Bajaj Auto shares buyback: Who stands to benefit the most?

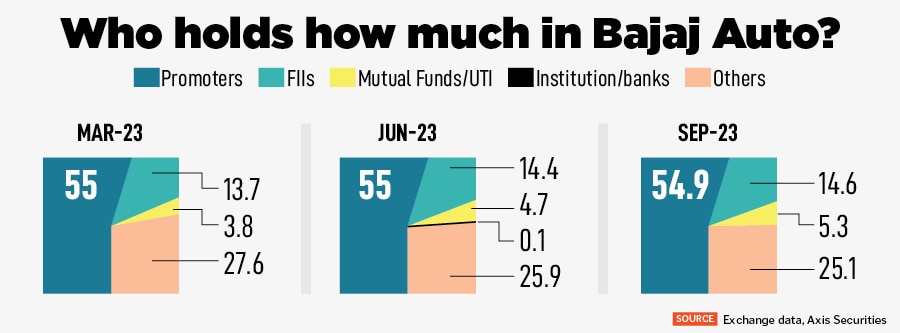

The share buyback at Rs10,000 apiece is at a whopping 43 percent premium. But not all will benefit from it as acceptance ratio is likely to be lower. With the promoter group holding 54.94 percent as of December 2023, they will potentially get a bulk of the money

File Photo: A worker cleans a Bajaj motorcycle at a Bajaj Auto showroom in Kolkata, India.

Image: REUTERS/Rupak De Chowdhuri /File Photo

File Photo: A worker cleans a Bajaj motorcycle at a Bajaj Auto showroom in Kolkata, India.

Image: REUTERS/Rupak De Chowdhuri /File Photo

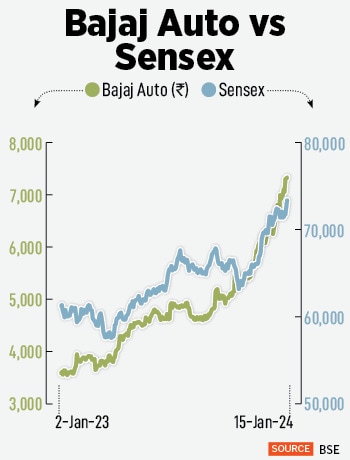

It’s not surprising that the shares of a company which declared a buyback have seen bountiful gains on the stock exchanges, as a consequence. Shares of Bajaj Auto hit record highs of Rs7,420 apiece, a day after the company announced its buyback or share repurchase plans on late Monday evening.

However, all that exuberance and joy for those queuing up to buy shares of Bajaj Auto in pursuit of availing the buyback may be a bit misplaced. No doubt, the share buyback at Rs10,000 apiece is at a premium of a whopping 43 percent from the closing price of Rs6,985.7 on Monday. But not all will benefit from the buyback as the acceptance ratio is likely to be on the lower side.

Considering the small buyback, most retail investors will not be able to receive any considerable benefit from the same as the acceptance ratio is expected to be 4 to 13 percent, says Aditya Welekar, senior research analyst-auto and metals, Axis Securities. He expects a return of 2 to 4 percent in the stock in the next three to four months. Acceptance ratio in a share buyback by a company is the proportion of shares tendered by shareholders that the company intends to accept for share repurchase. For instance, if a company repurchases 25 percent stake from the buyback and the total percentage stake held by external shareholders is 50 percent, the buyback acceptance ratio will be 0.5 or 50 percent, indicating the company will accept one share for every two shares held by shareholders.

The board of Bajaj Auto approved the buyback of 40 lakh shares at a price of Rs10,000 per share for an aggregate amount not exceeding Rs4,000 crore. The buyback offer amounts to 1.41 percent of the total number of equity shares of the company which will be executed through a tender route.

Just over a year ago, Bajaj Auto had made a repurchase of shares worth Rs2,500 crore. From July to October 2022, Bajaj Auto had offered a buyback at Rs4,600 apiece.

Just over a year ago, Bajaj Auto had made a repurchase of shares worth Rs2,500 crore. From July to October 2022, Bajaj Auto had offered a buyback at Rs4,600 apiece.