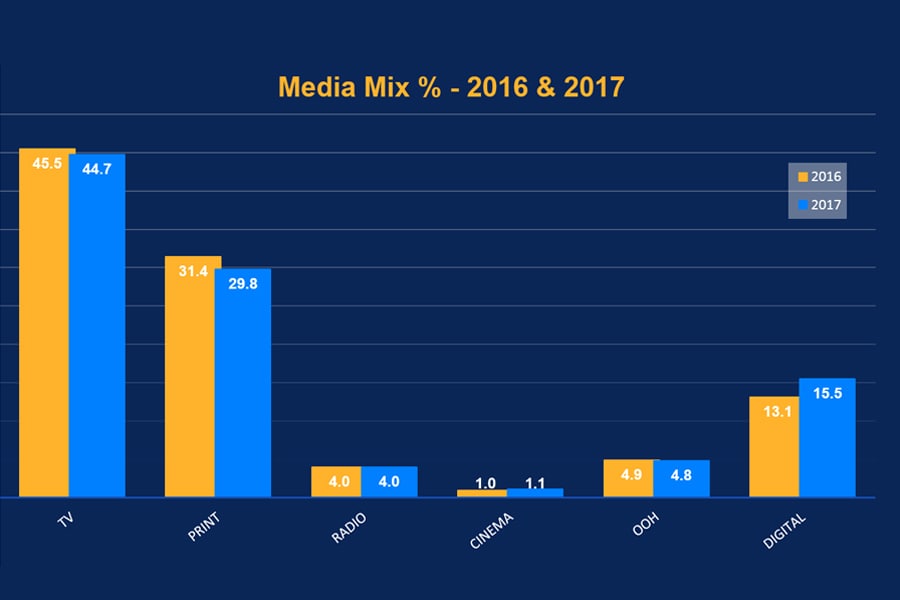

Source: Group M TYNY 2017 reportSimilarly, television enjoys a lion’s share of the AdEx pie with 45 percent, and is expected to grow by 8 percent to Rs 27,378 crore from Rs 25,350 in 2016. It grew by 10 percent in 2016 over 2015. The growth this year will be fuelled by Free To Air channels adding more inventory and pure HD content gaining ground. The market will also see consolidation of nice channels, states the report.

Further, radio is expected to grow at a little over 10 percent, while it grew by 12 percent in the previous year. The growth will come once the Phase 3 rollout is completed in 2017.

Cinema advertising will grow at a high double-digit rate of 20 percent on the back of consolidation which has led to investments in infrastructure and growing acceptance of premium Indian and Hollywood content by advertisers. The medium had grown by 37 percent in 2016.

In terms of sectors contributing to AdEx, the report finds that FMCG will contribute to 27 percent of the total ad spend.

Source: Group M TYNY 2017 report

Source: Group M TYNY 2017 report2017 will witness a high emphasis on ‘viewability’ metrics and outcome-based optimisation. Ad spends will also grow on OTT platforms, as internet speeds improve and catch up TV gains ground.