Chaotic bond markets to continue to combat inflation and recession fears in 2024

Last year, global bond markets toggled between persistent inflation and recession in an aggressive rates-tightening era. Will the 2024 playbook be the same?

Bond markets went through a topsy turvy phase across all regions in 2023, the impact of which was felt in equities and gold as investors shifted to alternative assets as a safe bet. Image: Shutterstock

Bond markets went through a topsy turvy phase across all regions in 2023, the impact of which was felt in equities and gold as investors shifted to alternative assets as a safe bet. Image: Shutterstock

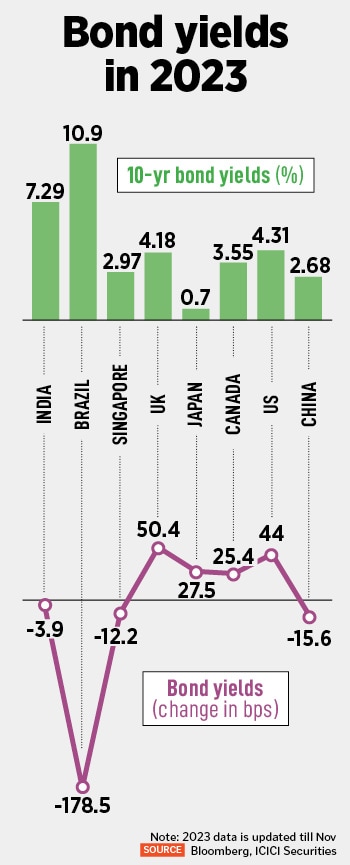

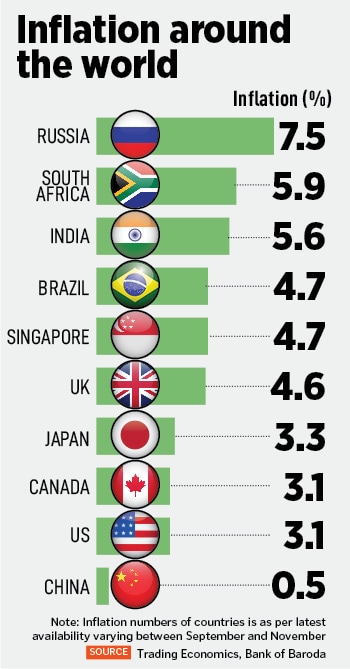

If there was one asset class that gave global central bankers and investors a varying sense of caution and exuberance in 2023, it was bonds. Navigating through the fears of widening inflation and interest rate tightening cycle, the 10-year bond yields in the US spiked to multiple-year highs while investors rushed to the safety of fixed income. The playbook of bond markets in 2024 is expected to stay the same, at least in the first half, as the scenario has changed just a little. The era of aggressive rate cycle may have ended or is ending soon, but inflation remains sticky.

“In the first half of the year, bond yields would tend to be elevated for sure and then come down depending on how the US Federal Reserve plays out its plans. Inflation has been coming down for sure, but until the Fed is convinced of the trajectory and sustainability of the same, there will be no change in policy. We should remember that as the world economy moves forward, there would be some push given to commodity prices,” says Madan Sabnavis, chief economist, Bank of Baroda.

He explains that 2023 was a year when central banks tended to either increase their policy rates or provide indirect guidance of not being in a position to lower rates due to inflation concerns. “The markets have been reading into the language of central bankers and responding accordingly. Hence there has been a tendency for bond yields to increase across the world. This will continue until such time there is a definite reversal in policy stance of the central banks. However, it has been seen towards the end of the year that signals of no more rate hikes have tended to assuage yields and lift prices. Albeit marginally,” Sabnavis elaborates.

According to him, the rate hiking cycle of 2022-23 is now at its peak. In the US and many other developed economies, interest rates have gone too far from their natural levels. It will be difficult for interest rates to sustain at these levels for long without causing serious problems in the financial sector and the economy. Pathak expects interest rates to revert in 2024, and the reversal could be quick and sharp.

According to him, the rate hiking cycle of 2022-23 is now at its peak. In the US and many other developed economies, interest rates have gone too far from their natural levels. It will be difficult for interest rates to sustain at these levels for long without causing serious problems in the financial sector and the economy. Pathak expects interest rates to revert in 2024, and the reversal could be quick and sharp. As the year goes by, a strong gush of foreign institutional investors’ (FII) money is expected to hit Indian bonds. In a significant and first-ever move, index provider JP Morgan will include India Government Bonds (IGBs) in the Global Bond Index-Emerging Markets from June 2024. The inclusion in the widely-tracked index is likely to benefit India by roughly around $20-40 billion in the next 18 to 24 months as Indian bonds will be accessible to foreign investors while the rupee is likely to be strengthened, thus boosting the economy. The inclusion, which starts from June 28, will be in a staggered manner. A 1 percent weightage per month over a total of 10 months (through March 2025) will be added, before India reaches the maximum weighting of 10 percent in the GBM-EM GD index

As the year goes by, a strong gush of foreign institutional investors’ (FII) money is expected to hit Indian bonds. In a significant and first-ever move, index provider JP Morgan will include India Government Bonds (IGBs) in the Global Bond Index-Emerging Markets from June 2024. The inclusion in the widely-tracked index is likely to benefit India by roughly around $20-40 billion in the next 18 to 24 months as Indian bonds will be accessible to foreign investors while the rupee is likely to be strengthened, thus boosting the economy. The inclusion, which starts from June 28, will be in a staggered manner. A 1 percent weightage per month over a total of 10 months (through March 2025) will be added, before India reaches the maximum weighting of 10 percent in the GBM-EM GD index