Crypto crash: A wake-up call

Retail investors are finding their way through the sharp crypto crash. As prices remain subdued, experts warn against looking at the space as a get-rich-quick scheme, even as investments into the ecosystem remain intact and the clamour for regulating it continues

Illustration by: Sameer Pawar

Illustration by: Sameer Pawar

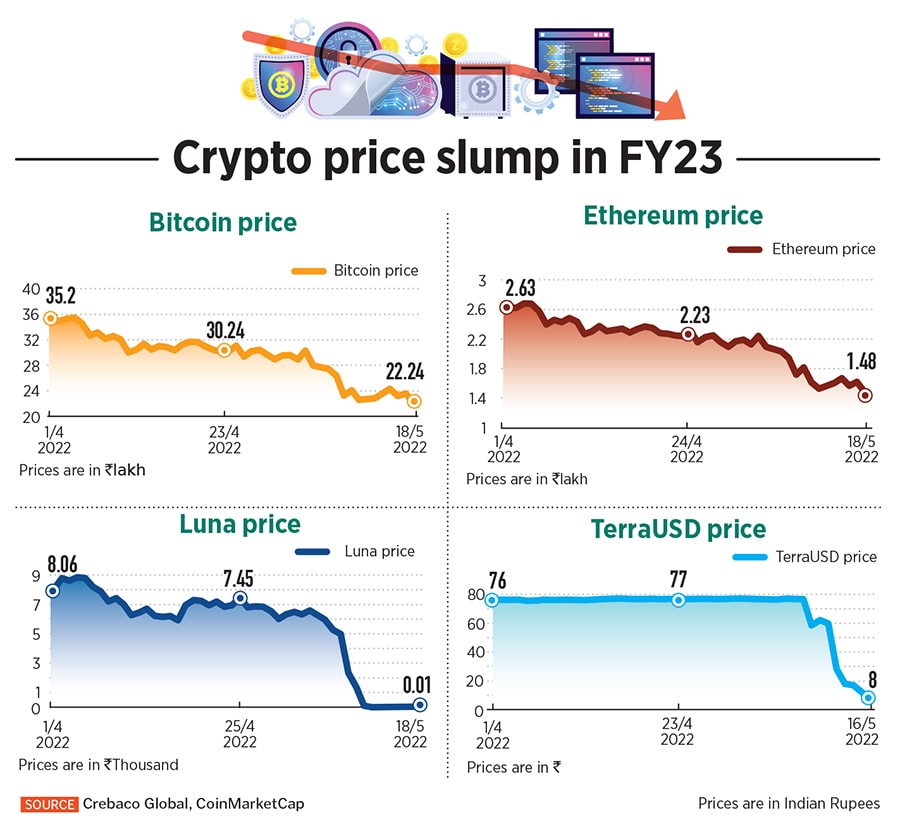

Akash Jain, a 34-year-old crypto investor and miner, is the true new-age investor. Investing full time in cryptocurrencies since 2015-16, he thought he spotted opportunity and invested nearly Rs 2 lakh ($2,600) into what had become a nearly worthless risky digital coin Luna, just before it got delisted at the major crypto exchanges. Luna was one of the digital coins that triggered a sell-off in the global cryptocurrency market which saw an estimated $2 trillion of losses in May.

The Luna coin, at the time of writing, remains temporarily delisted from global exchanges Coinbase and Binance and several Indian crypto exchanges including CoinSwitch Kuber and CoinDCX (where Jain holds Luna). Practically, Jain cannot exit from this trade and cannot do much until the coin is relisted.

Jain, who has a Masters in International Business from University of Greenwich, owns a designing firm which is mostly managed by his wife due to his full-time commitment to investing. Till 2021, Jain was making good profits out of these crypto investments. But in 2022 his losses have mounted close to Rs 10 lakh ($13,150).

Nearly 70 percent of his investment portfolio is into cryptocurrencies. Experts recommend only around 10 percent.

“The biggest mistake I made in crypto was that I would sell off after every small profit… that was my mistake,” Jain told Forbes India, from his home in Ahmedabad. This is contrary to the investment doctrine of locking in gains in an uncertain global economic and trading environment, assuming one’s goal is ensuring safety of capital.