Thinking of a Home Loan Refinancing? Now is the Right Time!

Understanding Your Interest Rate

Before you decide whether you should refinance your Home Loan, it is important to understand whether your Home Loan has a base rate or an MCLR or Marginal Cost of Funds-based Lending Rate. If you took a loan between 1 April 2010 and 31 March 2016, it will have a base rate. With such loans, when the repo rate is cut, it may take a long while for your loan to accrue the benefit.

If you have taken your loan post 31 March 2016, however, your loan follows the MCLR regime. This means that your interest rate will change quickly once the repo rate changes, thereby improving your benefits. Depending on the reset clause, which is usually 6 months or 1 year, the interest rate of your loan will be reset regularly, in line with the prevailing rate. As a result, you can make the most of rate cuts in a timely manner, and reduce your financial obligation.

So, first, start by shifting your loan to an MCLR regime to make the most of the cuts in Home Loan interest rates . Next, evaluate whether it is a good idea for you to refinance your Home Loan.

Should You Refinance Your Home Loan?

While other factors may point you in the direction of refinancing, evaluate your own situation before considering switching your Home Loan to another lender by carrying out a Home Loan Balance Transfer . You might have several underlying reasons for considering a refinance. It is important that you think them through.

Is it to benefit from a lower rate of interest?

Here it is important to calculate your actual gains instead of simply looking at the lower interest rate. This will allow you to see if your savings are significant. As a result, you will be able to ascertain if you should refinance now.

Is it to lower your monthly outflow?

While you can refinance your loan to seek a lower EMI, it is important to understand the complete picture. This move will increase the total cost of your loan as it will take you longer to clear the loan and so, the total interest payment will be higher. But, if you seek more flexibility on a monthly basis, this is a worthy benefit to consider.

Is your current mortgage at the right stage?

It is important to evaluate how far you are into the tenor before deciding to refinance. It is ideal that you refinance your loan within 4 or 5 years of the tenor. During this period, the interest component of your EMI is highest. So, refinancing your loan will help you lower this greatly. If you’re towards the end of the tenor, refrain from refinancing as the cut in interest rate won’t reflect in actual monetary benefit. This is because you have already paid most of the interest.

Once you’re convinced about refinancing your Home Loan, consider following the following steps.

Negotiate with Your Current Lender

Before you decide to refinance your Home Loan by seeking a Home Loan Balance Transfer, make it a point to talk to your existing lender. If you are an ideal customer, with a good payment record, good credit history and no defaults, you may be able to renegotiate the terms of your Home Loan. You can either request a decrease in your loan’s interest rate, or lengthen the tenor to suit your affordability. Since you don’t have to pay any legal or processing charges, this may work out to be cheaper on the whole.

