IndusInd Bank's success mantra: Plan. Execute. Repeat

A strong performance culture, clarity of strategy and smart and innovative execution are at the core of IndusInd Bank's success. And much of that can be attributed to MD and CEO Romesh Sobti's leadership skills

When you say you’ll start at 4.30 pm you must start at 4.30 pm,” says Romesh Sobti, indicating that he’ll have to take a short break from his interaction with us to rush off for a webcast with the 24,000 employees of private sector lender IndusInd Bank. It’s the day after the first quarter results for FY17, and the bank which Sobti, 66, has led from the front for eight years has turned in yet another stellar performance. Loan growth is at 30 percent, fees have grown 28 percent, and the current account-savings account (CASA) ratio, a key metric, is at 34.4 percent. Profit after tax also grew strongly at 26 percent, with net non-performing assets (NPAs) at 0.38 percent.

“We will talk [during the webcast] about what happened in the last quarter, what the new initiatives are, what we see happening in the future. And then we will invariably talk about compliance. For 33 quarters I have talked of compliance. Stay within the rules of the land. Compliance has to be drilled in, indoctrinated,” Sobti, a 17-year ABN Amro Bank veteran, explains. For him, a successful strategy must entail that all employees of an organisation are on the same page. It is this belief in discipline and a strong performance culture that has led IndusInd—a private sector bank promoted by the Hindujas in 1994 and a marginal player for years—to become an investor favourite.

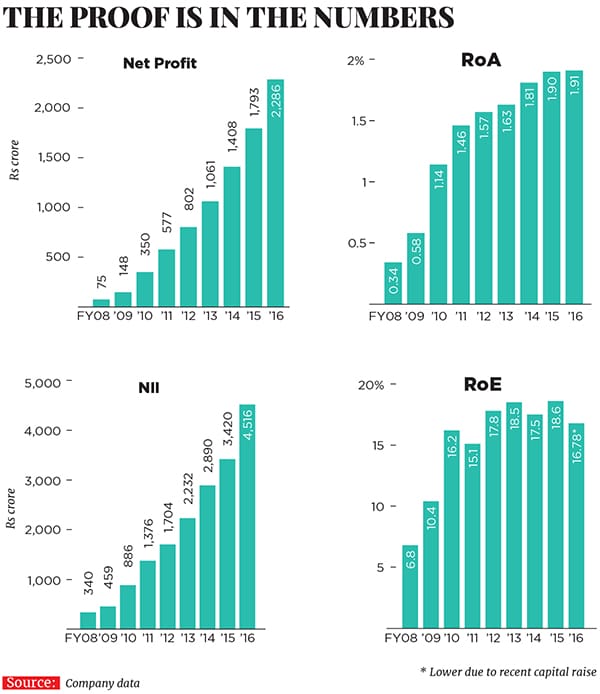

When Sobti, the managing director and CEO, took over the reins of IndusInd in February 2008 as the global financial crisis was breaking, the bank was seen as an impaired entity with very little going for it. It ended FY08 with a net profit of Rs 75 crore, net interest income (NII) of Rs 340 crore, return on assets (RoA) of 0.34 percent and net NPAs at 2.27 percent. By FY16, the bank’s net profit had soared to Rs 2,286 crore, with NII at Rs 4,516 crore and RoA at 1.91 percent, evidence of the effect Sobti and his team have had on the fortunes of the bank. And the market has rewarded IndusInd handsomely for the transformation: Between February 1, 2008 and July 11, 2016, its stock has soared from Rs 93.50 to a staggering Rs 1,127, a gain of 1,105 percent. For FY16, the bank, which now ranks among the country’s top six in the private sector, clocked revenues of Rs 7,813 crore and operating profits of Rs 4,141 crore.

Meticulous planning

Much of IndusInd’s success can be attributed to the manner in which Sobti—and the team he brought in from his erstwhile organisation ABN Amro Bank—put in place three-year planning cycles (PCs) and went about executing those plans with clockwork precision. “It’s a transition from a highly impaired bank, in terms of earnings profile and the quality of the book, to a status where we could have claims to some rankings on these scores,” says Sobti, dressed in a smart grey suit and natty green tie in his Mumbai office, typically seeking to underplay the success. “The journey was broken up into cycles of three years. We call them planning cycles. They give you focus.” So, from PC-1, which began in 2008, the bank is currently on the last lap of PC-3, which ends in FY17. While the first stage was about restoring profitability, health to the book, credibility and essentially setting out what the bank wanted to be, the second was about achieving scale. The third cycle was where market share was seen as a key objective.

“In the first three years, we had some tailwinds and also some headwinds. We rode both well. Re-talenting was also somewhat easy because we had the Lehman crisis and others were releasing talent,” Sobti explains. The growth story which Team Sobti laid out also attracted talent, as did a stock options plan. “We wanted to be a universal bank, focusing on distribution as a key area and building a liability-first franchise.” The fact that the plan was working was clear at the end of phase one itself: “We saw the sharpest increase in our key vectors of success. Net interest margin (NIM) rose [from 1.53 percent in FY08] to 3 percent and RoA rose [from 0.34 percent in FY08] to 1.5 percent, while cost-to-income declined from 73 percent to 50 percent,” Sobti recalls.

