Does markets sell-off in tech stocks indicate the end of the bull run?

Wobbly shares of Indian software services companies made investors nervous as selling pressure intensified with a few blue chip companies dragging the benchmark indices indicating markets sentiment is fragile

The decline in Infosys shares had a spillover effect on all IT major stocks on Friday, dragging the benchmark indices majorly

Image: Shutterstock

The decline in Infosys shares had a spillover effect on all IT major stocks on Friday, dragging the benchmark indices majorly

Image: Shutterstock

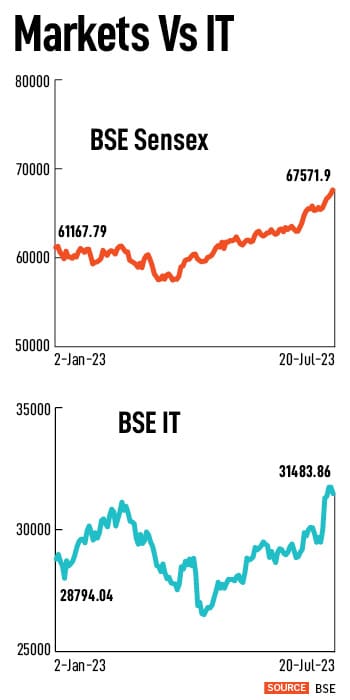

Sell-off in a few big blue chip companies rubbed the shine off Indian markets’ dream run that had taken the benchmark indices to new record highs multiple times in June and July. Shares of Indian software services companies, which participated in the rally a bit late, fell prey to massive panic selling pressure on Friday as investors rushed to dump those stocks following concerns on June quarter results.

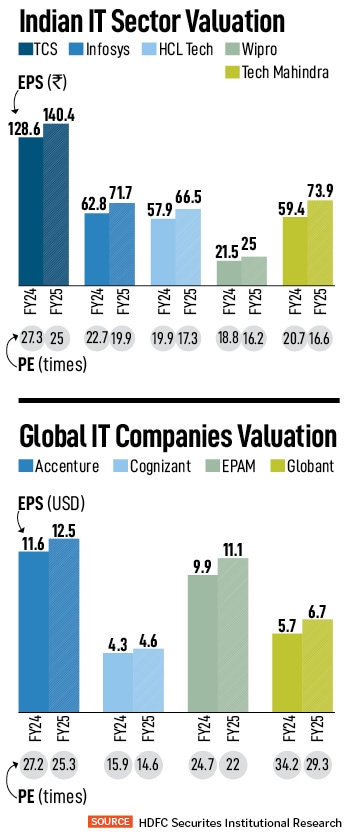

Shares of Infosys slumped 9 percent during the day as investors interpreted its lowering FY24 revenue guidance as discretionary demand weakening and slowdown in client decision-making. Infosys slashed its revenue growth guidance to 1-3.5 percent from 4-7 percent (year-on-year) in constant currency terms for full financial year 2024, while posting net revenue of $4,617 million, which is a 1 percent growth in sequential basis and a jump of 4.2 percent (YoY) in the June quarter.

Surprise lowering of revenue growth guidance for FY24 is premised on weaker discretionary demand (transformation projects) leading to lower than expected volumes and slow client decision-making, as per management, says Abhishek Bhandari, analyst, Nomura. He adds that growth is likely to be back-ended in FY24 driven by a ramp-up of some large deals and winning a few in the pipeline. “Required revenue growth rate to achieve revised guidance is -0.2 percent to +1.2% quarter-on-quarter for Q2-Q4,” Bhandari says.

That is not all.

The decline in Infosys shares had a spillover effect on all IT major stocks on Friday, dragging the benchmark indices majorly. The BSE IT index slumped over 5 percent during the day while shares of TCS slipped 3 percent. Wipro and HCL Tech also fell.

“From a near-term perspective, we believe global uncertainties and economic slowdown may impact the automation spend and result in delays in investment decisions in North America from where Infosys earns majority of its revenue (around 40 percent). IT services are expected to have lower demand in the near term. As compared to North America, Europe is expected to have resilient demand and positive investment to continue,” Omkar Tanksale, research analyst, Axis Securities says. As these uncertainties settle down in the next two to three quarters, Tanksale feels the demand scenario is likely to gain momentum once again and would be backed by consistent deal wins.Tata Consultancy Services Ltd (TCS) reported a revenue growth of 0.4 percent on a (QoQ) basis (in rupee terms) and a jump of 12.6 percent on annual basis but it was the lowest in the last 12 quarters.

“From a near-term perspective, we believe global uncertainties and economic slowdown may impact the automation spend and result in delays in investment decisions in North America from where Infosys earns majority of its revenue (around 40 percent). IT services are expected to have lower demand in the near term. As compared to North America, Europe is expected to have resilient demand and positive investment to continue,” Omkar Tanksale, research analyst, Axis Securities says. As these uncertainties settle down in the next two to three quarters, Tanksale feels the demand scenario is likely to gain momentum once again and would be backed by consistent deal wins.Tata Consultancy Services Ltd (TCS) reported a revenue growth of 0.4 percent on a (QoQ) basis (in rupee terms) and a jump of 12.6 percent on annual basis but it was the lowest in the last 12 quarters.  Nasdaq, which is a tech-heavy index, jumped over 30 percent from beginning of January, while Nasdaq 100 rallied over 42 percent. The Nasdaq 100 index, which tracks the 100 largest non-financial stocks on the Nasdaq stock exchange, is concentrated on seven major stocks (Microsoft, Apple, Nvidia, Amazon, Meta, Tesla and Alphabet) which constitute 55 percent of the weightage of the index. Hence, the rally in that index was not really showing the right picture leading Nasdaq to implement a special rebalance of the Nasdaq 100 index on July 24.

Nasdaq, which is a tech-heavy index, jumped over 30 percent from beginning of January, while Nasdaq 100 rallied over 42 percent. The Nasdaq 100 index, which tracks the 100 largest non-financial stocks on the Nasdaq stock exchange, is concentrated on seven major stocks (Microsoft, Apple, Nvidia, Amazon, Meta, Tesla and Alphabet) which constitute 55 percent of the weightage of the index. Hence, the rally in that index was not really showing the right picture leading Nasdaq to implement a special rebalance of the Nasdaq 100 index on July 24.