Cryptocurrency: Is there hope beyond a dark winter?

Retail investors are trying to bravely ride out this storm of falling prices, shrinking trading volumes and high taxes by buying blue-chip cryptos and stablecoins instead of meme coins. Venture capital firms and crypto exchanges are confident that the sector will pull out of this tough phase

The phrase ‘crypto winter’ describes a bearish phase when prices collapse, with indications that they are likely to remain under pressure for months

The phrase ‘crypto winter’ describes a bearish phase when prices collapse, with indications that they are likely to remain under pressure for months

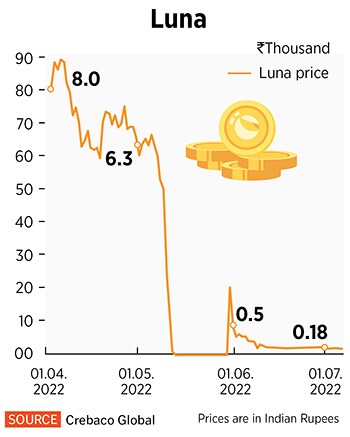

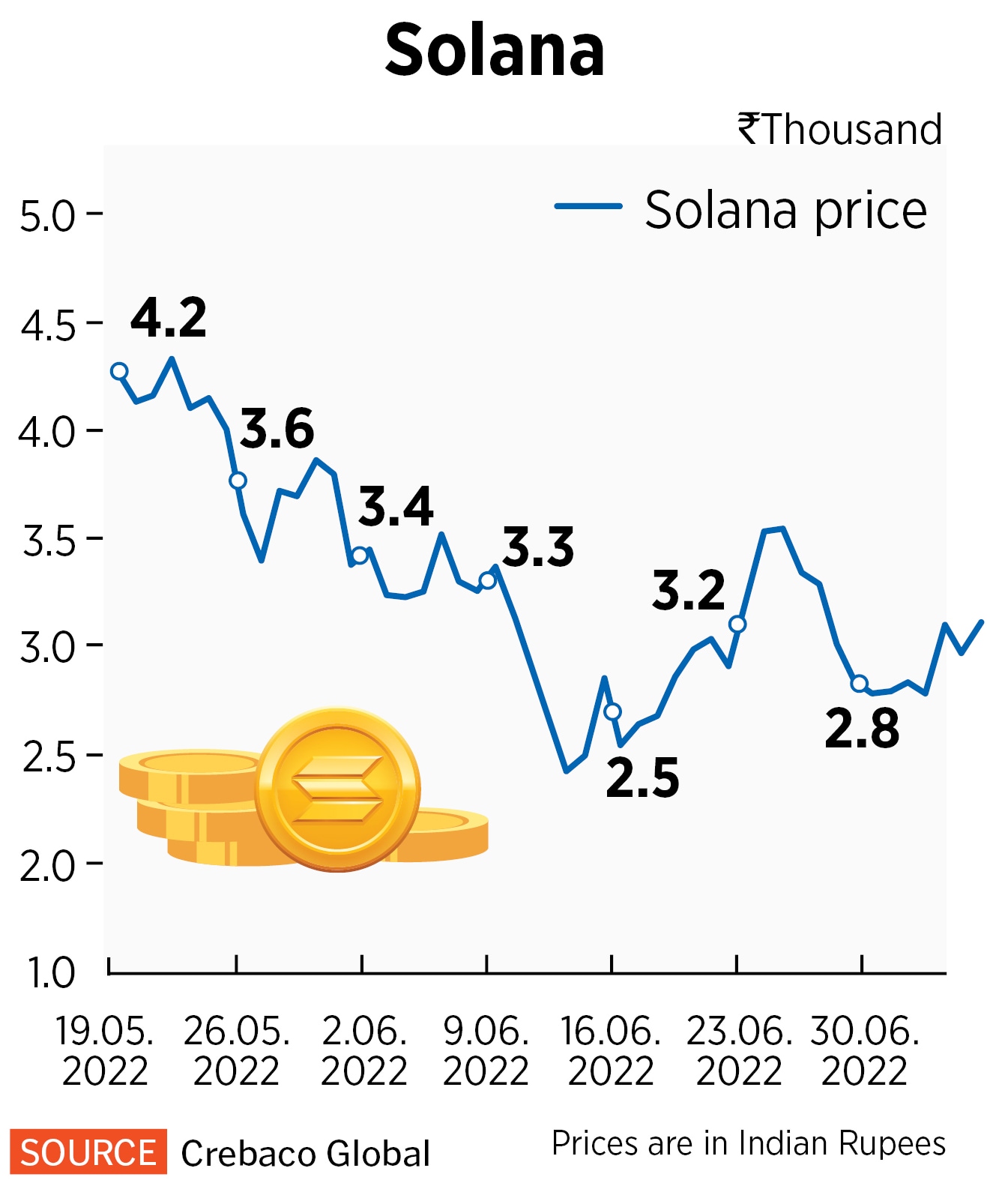

When a week starts to appear too long for the market, you realise that there is a deep malaise. Volatility and uncertainty have become so constant in the cryptocurrency market space that the news of the collapse of the digital coins terra and luna eight weeks ago appears to be an indefinite period.

The phrase ‘crypto winter’ that is being used frequently by market intermediaries, investors, media and columnists is not fallacious even as the summer season pans across the Northern Hemisphere. It describes a bearish phase when prices collapse, with indications that they are likely to remain under pressure for months. It's a winter that is harsh and brutal.

