Razorpay looks to expand services beyond payment gateways

The aim is to grow from being a payments acceptance provider to offering a platform to manage all things payments within a business

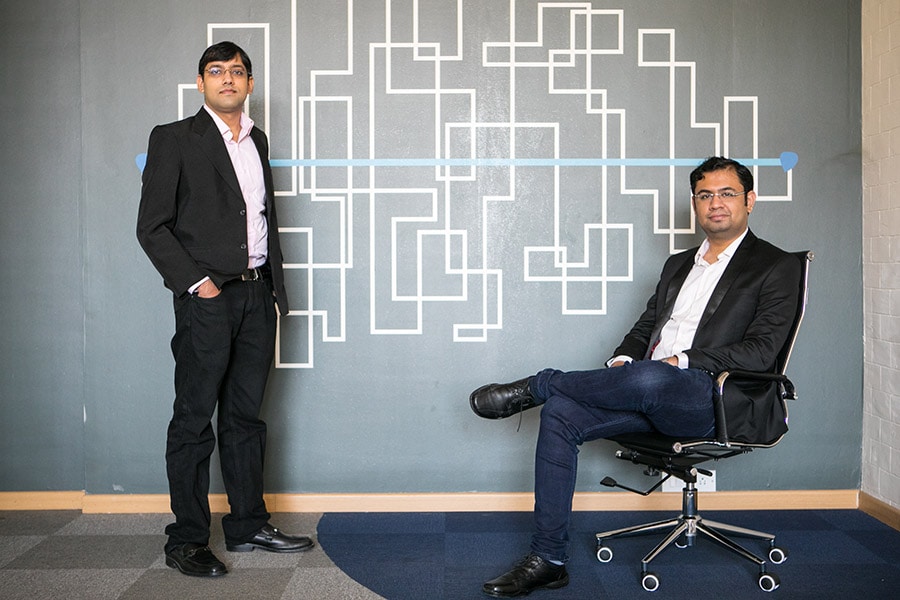

Harshil Mathur (right) CEO and Shashank Kumar, Co-Founders of Razorpay

Harshil Mathur (right) CEO and Shashank Kumar, Co-Founders of Razorpay Photo: Selvaprakash Lakshmanan for Forbes India

Enabling businesses to accept digital payments irrespective of how a consumer chooses to do so—credit/debit cards, net banking, wallets, UPI—was the raison d'être Harshil Mathur, CEO, and Shashank Kumar, CTO started Razorpay in 2014. (The two were Forbes India’s 30 Under 30 award winners in the Technology category this year.)

The startup is now ready for bolder bets, the two co-founders told reporters in Bengaluru on Thursday, unveiling a small suite of products that will help businesses do much more than accepting payments. “Payment acceptance is just a part of the problem. There is a whole set of issues that a merchant faces—from sources that our gateway does not support to disbursing the payments to [other] end vendors,” said Mathur.

The rise of cloud computing, the government’s Digital India push, and policy-driven changes such as demonetisation, have accelerated the shift towards digital money in the country. Companies such as Razorpay, therefore, are well placed with the right solutions at the right time in the right market.

At the start of the year, Mathur and Kumar had over 20,000 businesses using their software-as-a-service platform, integrating some 100 different forms of payments “with two lines of code” and good to go. They have since doubled their client base and expect to more than double it in the next two years. The volume of transactions has grown 20 times in the last 12 months, Mathur said.

Razorpay’s ‘card-saving’ technology has on its file 2 million consumers that merchants get immediate access to when they sign on to use Razorpay, and when India’ government-backed unified payments interface (UPI) was launched, Razorpay was among the first to support the instant-payments method.

The company announced on Thursday, what the young co-founders, both of whom are IIT Roorkee graduates, see as a “fully-converged digital solution that solves all problems associated with the movement of money inside a business”. This means products that will support managing cashflows from accepting payments—both ad hoc and periodic—to wiring the money onto banks, suppliers and others, and all the other steps and processes in between, Mathur said.

Among Razorpay’s biggest customers are NIIT, Quickr, DSP BlackRock mutual fund, Zomato and GoIbibo. The co-founders originally started their venture in Jaipur, but moved to Bengaluru, in part because it would be easier to source tech talent—the company has about 110 staff today with offices in three cities.

Razorpay, which has raised about $11.5 million in funding so far, counts Tiger Global, Matrix Partners and Mastercard as investors, in addition to 33 angel investors.

X