Sumant Kathpalia, 55, head of consumer banking at IndusInd, who joined the bank with Sobti from ABN Amro, says the key was to focus on different aspects of the business in the different planning cycles. “While PC-1 was about getting the financial vectors right, PC-2 was about introducing retail banking in a bigger way and getting into the credit cards business [which it did by buying Deutsche Bank’s cards business in 2011]. PC-3 was about becoming a full-blown consumer bank.”

From being primarily a commercial vehicles lender and having a mid-market corporate portfolio, today IndusInd’s Rs 1,45,750 crore balance sheet has a 51:49 corporate advances to consumer advances ratio, something which Sobti says he wants to bring to a 50:50 level, making it a truly diversified bank. Even within the consumer business, the bank is aiming at bringing the vehicle- and non-vehicle financing ratio to 50:50 over the next three years from 70:30 now. In 2015, IndusInd also acquired ABN Amro’s diamonds and jewellery financing business, something Sobti had himself set up during his stint at the bank. “Today, we are the largest diamond financier in the country and the third largest in the world,” Sobti says. These diversifications and additions to the portfolio have meant that IndusInd now has much better scores in the six key performance metrics it has set for itself: NIM, RoA, return on equity (RoE), cost to income, gross and net NPAs, and revenue per employee.

“We now have a much better balance in the book and we can drive growth in the segments which matter and match assets and liabilities better. It’s been about derisking and getting in deeper variety in revenue streams,” explains Paul Abraham, 58, chief operating officer, another key Team Sobti member who came along with him in 2008.

Adds Suhail Chander, 58, head of corporate and commercial banking: “Sometimes we are ourselves surprised at the width of our corporate book now. Earlier, because we had nearly no products, we were competing on price. So we were the highest-cost borrower and the lowest-cost lender. We had a small, lower-middle corporate book. Today, you slice and dice our corporate book in any way—the top 100 companies or the best performing companies—we will have 95 percent of them with us.”

Strategy and execution

At the core of Sobti’s strategy for IndusInd was the need to differentiate the bank and ensure optimum use of capital so that resources could be channelised into areas which threw up the highest return on assets. It is this thinking which gave rise to what defines the bank’s three-pronged approach of differentiation, domain leadership and diversification. Sobti is clear that these three ‘Ds’ will drive whatever the bank chooses to do, now and in the future.

“On differentiation, we faced an existential question. Why should people bank with us? That led to innovations,” he explains. This line of thinking led to the bank offering services like Choice Money, where customers can ask for denominations of their choice at ATMs, My Account My Number (where customers can choose their own account numbers), Video Branch (where they can speak to the bank on video call) and, most recently, biometric fingerprinting for transacting on mobile, something which COO Abraham says has now led to 1,500 downloads of the IndusInd Bank app daily. “Differentiation must be around innovations, essentially around what the customer desires but has never expressed,” says Sobti. “You always wanted smaller bills at ATMs but the machines gave you Rs 1,000 denominations.”

Domain leadership has also been a key strategic element, leading the bank to select what it calls ‘home markets’—where it sees the possibility of leadership and where competitive pressures can be better tackled. “So if I see a market where I have a 5 percent share of the branch network, I should also have a 5 percent share of CASA and 5 percent of fees,” Sobti says. These markets, selected after months of strategic thinking, came from the understanding that it is better to play in places where you know you can win. “We chose 16 home markets, mainly in tier II cities, where we will compete with the big guys. We started this two and a half years ago and this is playing out very well,” says Kathpalia.

Another element which has contributed significantly to the IndusInd story is the change in the branch construct. From a mini-bank which would do everything when Team Sobti took over, today the balance sheets of IndusInd’s 1,004 branches essentially have just two key components: CASA and fees. “If you ask a branch manager what is the DNA of an IndusInd branch, she will just give you one answer: CASA,” says Sobti proudly. There is no lending discretion now at the branch level with such decisions totally centralised. The branch does not get the interest income, but originates business and gets distribution fees. “This is also indoctrinated strongly in every branch,” says Sobti. “Branches are now about sales and service. Their profitability and break-evens are predicated on CASA and fees,” adds Abraham.

Distribution: the fourth D

IndusInd and the leadership team are also obsessive about the efficient use of capital. Capital needs to flow in only to those areas where returns are worth it. That has led to the distribution business gaining ground, with the bank choosing to hold hands with other entities while ensuring its customers get the full suite of products they seek. “We don’t manufacture everything. We would rather distribute them. We don’t even do mortgages ourselves. But we distribute everything from life, general and health insurance to mutual funds and foreign currency cards,” says Sobti. “Efficient distribution is part of our DNA. We don’t believe in the conglomerate approach that we should own the insurance or mutual funds companies also.” That, he says, is the reason why IndusInd’s fee-to-assets ratio is also the highest in the industry. “[But] we don’t talk about it,” he says with a smile. “Our domain is banking.”

