Warren Buffett is optimistic? Pessimistic? No, realistic

More than his words, he spoke with his wallet; what he said should be a warning for all investors and policymakers

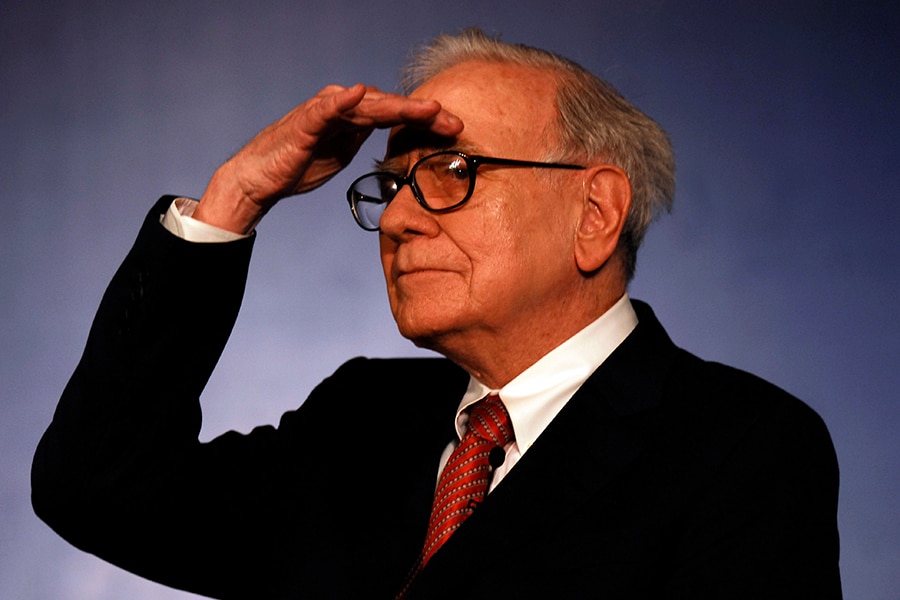

Image: Ankit Agrawal/Mint via Getty Images

Image: Ankit Agrawal/Mint via Getty Images

(DealBook)

You could always count on the folksy and cheery optimism of Warren Buffett.

But if you listened closely to Buffett over the weekend during Berkshire Hathaway’s shareholders’ meeting — his annual “Woodstock for Capitalists” was conducted virtually because of the coronavirus pandemic — his words often betrayed a deep sense of concern about the immediate future. That should be a warning to all investors and policymakers.

While many of the headlines about the meeting were about Buffett’s positive aphorisms — “Nothing can basically stop America,” “You can bet on America” — underneath those long-term proclamations was a decidedly different message.

Each year for the last decade, I sat onstage at this big meeting in Omaha, Nebraska, with Buffett and his best friend, Charlie Munger, as one of several journalists asking him questions sent in by the public. His positivity, even during difficult economic moments, always radiated with a clear sense of certainty. After all, he is known as the Oracle of Omaha.

©2019 New York Times News Service