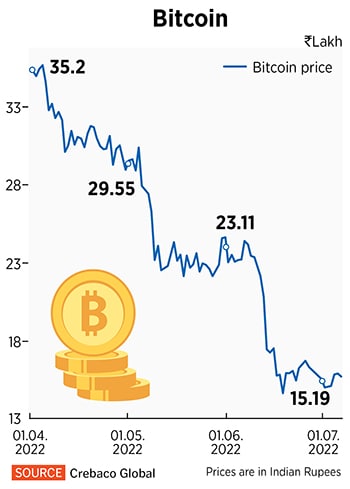

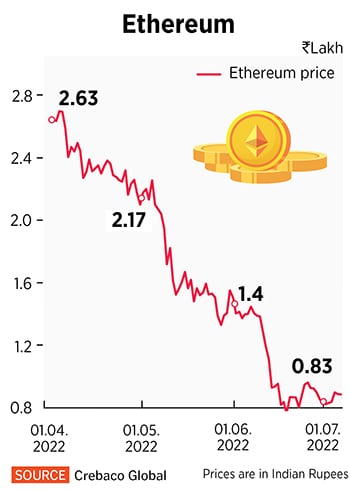

In an interview to CNN in July, US entrepreneur-billionaire Samuel Bankman-Fried, CEO of crypto exchange FTX, warned of some crypto assets being “empty products” and “having a real crash potential”. Bankruptcies, restructuring and consolidation have been sharp in recent weeks within the industry, raising fears of a contagion effect. The market cap of global cryptocurrencies is down by a third in value to $0.88 trillion as of July 12 from its November 2021 levels, and bitcoin and ethereum prices have more than halved in 2022.

US-based crypto broker and lender Voyager Digital which filed for bankruptcy has announced a restructuring plan and the promise to compensate its customers. Another crypto lender Celsius Network is exploring strategic transactions and restructuring of its debt to stay afloat, while lender Nexo has offered to buyout troubled crypto exchange Vauld, after the latter’s business was suspended due to financial challenges recently.

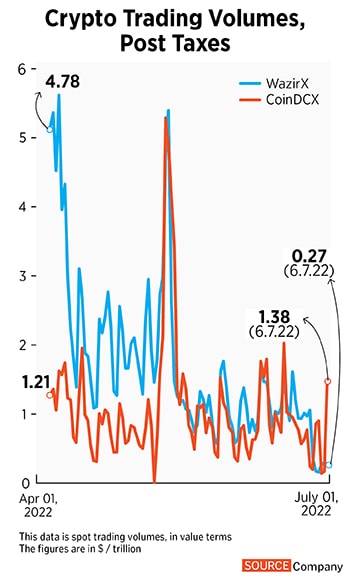

In India, trading volumes at some crypto exchanges have fallen between 70 percent and 90 percent in spot trade (see chart) after the government imposed stringent taxes and duties in FY23 to discourage such trade. Two crypto exchanges, CoinSwitch Kuber and CoinDCX, both unicorns, are now being probed by government agencies for possible foreign exchange violations.

A winter till September?

A winter till September? Menon is confident of a bounce-back. “If we look at the past trends, bitcoin has lost more than 50 percent of its value seven times before and 80 percent thrice. Regardless, it has always bounced back,” he tells Forbes India. “Historically, you can’t put a finger on a specific time by which we can see situations improve. Global factors have majorly impacted us and it will take some time to improve to see the crypto winter waning. The last bear phase lasted between 2018 and 2020, and 2021 was welcomed by a bull run where bitcoin touched its all-time high. We will have to wait and watch, but like PB Shelley said, ‘If winter comes, can spring be far behind?’”

Menon is confident of a bounce-back. “If we look at the past trends, bitcoin has lost more than 50 percent of its value seven times before and 80 percent thrice. Regardless, it has always bounced back,” he tells Forbes India. “Historically, you can’t put a finger on a specific time by which we can see situations improve. Global factors have majorly impacted us and it will take some time to improve to see the crypto winter waning. The last bear phase lasted between 2018 and 2020, and 2021 was welcomed by a bull run where bitcoin touched its all-time high. We will have to wait and watch, but like PB Shelley said, ‘If winter comes, can spring be far behind?’”

A CoinSwitch spokesperson says: “We receive queries from various government agencies. Our approach has always been that of transparency.” CoinDCX declined to comment on the matter.

A CoinSwitch spokesperson says: “We receive queries from various government agencies. Our approach has always been that of transparency.” CoinDCX declined to comment on the matter.  “I’m not selling any of my crypto as of now... just buying more on every dip,” he says. Jain is unfazed by the high taxes, which could hurt short-term trading more. The 34-year-old crypto miner says he is likely to hold on to this investment till 2024, forecasting a major bull run at that time.

“I’m not selling any of my crypto as of now... just buying more on every dip,” he says. Jain is unfazed by the high taxes, which could hurt short-term trading more. The 34-year-old crypto miner says he is likely to hold on to this investment till 2024, forecasting a major bull run at that time. “Innovations have always come before regulations. You cannot second-guess innovation. But regulations have to follow and keep pace with innovation to protect users and enable legitimate businesses,” says CoinSwitch’s Singhal. “India has the potential to lead the technological shift unleashed by cryptos, and it is my belief that the government recognises this. Today, there may be challenges with regards to certain regulations and provisions, but crypto is here to stay,” he adds. Singhal is confident that CoinSwitch is “on track” to evolve into a one-stop wealth tech destination for India. It is working on non-crypto offerings which are likely to be announced soon.

“Innovations have always come before regulations. You cannot second-guess innovation. But regulations have to follow and keep pace with innovation to protect users and enable legitimate businesses,” says CoinSwitch’s Singhal. “India has the potential to lead the technological shift unleashed by cryptos, and it is my belief that the government recognises this. Today, there may be challenges with regards to certain regulations and provisions, but crypto is here to stay,” he adds. Singhal is confident that CoinSwitch is “on track” to evolve into a one-stop wealth tech destination for India. It is working on non-crypto offerings which are likely to be announced soon.