Disney+Hotstar has lost the lucrative IPL deal. Is it now a fight for survival?

The OTT platform has competition closing in, even as it could lose millions of subscribers

Disney+Hotstar is facing the threat of losing between 30% to 40% of its subscribers after losing the IPL rights

Image: Shutterstock

Disney+Hotstar is facing the threat of losing between 30% to 40% of its subscribers after losing the IPL rights

Image: Shutterstock

In early June, as anticipation grew over the digital and television rights of the lucrative Indian Premier League (IPL), Disney Star knew that it was on a rather sticky wicket.

The Mumbai-headquartered broadcaster—it has been telecasting the IPL on television for five years and on its digital platform Disney+ Hotstar for a little longer than that—knew the competition, especially for television rights, would be intense. The Board of Control for Cricket in India (BCCI) was holding the e-auction for the media rights for the next five years on June 12.

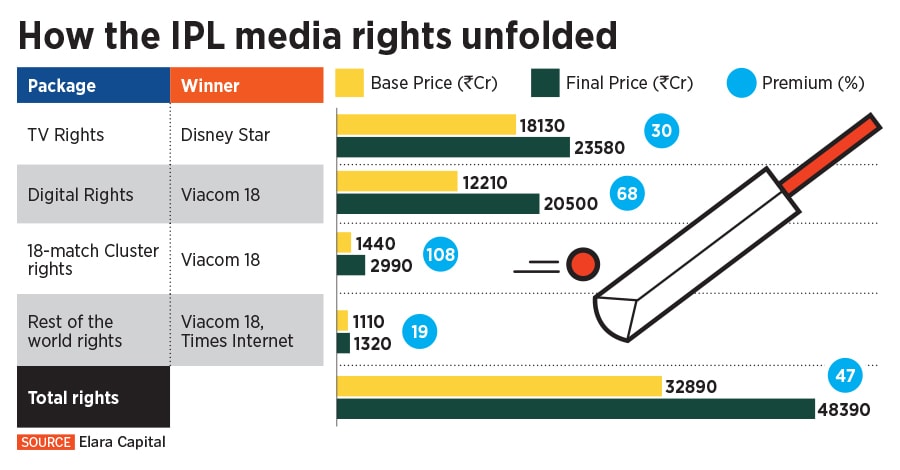

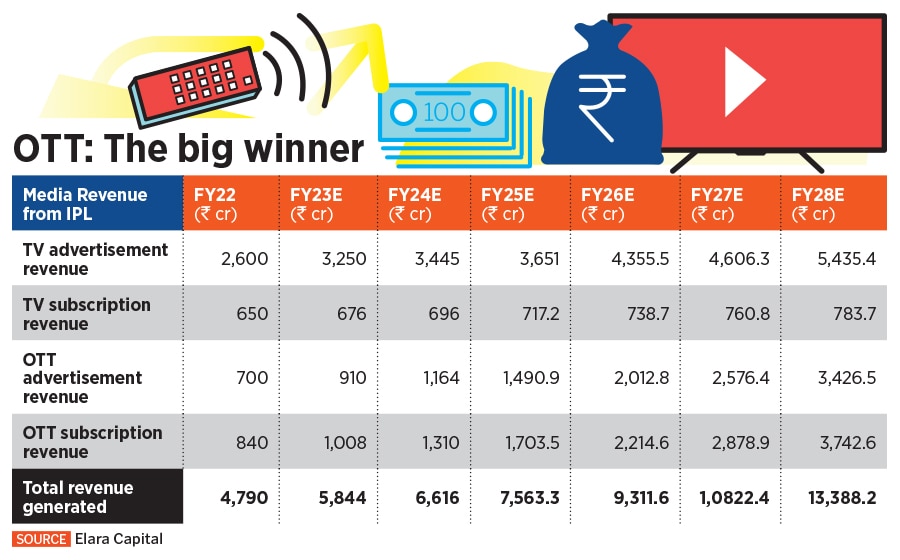

This time around, BCCI had divided the process into four packages. Domestic television broadcast rights, the most expensive one, carried a base price of Rs 18,130 crore, while for digital rights it was Rs 12,210 crore. BCCI was also offering two other rights, one for international broadcasting, which carried a base price of Rs 1,110 crore and a non-exclusive digital right for Rs 1,440 crore that included streaming rights for the playoffs and season openers. Disney Star was facing the heat from Sony, Viacom 18, and Zee Entertainment, among others.

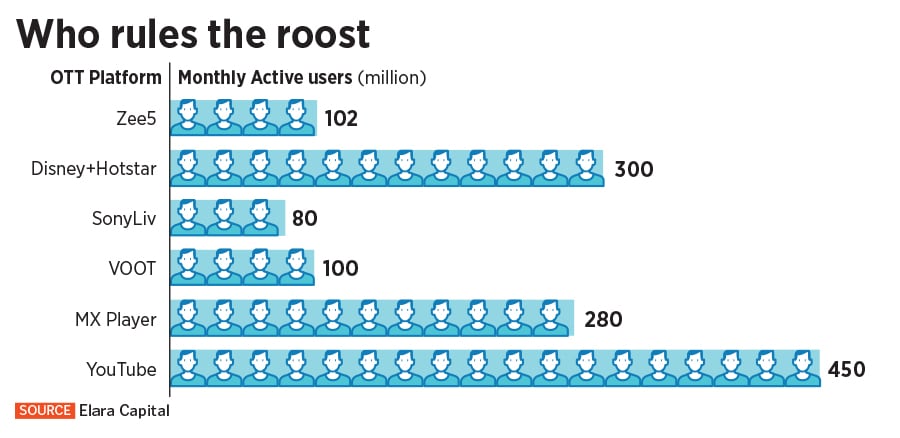

“There wasn’t much hope on the television side,” says a Disney Star employee, on condition of anonymity. “We were confident about Hotstar though.” Disney+ Hotstar, launched in 2015, has 50 million paid subscribers and is India’s largest streaming platform. Much of it is thanks to IPL, and Disney Star was expected to go all out and bag the digital rights this time too. In 2018, Star India had won the digital and television rights for IPL for Rs 16,347.50 crore, and built Hotstar on the back of cheap data and widespread smartphone usage.

However, on June 14, after three days of intense bidding, while Disney Star won the television rights, it lost the digital rights to Viacom 18, which offered Rs 23,758 crore for 2023-2027. Despite the base price of TV rights being much higher than digital—Rs49 crore compared to Rs33 crore per match—Viacom 18 will pay around 50 crore per match for the digital rights. Viacom18 also won the non-exclusive digital rights, for which it will pay Rs 33.24 crore per match, for 98 matches between 2023 and 2027.