Bonds play: FII money into Indian debt market fizzling out again

Indian bonds are losing FII support despite inclusion in two major global indices from June. Is it too early to panic?

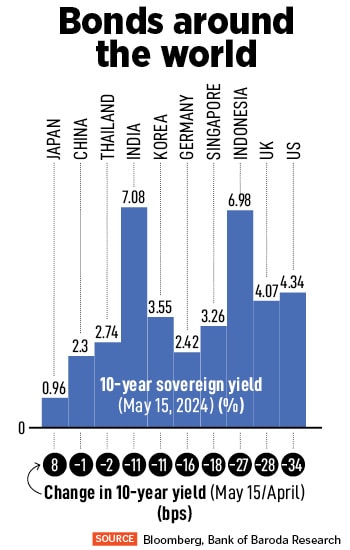

Globally, bond markets have been volatile, mostly due to stronger-than-expected US inflation data and rising geo-political tensions.

Image: Shutterstock

Globally, bond markets have been volatile, mostly due to stronger-than-expected US inflation data and rising geo-political tensions.

Image: Shutterstock

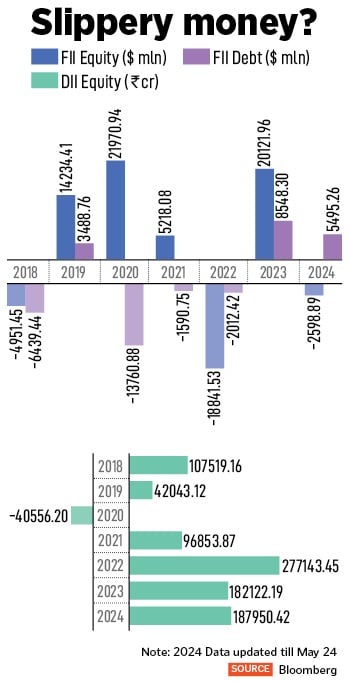

It is not a surprise that Indian bond markets have been less attractive for foreign institutional investors (FIIs). However, inclusion of Indian government bonds in two global indices, starting this June, was widely expected to turnaround flows. Rather, the excitement seems to be fizzling out as FII inflows into Indian bonds have once again begun to limp, after the initial burst of money.

In May, FIIs became net buyers of Indian bonds only in the second half of the month, following a hectic sell-off in the previous month; in April, FIIs sold Indian bonds worth nearly $1.9 billion. So far FII inflows into Indian bonds is a feeble $273 million in May. One of the major factors leading to the drastic fall is volatility in the 10-year sovereign yield, especially in the US.

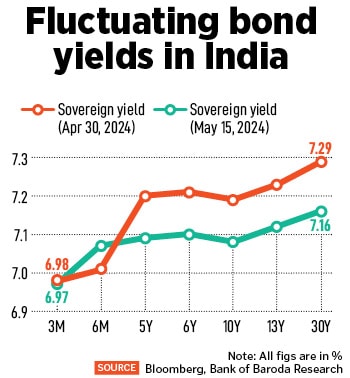

The 10-year yield in India heated up by 13 basis points in April, but later fell to 7.08 percent by May 15 due to a gradual decline in US 10-year treasury rates. Thereby, the pace of outflow of FII in debt markets slowed down in May. Typically, bond prices and bond yields are inversely related.

According to Dhawal Dalal, president and CIO, Fixed Income, Edelweiss Mutual Fund, FIIs selling in IGBs was partly linked to rising US treasury yields and an appreciation in the dollar index, which made investing in dollar bonds more attractive as compared to holding debt products in emerging markets (EM). “FPI selling debt in EM was not confined to India but it was broad-based across other Asian nations as well. The other part could be booking gains and de-risking ahead of the outcome of general elections,” he explains.

The US 10-year treasury yields were volatile in April and May, rising 48 bps in April. By May 15, it had hit 4.43 percent, cooling off 34 percent in nearly a month. Globally, bond markets have been volatile, mostly due to stronger-than-expected US inflation data and rising geo-political tensions. As a result, the yields on US treasuries rose significantly. Indian government bond yields too mirrored the moves of the US treasury and rose 14 bps to 7.2 percent in April.

The US 10-year treasury yields were volatile in April and May, rising 48 bps in April. By May 15, it had hit 4.43 percent, cooling off 34 percent in nearly a month. Globally, bond markets have been volatile, mostly due to stronger-than-expected US inflation data and rising geo-political tensions. As a result, the yields on US treasuries rose significantly. Indian government bond yields too mirrored the moves of the US treasury and rose 14 bps to 7.2 percent in April.

Index provider JP Morgan is due to start IGB inclusion by June 2024, and it will extend over 10 months, with 1 percent increments on its index weighting, till it likely reaches 10 percent. Separately, Bloomberg Index Services will include India’s bonds in its Bloomberg EM Local Currency index and related indices from January 2025, over a 10-month period to October. Once complete, India would join both China and South Korea as markets that reach the 10 percent cap in that index.

Index provider JP Morgan is due to start IGB inclusion by June 2024, and it will extend over 10 months, with 1 percent increments on its index weighting, till it likely reaches 10 percent. Separately, Bloomberg Index Services will include India’s bonds in its Bloomberg EM Local Currency index and related indices from January 2025, over a 10-month period to October. Once complete, India would join both China and South Korea as markets that reach the 10 percent cap in that index. He is not alone in his optimism about Indian bonds becoming attractive again. According to Dalal, FIIs will start buying IGBs to the tune of $2 billion a month on average from June 2024 as part of index inclusion till March 2025. In the meantime, any positive news on India's sovereign credit rating upgrade could result in increased demand from FIIs.

He is not alone in his optimism about Indian bonds becoming attractive again. According to Dalal, FIIs will start buying IGBs to the tune of $2 billion a month on average from June 2024 as part of index inclusion till March 2025. In the meantime, any positive news on India's sovereign credit rating upgrade could result in increased demand from FIIs.