Counterstrike: How IndiGo is taking the fight to Air India even before the latter's turnaround

India's largest airline's decision to offer business class tickets and launch a frequent flyer programme comes amidst the national carrier's expansion and a $75 billion makeover. It's a way to divert business from the competitor and defend its market share, say experts

IndiGo is attempting to reinvent luxury travel, a realm it hasn’t dabbled in so far, as it unveiled its version of the business class.

Image: Indranil Mukherjee / AFP

IndiGo is attempting to reinvent luxury travel, a realm it hasn’t dabbled in so far, as it unveiled its version of the business class.

Image: Indranil Mukherjee / AFP

It’s most certainly a pre-emptive strike, a sort of make-or-break moment for India’s largest airline.

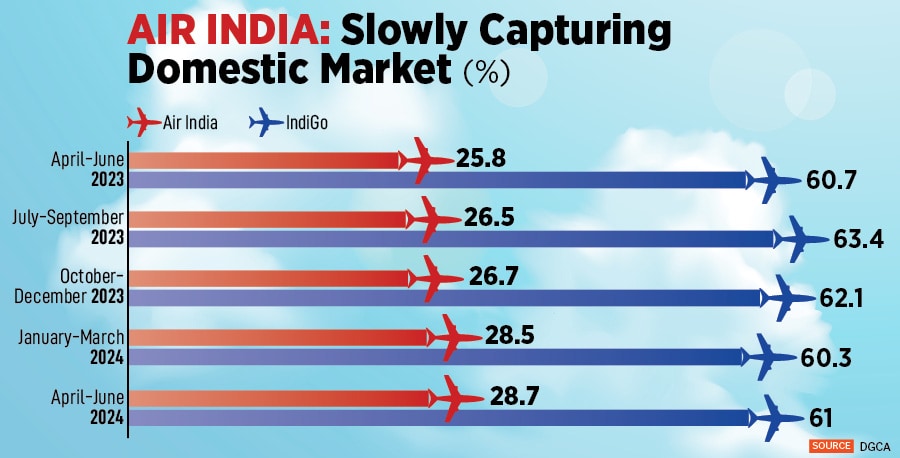

But, at the end of it, if there’s a silver lining, it’s that nobody knows Indian skies better than IndiGo, having proven that in the past 18 years. From its launch in 2006 into a market that was dominated by the likes of Jet Airways and Air Deccan to now cornering over 60 percent of the Indian market, IndiGo has pushed through a low-cost proposition that’s become something of a norm and even a case study on surviving the brutal Indian skies, all while raking in impressive profits.

That’s why all eyes are now on how the Gurugram-headquartered airline is attempting to reinvent luxury travel, a realm it hasn’t dabbled in so far, as it unveiled its version of the business class. For nearly two decades, the airline had shunned that idea and offered only economy seats, with paid-for meals and charging for services such as seat selection, without access to lounges.

Now, besides the business class, the airline is also launching a frequent flyer programme, a loyalty programme that helps to redeem points for flights or other rewards, making it the only low-cost carrier in India to offer it apart from Air India Express. Considering it flies six out of every 10 passengers in the country, and ferries as many as 10 crore passengers annually, the frequent flier proposition has already raised eyebrows.

“With India’s soaring economy and the evolving aspirations of the Indian society, it’s time for us to redefine air travel once again and provide our evolving customers more benefits as they travel the world on us,” Pieter Elbers, CEO of IndiGo, said in a statement.

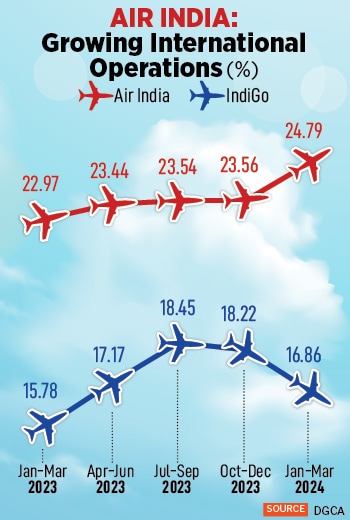

And there might just be a growing case for it. From a market share of 26.7 percent in the domestic market between October and December 2023, Air India group’s market share has grown to 29.1 percent in the quarter between April and June this year. On the international routes, from a market share of 23.56 percent during the October-December quarter in 2023, the Air India group has grown its share to 24.79 percent during the January-March quarter; IndiGo has seen that number decline from 18.22 percent to 16.86 percent. The Directorate General of Civil Aviation (DGCA) is yet to release data for the April to June quarter.

And there might just be a growing case for it. From a market share of 26.7 percent in the domestic market between October and December 2023, Air India group’s market share has grown to 29.1 percent in the quarter between April and June this year. On the international routes, from a market share of 23.56 percent during the October-December quarter in 2023, the Air India group has grown its share to 24.79 percent during the January-March quarter; IndiGo has seen that number decline from 18.22 percent to 16.86 percent. The Directorate General of Civil Aviation (DGCA) is yet to release data for the April to June quarter.