- Home

- UpFront

- Take One: Big story of the day

- Can India's social stock exchange flourish where others have failed?

Can India's social stock exchange flourish where others have failed?

The social stock exchange is inching closer to its first listing of non-profits, possibly as early as August, officials say. If global precedents of using capital markets for social impact are anything to go by, India faces a tall order ahead

Divya writes about gender, philanthropy, startup and workplace trends, and business from the lens of its impact on people. She is keen to find interesting stories and new ways of telling them. A journalism graduate from Mumbai who was previously with The Economic Times, Divya is also an editor and proof-reader. Outside of work, she likes to travel, read books, drink hot chocolate, and endlessly watch, read and talk about cinema.

- For businesses, sustainability should be a leadership challenge, not a cost problem: Rajeev Peshawaria

- Philanthropy for mental health should focus more on community-led models

- I was never taken seriously as someone who can build a business: Masoom Minawala

- Indian companies should focus on high value manufacturing: Vijay Govindarajan

- Roop Rekha Verma's unwavering fight to uphold constitutional values

India’s SSE, which is a segment on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), is targeting to list its first few non-profits in August

Image: Shutterstock

India’s SSE, which is a segment on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), is targeting to list its first few non-profits in August

Image: Shutterstock

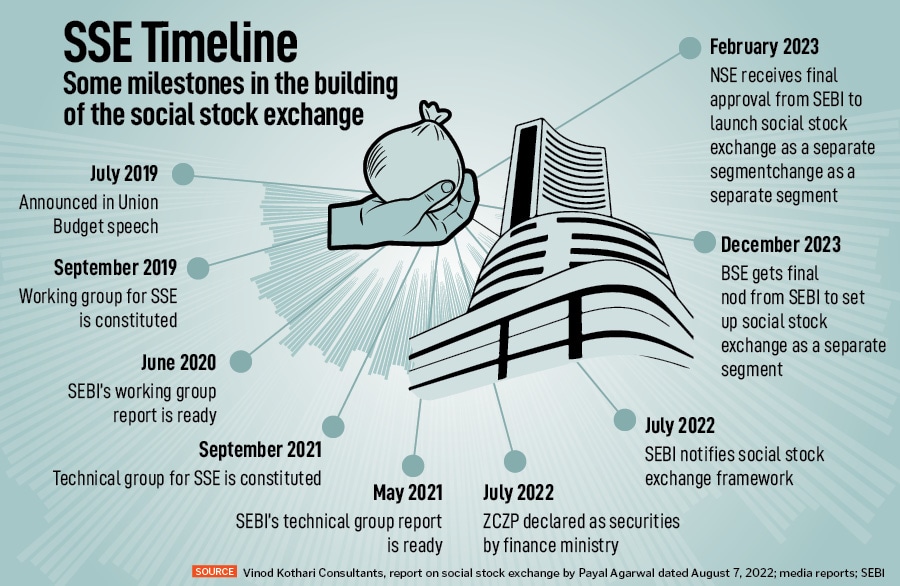

In her Budget speech in 2019, Finance Minister Nirmala Sitharaman proposed the creation of a social stock exchange (SSE). It would be an electronic fund raising platform under the regulatory ambit of the Securities and Exchange Board of India (SEBI), “for listing social enterprises and voluntary organisations working for the realisation of a social welfare objective so that they can raise capital as equity, debt or as units like a mutual fund”, she said.

Related stories

Four years later, India’s SSE, which is a segment on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), is targeting to list its first few non-profits in August, two officials involved have confirmed to Forbes India.

“The BSE social stock exchange has received 16 registrations from non-profits so far and we are in active discussions with two of them to target listings in August,” says Hemant Gupta, head of the social stock exchange at BSE, and head of SEBI’s governing council for the BSE. He does not reveal names but says both non-profits work in the skill development space.

R Balasubramaniam, founder of the Grassroots Research and Advocacy Movement (GRAAM), who heads SEBI’s advisory committee on the social stock exchange, also confirms that his committee, along with senior officials from SEBI, is meeting non-profits and potential investors in Mumbai towards the end of July to help them understand why the SSE could be an important platform for social impact, and target a few listings in August. SEBI Chairperson Madhabi Puri Buch is also likely to be present at this meeting, though that was not confirmed at the time of writing this article.

Everyone is unclear about how the SSE will operate, Balasubramaniam says, and in the past many months, the efforts of stakeholders involved in building the social stock exchange have been to create awareness and facilitate training to get more people—both potential investors, and non-profits and social enterprises—on to the platform.

The process to get the SSE up and running has been slow, Balasubramaniam admits, but says it was intended that way. “Right now it needs to be slow by design,” he says, adding that the advisory committee has been meeting every quarter to talk about developments and address challenges. “My view is strengthen the foundation, build the fundamentals. Help good non-profits get registered and listed and roll out a few products, get investor confidence, let the exchanges and intermediaries learn how to operate in this new ecosystem, and then go to the next step.”

