Decoding Uni's Pay 1/3rd Card

The fintech startup promises a customer-friendly credit experience to solve short-term liquidity woes, but does it really stand out in India's competitive buy now pay later space?

Laxmikant Vyas, Co-founder & CRO, Nitin Gupta, Founder & CEO, Prateek Jindal, Co-founder & CPO

Laxmikant Vyas, Co-founder & CRO, Nitin Gupta, Founder & CEO, Prateek Jindal, Co-founder & CPO

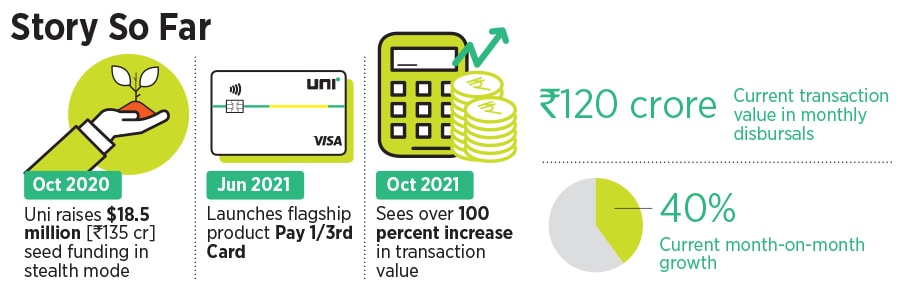

Fintech veterans Nitin Gupta, Prateek Jindal, and Laxmikant Vyas may have started out on different paths, but their journeys brought them together to the same destination–Uni, a fintech startup launched in October last year that provides new-age credit cards.

Uni’s flagship product launched this June, the ‘Pay 1/3rd’ card, automatically splits transactions into three parts at no extra cost. Customers can also pay in full in return for cashback. The idea of the card, which targets short-term liquidity, was the result of a survey that gave co-founder and CEO Gupta an insight into consumer spending habits. “We conducted a survey among the employees in the firm I was working at previously, where we found that 40 percent employees borrowed money from friends or family. That is when it dawned upon us that once in a while, most users face short liquidity crisis,” says Gupta, who wants to make credit products accessible and democratic.

The co-founders have previous experience in building credit products, with Gupta, Jindal and Vyas having worked with PayU, Ola Financial Services and Bajaj Finance respectively. The Bengaluru-based startup, backed by Lightspeed Ventures and Accel India, raised a seed round of around $18.5 million [Rs135 crore] in October 2020, while still in stealth mode. Uni is present across 47 cities in India including Delhi, Mumbai, Hyderabad, Pune, Chennai, Kolkata, Ahmedabad, Lucknow, and Jaipur. The Pay 1/3rd is a physical and digital card powered by Visa.

“With over 220 million [22 crore] credit eligible consumers, there is great potential for expanding access to credit through the adoption of innovative pay later products, especially amongst a rapidly digitising consumer base,” says TR Ramachandran, group country manager, India and South Asia, Visa.

Jindal, who is also the chief product officer at Uni, says that the buy now pay later (BNPL) trend is picking up in India. “People want more options to plan their finances better. Millennials and GenZ want to make things happen, not wait for them to happen. If there is a sale on the phone of their choice today, they want to be able to buy it and have options with payment modes. This format [BNPL] helps them plan better and solve for short-term liquidity crunches.”