As the rupee falls, India's importers have little option but to stay nimble

The RBI is in a battle suit to protect the rupee, which is depreciating against the dollar due to rising import costs and foreign fund outflows, leaving corporates to take swift financial decisions in a volatile environment

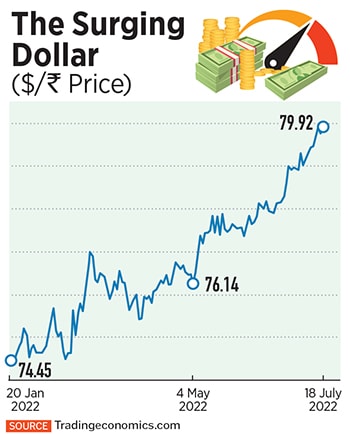

In 2022, the rupee has depreciated around 7.5 percent against the dollar–but it is still less than some Asian currencies

Image: Rajendra Jadhav / Reuters

In 2022, the rupee has depreciated around 7.5 percent against the dollar–but it is still less than some Asian currencies

Image: Rajendra Jadhav / Reuters

A slippery, rollercoaster ride is the path ahead for India’s importers, where some of whom need to rush to cover unhedged foreign currency exposures or take swift financial decisions to help curb costs, as the rupee weakens against the dollar.

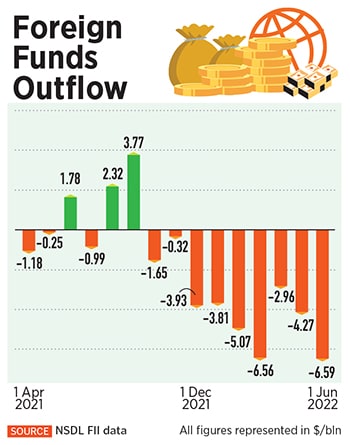

In recent days, sentiment towards the rupee has weakened after it briefly hit a lifetime low against the dollar, at 80 levels, intraday last week. In 2022, the rupee has depreciated around 7.5 percent against the dollar–but it is still less than some Asian currencies such as Thai baht, Korean won and Taiwan dollar. On July 18, the rupee was trading 0.18 percent up against the dollar, at 79.93.

But the constantly fluctuating rupee has meant that importers such as robotics maker CynLr—whose sophisticated components towards robotics are imported—need to be nimble in their financial decisions.

Dipping Purchasing Power

“Whenever we have cash in rupees, but our expenses are global, often in dollars, the immediate thing that we noticed is that our purchasing power is dropping,” says Gokul NA and Nikhil Ramaswamy, co-founders of Vyuti Systems, a hi-tech engineering startup in Bengaluru that makes sophisticated computer vision based guidance systems for industrial robotic arms—better known by their brand CynLr.

About 90 percent of the cost of CynLr’s most sophisticated components is pegged to imports, Gokul says. The rest, which are more mechanical in nature, are sourced locally. Imaging sensors, camera components, servo motors, encoders, and robotic arms are all manufactured overseas. “Optics come from France, cameras come from Germany, and a few components from Canada, and all of these international vendors, we pay them in dollars,” Ramaswamy tells Forbes India.

RBI in Battle Suit

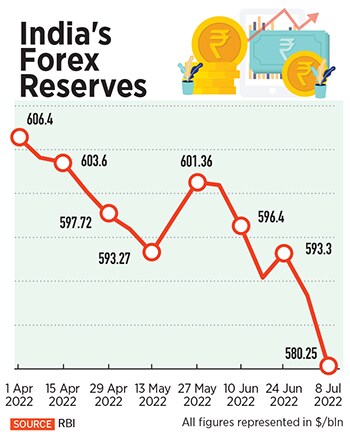

RBI in Battle Suit The falling rupee has meant that India’s foreign exchange reserves have also been falling in recent weeks (see forex reserves chart), to $580.2 billion as on July 8, against $606.4 levels at the start of the financial year on April 1, according to RBI data. Economists say this is due to the fall in the foreign currency asset (FCA) levels.

The falling rupee has meant that India’s foreign exchange reserves have also been falling in recent weeks (see forex reserves chart), to $580.2 billion as on July 8, against $606.4 levels at the start of the financial year on April 1, according to RBI data. Economists say this is due to the fall in the foreign currency asset (FCA) levels. “The latest RBI action will help in our trade with Russia, but one must understand that payment in rupees is not accepted by other regions such as UK, USA or the EU. This step helps make forex payments to Russia in rupees, which will help curb the outflow of the dollar,” says Indo Count Industries’ CEO and Executive Director KK Lalpuria.

“The latest RBI action will help in our trade with Russia, but one must understand that payment in rupees is not accepted by other regions such as UK, USA or the EU. This step helps make forex payments to Russia in rupees, which will help curb the outflow of the dollar,” says Indo Count Industries’ CEO and Executive Director KK Lalpuria.