The idea behind the potential initial listing in August is to create a proof of concept that can be built up step by step. “I am positive that if we sustain the same kind of energy and keep pushing it for a year more, even if you get 25 non-profits to start listing by the end of FY24, I would call the social stock exchange a success,” Balasubramaniam says. The SSE is to start with listing non-profits, as it is taking some more time for social enterprises to figure out compliance and other regulatory requirements, says Gupta.

Also read: Indian philanthropy is growing from tradition to innovation: Neera Nundy

Purpose over profit

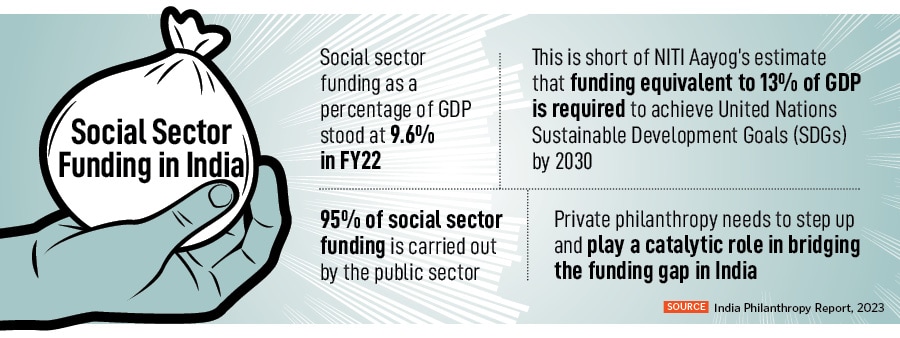

The idea behind a social stock exchange is powerful: Use financial markets to move capital towards social impact. In India, it could bridge the trust and credibility gap that currently exists between the social sector and individuals and corporations with means to make a difference.

The social sector contributes two percent of India’s gross domestic product (GDP), but even as a sector that forms the first line of response for any social crisis or emergency—be it the Covid-19 pandemic or the recent floods—it is less visible, understood and talked about, says Pushpa Aman Singh, founder, GuideStar India, which is an information repository listing nearly 12,000 non-profits in the country.

Singh, who is part of SEBI’s advisory committee for the SSE, believes it can have a “transformative impact for the development sector”, providing more visibility to their operations, giving them access to a larger pool of donors and in the long run, hopefully bring some ease of raising funds.

When the social stock exchange was announced, one concern that was raised was whether it will favour large organisations with English-speaking professionals at the cost of smaller grassroots organisations. “The social stock exchange is not going to cover every last non-profit, certainly not going to cover very small, remote, very rural non-profits, in the same way as the main stock exchange does not cover every kind of company,” says Ingrid Srinath, former director of the Centre for Social Impact and Philanthropy (CSIP) and member of the governing council of the BSE SSE. That said, she adds that the entry thresholds for non-profits have been kept as low as possible.

As per the technical group report on SEBI, a non-profit has to be operational for at least three years, with annual spending of at least Rs 50 lakh and annual funding of at least Rs 10 lakh in the past financial year.

Unlike most global counterparts, India does not have a legal definition of a social enterprise, but the SSE considers a for-profit company (except section 8 company) to be a social enterprise if it is working on one or multiple of the 15 broad areas outlined by the SEBI that demonstrate primacy of social impact. These areas include hunger, poverty and malnutrition, education, livelihoods, gender, and disaster management. Balasubramaniam explains that these enterprises also need to have 67 percent of their revenues, expenditure and consumer base in the social sector.

Organisations that cannot be classified as social enterprises include corporate foundations, political or religious organisations, professional or trade associations, infrastructure and housing companies, except affordable housing.

The rules for raising funds on the SSE for social enterprises are the same as for listed non-profit entities in regular stock exchanges. Listed non-profits, to begin with, will raise funds through zero coupon zero principal (ZCZP) bonds, which is essentially a donation certificate. It is meant for investors looking to create social impact without seeking financial returns. The minimum issue size is Rs 1 crore and minimum application size is Rs 2 lakh. These bonds can be issued for specific projects only and diversification is not supported.

While listed entities can use ZCZP, mutual funds, and social impact funds (a 100 percent grants-in, grants-out vehicle where investors expect only “social returns” and no returns on capital), other proposed instruments such as development impact bonds might require some changes to existing regulations, BSE’s Gupta says, which means we’ll have to “wait and watch how these instruments get fleshed out”.

At this point, clarity on tax benefits for donors and investors of the SSE is being sought. And companies participating in the SSE cannot count these funds as part of their corporate social responsibility (CSR) commitment. This is to make sure that the social stock exchange does not cannibalise existing funding routes like CSR and philanthropy, Srinath explains. “Diverting money from existing CSR and philanthropy and routing it through the social stock exchange will be a complete waste of time and not solve the purpose,” she says.

According to her, the point of the social stock exchange, therefore, boils down to attracting new capital from high net-worth individuals (HNIs) and donors, and the reason they will have confidence in investing through the SSE is because of the credibility it gets with the fact that it is regulated by SEBI and housed in the two stock exchanges, and is being developed under the aegis of the finance ministry. “Then there is the rigorous process that has been developed for annual social impact measurement,” Srinath says.