The Sobti Imprint

An electrical engineer by training, Sobti’s 33-year banking career has seen him work at State Bank of India (SBI), where he gathered experience in financing small farmers, at ANZ Grindlays, and then for about 17 years at ABN Amro Bank. There, he became executive vice president–country executive, India, and head, UAE and sub-continent, rising from the position of chief manager, before moving to lead IndusInd.

His calm and gentle demeanour belies a gravitas that has won him many admirers, both within the bank and outside. While those like Abraham, Kathpalia and Chander swear by his leadership (Kathpalia calls the IndusInd stint “the experience of a lifetime for a professional”), there are other seasoned bankers who are unstinting in their praise for the IndusInd boss. SV Zaregaonkar, 61, an IndusInd veteran who is also the bank’s chief financial officer and has seen every balance sheet since he joined in 1995 from Dena Bank, notices a lot of empowerment at the bank. “He [Sobti] did not disturb the existing setup when he came in with his team. He ensured there was a combination of the old and the new. He had the ability to manage both. He just changed the business model.” Zaregaonkar says that when the new team took over, aspiring for a Rs 500 crore operating profit was a huge task. “Now I do quarterly operating profits of over Rs 1,200 crore. In 2008, the NII was around Rs 400 crore. The NII we clocked in the latest quarter is Rs 1,356 crore. That’s how much things have changed.”

Vishwavir Ahuja, who is MD and CEO of the private sector RBL Bank (formerly Ratnakar Bank) and has followed a similar career trajectory, taking charge of a small private sector lender after a long and successful stint at Bank of America, says Sobti deserves the “highest respect and regard for being a mature businessman”.

“He is a seasoned banker, having cut his teeth at SBI and then through stints at Grindlays and ABN Amro. But at the same time, he is a true leader, a great listener and excellent at managing people. He is clear in his thinking and communicates clearly,” says Ahuja, who knows Sobti since 1983 and meets him regularly at social dos. “Thoughts like retirement cannot be associated with him. He is extremely fit, and when he’s not playing golf, you’ll see him walking,” he says. “He’s unobtrusive in the manner in which he drives people. He’s also very helpful. When I was taking over at RBL, he helped me very much. I see him as a mentor.”

Ahuja also says while other CEOs could have been overwhelmed by a promoter group like the Hindujas, that would never be the case for someone like Sobti who has the confidence of the promoters. “They have always been very supportive in all our plans,” Sobti stresses.

Cycle 4: A Sneak Peek

For PC-4, Sobti, the meticulous planner, has some key elements to play with. In a presentation made on May 26, 2016, called ‘A Glimpse into Planning Cycle 4’ at a Morgan Stanley conference, Sobti outlined four areas—rural banking, off balance sheet, digitisation and niche portfolios—as the likely focus for that period. Each of these themes, he says, can contribute 10-15 percent to the bank’s profits in that cycle. While rural banking and microfinance mesh well, future growth will be driven by higher penetration in rural India. Technology will lower costs of servicing and there will be a large opportunity for banks to cross-sell savings accounts, remittances, benefit transfers and insurance.

On the digital side, the bank will partner with existing players wherever possible to generate maximum returns as also with payment banks, aggregators and wallet companies. Earlier this year, it partnered with online payment solution firm PayU India to enhance the digital experience for customers by bringing the full suite of consumer banking products online and powering them through payment innovations and online ecosystems enabled by PayU India. A tieup with Paytm is also on the anvil.

“All this is playing out [but] none will work on its own,” Sobti says of digitisation. “Payment banks want collaboration; they have to sell products other than payment products. Banks want it as well. The digital ecology has many players who have to collaborate. Banks, payment banks, aggregators, the existing big payment players like Mastercard and Visa and even the fintech companies— all will collaborate. Success will come out of collaborations.” And along with digital will be the continuing hunt for profitable portfolios like the ones the bank picked up from Deutsche and ABN Amro.

So, does IndusInd favour portfolio acquisitions to bank buyouts?

“We will be there if a bank is available. But the universe of banks available is so minute. The last one was the Kotak–ING deal. So I am saying, let’s also look at an alternative strategy like what we did for credit cards and gems and jewellery,” he says. “You can stack up all this in a way that gives you inorganic growth without having to acquire a bank. But we won’t acquire for the sake of acquiring unless it gives me that 3D benefit.”

Having seen almost three full planning cycles and tasted success, what, then, does Sobti see as the definitive DNA of IndusInd Bank? “I can’t point to a thing,” he says candidly. “But I think it’s about a strong performance culture and one of delivery. It’s also about having a clear strategy. Strategise once, execute daily. Execution plans take up 30 pages, strategy takes up five. You can say our DNA is diversified,” he says with a laugh. That’s another play with D right there.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)