Consider a Home Loan Balance Transfer

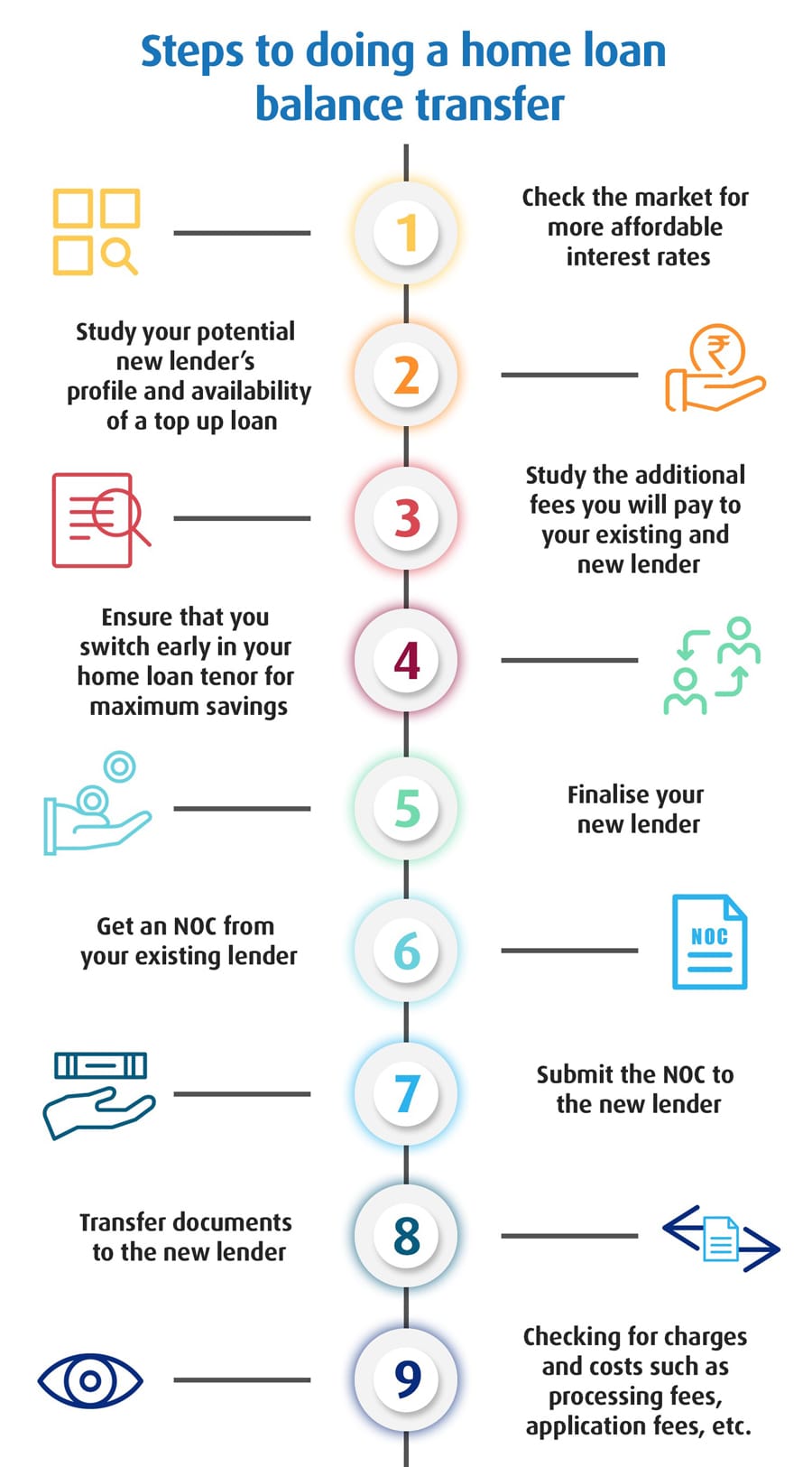

On speaking to your current lender, if you find that the financial institution is being rigid about the terms of the loan and not offering you any relief, you can carry out a Home Loan Balance Transfer and shift to another lender. First, research several lenders and examine the interest rates, processing fees, legal fees and mortgage fees. Ensure that the new lender offers you favourable terms especially with regards to prepayment and foreclosure. Once you select a new lender, get an NOC (No Objection Certificate) from your current lender as well as documents pertaining to your ongoing loan. Then, fill up the new application form, submit the necessary documents and transfer your loan.

You can use the low interest rate after a Home Loan Balance Transfer to repay the loan over a shorter tenor. This will create substantial savings especially with regards to the interest that you pay. Or, you can keep the tenor the same and simply enjoy lower EMIs. Then, invest what you save each month and maximise your wealth parallelly.

One loan that you can consider for a Home Loan Balance Transfer is Bajaj Finserv’s Flexi Hybrid Home Loan . With this loan, you have the option to pay only interest as EMIs at the beginning of the tenor, up to 4 years, and then pay the principal and interest, only on the amount that you use from the Flexi Loan sanction.

Here’s a quick look at the benefits that it offers.

• You can enjoy the benefits of a flexi-interest and flexi-term loan in a single loan and manage your finances efficiently.

• You can redraw any part prepayments that you make.

• You can part prepay, withdraw or foreclose the loan without paying any extra charges. You can do so many times as you wish to.

• The loan has a nominal annual fee and no hidden charges.

You can avail this loan when you carry out a Home Loan Balance Transfer as long as you are less than 50 years of age, and don’t own an under-construction property. With this loan, you can benefit from EMIs that are significantly lower than that of a term loan or a flexi term loan, thereby making your borrowing experience more cost-effective.

So, while now is a good time to refinance your Home Loan, when considering a Home Loan Balance Transfer, be sure to evaluate your situation first. Only once you find a feature-rich, low-cost loan should you consider making the switch.

X