What’s in it for investors?

Given that the minimum donation cap is envisaged as Rs 2 lakh on the SSE platform, it is likely that only individuals who have an income of over Rs 1 crore are likely to use this platform initially, says Amit Chandra, chairperson, Bain Capital India, who was a member of SEBI’s working committee for the SSE, over email. This means, he adds, a small percentage of the maximum base of around 1.31 lakh people who are in the income category of more than Rs 1 crore.

“The SSE will have to start with a small and existing pool of donors who will have to be motivated to use the platform for specific reasons but with a view to pave the way for it to open up over time,” Chandra says. “We are hoping that some next-gen philanthropists will find this platform more interesting, particularly for projects that align with their passion areas.” Over the long term, Chandra believes every individual who holds a demat account could be a potential investor in SSE, which means nearly 11 crore donors.

India’s social stock exchange is distinct from its global counterparts in the sense that it is right now based more on a donation-based model than an impact investment model. The difference is that the latter includes a component of returns, while the former is purely charity for a social cause. In India’s SSE, ‘returns’ will be measured in terms of social impact that will be determined through annual social audits.

A cadre of social auditors—who will verify the social impact of the project funded through the SSE—is already being trained and certified by the National Institute of Securities Markets (NISM) through courses, Balasubramaniam says. “The Institute of Chartered Accountants of India (ICAI) and the Institute of Cost Accountants of India (ICMAI) are reporting organisations that have created the standards for social assessors going to the field.”

So far, 1,000 professionals have undergone the certification for assessors and that shows effort towards preparation, says Chandra. He explains that while social impact often takes time, non-profits can often measure milestones over the short term (1-3 years) and outcomes (3-7 years), and these can be evaluated by these external assessors.

“This will give assurance to donors about the project deliverables and its outcomes,” he says, adding that investors on the SSE will be informed about the project and its milestones and the timelines it will take to achieve those upfront. “The SSE will therefore be an important initiative to ensure transparency, standardised reporting and impact assessments giving assurance to the investors before, during and after a project,” Chandra says.

Subho Moulik, advisor of social enterprise Samhita Social Ventures, says that there are ongoing conversations with SEBI to determine how to most effectively administer an “accountability layer” within existing instruments at the SSE. “A ZPZC instrument through an intermediary with a set of key performance indicators (KPIs) attached to it that enables a callable, and not just one-time capital, makes the market quite efficient,” he says, adding that there are also conversations about the possibility of using returnable grants or a philanthropic-funded credit guarantee or pay-for-performance funding for specific outcomes—that fit into the intermediary model that has been notified by SEBI—as a way to drive funding traction.

Also read: The changing purpose and process of philanthropy: Aparna Piramal Raje

Uphill climb ahead

Close to seven social stock exchanges were set up across the world since the early 2000s, including in Brazil, Canada, Jamaica, Portugal, Singapore, and the UK. Of these, only three—Canada, Singapore and Jamaica—are currently functional. Some of the main reasons these SSEs folded up are because of low awareness and training about how social stock exchanges work, which resulted in low enthusiasm among the investor community, and low economies of scale for listed non-profits and social enterprises.

Balasubramaniam agrees that capacity-building, sensitisation and training for all stakeholders, including the regulator and the exchanges, is crucial for the SSE, but believes India is in a strong position to follow through. He says he has spent many years of his career trying to understand why SSEs around the world have failed and believes India can address these challenges. “In many countries, the government and its intent was not clear. Here, the advantage is that the government announced the setting up of the social stock exchange. It was not a market emergency. The finance minister was clear that they want the social sector to start looking at a larger pool of funds,” he says.

Second, he explains that many countries approached the SSE with a conventional regulatory mindset, but in India, SEBI was clear about designing the model with inputs from a cross-section of stakeholders. Third, “we have a Rs 100 crore capacity building fund. Even SEBI, the exchanges, the intermediaries and non-profits need training, right? They need to understand how the dynamics of the SSE will be different”, Balasubramaniam says.

Gupta of BSE says that in his experience of dealing with the non-profits for the SSE, he realises that they need a lot more handholding than corporates listing on the bourses. So while his team provides the required support to non-profits for registrations or listings, they are training themselves in the new processes.

Chandra says that currently there are about 20,000 probable non-profits with the potential to list on the SSE and anticipates that the first few hundreds might require low-touch capacity building support. “The rest will definitely require more comprehensive capacity and knowledge building support, but there are credible intermediaries who can be leveraged for the smooth transition of NGOs onto the SSE platform,” he says.

The regulator’s working group report says that India’s SSE is envisioned to facilitate trading—thus operating in a similar way as traditional stock exchanges—but no guidance on this is available in the public domain yet. Balasubramaniam says there is a long way to go for trading, because the ecosystem is not that mature right now. Which is why at present, he believes it makes sense to focus on social impact. “We should try to run only after we learn how to walk,” he says. “Right now, we are learning how to walk.”