Can single-language OTT platforms take on the streaming giants in India?

The recent success of The Great Indian Kitchen on Neestream puts the spotlight on services that cater to a niche, but growing audience base keen to consume digital content in regional languages

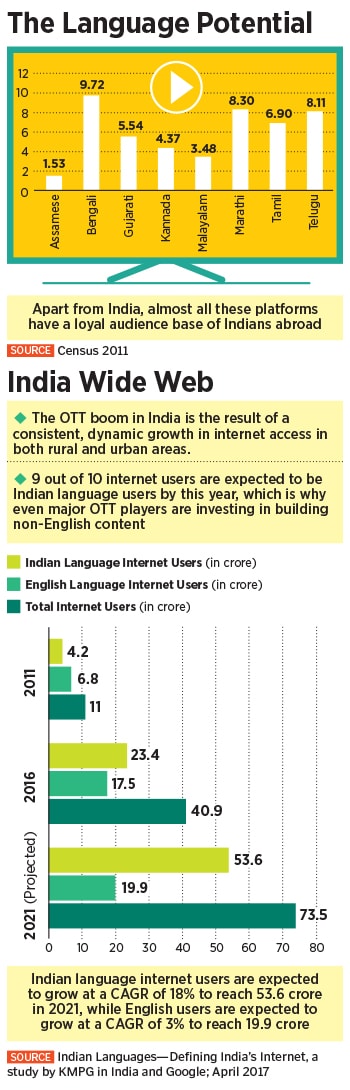

Single-language OTT sites, like CityShor.TV in Gujarati, Neestream in Malayalam, Hoichoi in Bengali and Planet Marathi in Marathi, are streaming movies and shows for people

Single-language OTT sites, like CityShor.TV in Gujarati, Neestream in Malayalam, Hoichoi in Bengali and Planet Marathi in Marathi, are streaming movies and shows for people

On January 15, a nondescript Malayalam film made on a shoestring budget of Rs 2 crore caught the eye of the nation. It was around the time actor Kamal Haasan’s political party Makaal Needhi Maiam in Tamil Nadu sparked controversy with a manifesto pledge ahead of the upcoming state elections, promising monthly wages to housewives in recognition of their domestic labour. Economists pointed out that this might not only be difficult to implement, but it might also, more dangerously, reinforce gender stereotypes and deter women from seeking employment outside the home.

Filmmaker Jeo Baby’s The Great Indian Kitchen, released just a week after this debate, addressed this very issue of the invisibility and lack of recognition to unpaid domestic work, and the everyday sexism women have to deal with at home. The film was praised almost universally by critics for its nuance, sensitivity and how it fiercely crafts a takedown of patriarchy. Interestingly, this was also a film that was rejected by almost every major OTT platform and TV channel out there.

Baby tells Forbes India that Netflix and Amazon Prime refused to take up the film without giving a reason for their rejection, and major TV channels refused to premiere it, possibly fearing the film’s stand on the politics around the entry of women in Kerala’s Sabarimala Temple. So, Baby had no option but to turn to Neestream, a single-language OTT platform dedicated to Malayalam films and series. In retrospect, it was the best decision he could have taken. “For us, releasing the film was a priority because my four friends and I had pooled in our personal money to make this. And Neestream, which is popular in Kerala and among Malayalees, seemed like a good option. The platform, on its part, was on the lookout for good content to support. The partnership worked for everyone,” says Baby, whose film, priced at Rs 140 [or $2] on the platform, broke even last week, and continues to do well.

Baby tells Forbes India that Netflix and Amazon Prime refused to take up the film without giving a reason for their rejection, and major TV channels refused to premiere it, possibly fearing the film’s stand on the politics around the entry of women in Kerala’s Sabarimala Temple. So, Baby had no option but to turn to Neestream, a single-language OTT platform dedicated to Malayalam films and series. In retrospect, it was the best decision he could have taken. “For us, releasing the film was a priority because my four friends and I had pooled in our personal money to make this. And Neestream, which is popular in Kerala and among Malayalees, seemed like a good option. The platform, on its part, was on the lookout for good content to support. The partnership worked for everyone,” says Baby, whose film, priced at Rs 140 [or $2] on the platform, broke even last week, and continues to do well.

“More than two lakh people streamed The Great Indian Kitchen on the platform after its release, which was unprecedented for us,” says Charles George, regional head-Kerala, Neestream. The platform was launched in November 2020 by NeST Technologies Corp, which is part of the US-based JKH Holdings, only for Malayalam-language viewers and has garnered a subscriber base of over 3 lakh people in the past three months.

“We have over 80 titles on the platform right now and are adding more original TV series and films in the months to come. Unlike larger, multi-language OTT players, our business strategy has been to let content bring us recognition. We don’t want to worry about the commercialisation aspect or entertainment value of films right now while considering titles on the platform in order to compete with larger, national players,” he adds.

Charles George, regional head-Kerala, Neestream, says that their strategy is to focus on content over commercial viability or entertainment value

Charles George, regional head-Kerala, Neestream, says that their strategy is to focus on content over commercial viability or entertainment value Vishnu Mohta, co-founder, Hoichoi, wants to aggregate all the different kinds of content that the Bengali language has to offer, under his platform

Vishnu Mohta, co-founder, Hoichoi, wants to aggregate all the different kinds of content that the Bengali language has to offer, under his platform

Akshay Bardapurkar is gearing up to launch 15 new web series and over 200 films on Planet Marathi in May

Akshay Bardapurkar is gearing up to launch 15 new web series and over 200 films on Planet Marathi in May

Pallav Parikh, co-founder, CityShor.TV, wants to help scale up and popularise the Gujarati film industry through his OTT platform

Pallav Parikh, co-founder, CityShor.TV, wants to help scale up and popularise the Gujarati film industry through his OTT platform

Parikh is attracting audiences to the platform by striking partnerships with cinemas to screen their content. Right now, he explains, the yearly subscription model is priced at Rs 300 and monthly at Rs 50. Releasing OTT shows in a cinema will attract people who are reluctant to watch them on mobile apps. “Right now, user behaviour here is that they will not buy an OTT subscription for Rs 50 a month, but will happily pay Rs 150 for a movie ticket. Once they buy a ticket, they also get a membership to the platform.”

Parikh is attracting audiences to the platform by striking partnerships with cinemas to screen their content. Right now, he explains, the yearly subscription model is priced at Rs 300 and monthly at Rs 50. Releasing OTT shows in a cinema will attract people who are reluctant to watch them on mobile apps. “Right now, user behaviour here is that they will not buy an OTT subscription for Rs 50 a month, but will happily pay Rs 150 for a movie ticket. Once they buy a ticket, they also get a membership to the platform.”