FM Sitharaman's budget focus: Push for manufacturing jobs, expanding PLI schemes

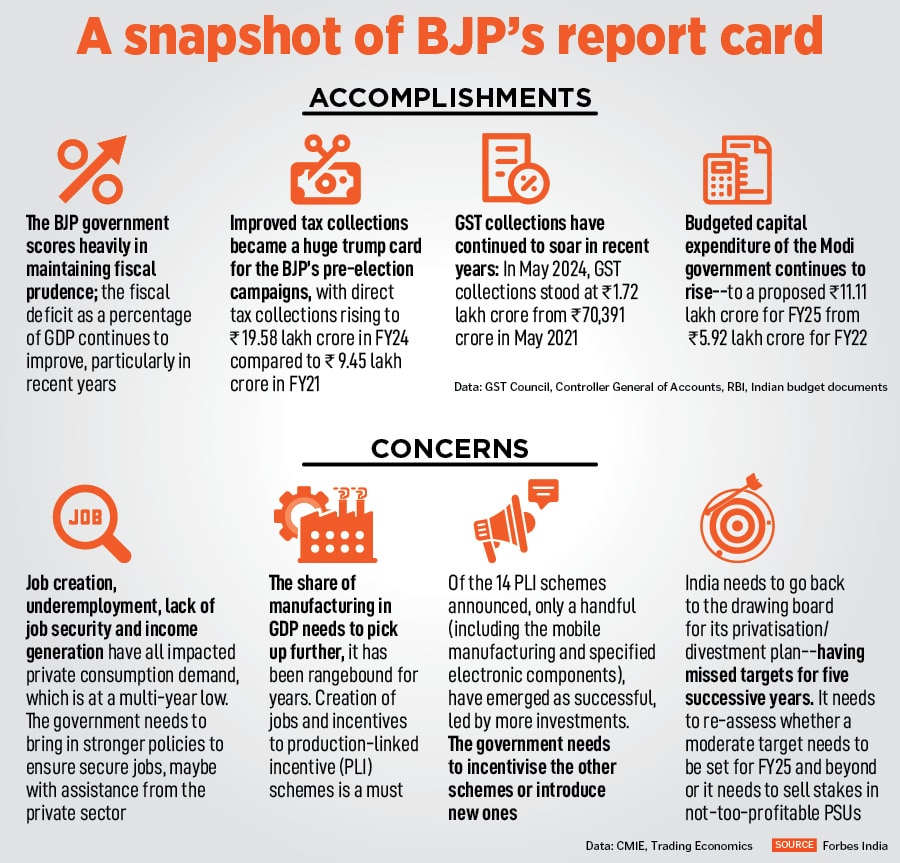

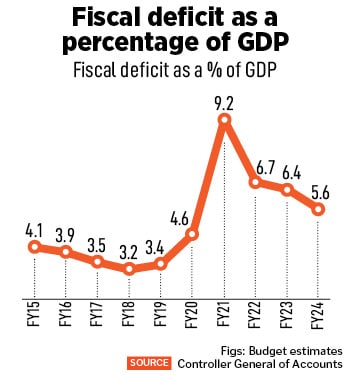

The quality of fiscal consolidation has improved as has capex push, but the newly-elected government needs to strike a balance on the financial assistance going to alliance parties and the path towards reaching fiscal deficit targets

Finance Minister Nirmala Sitharaman is expected to focus on giving a boost to manufacturing jobs and income generation and assist consumption demand, in the upcoming budget.

Image: Sanjeev Verma/Hindustan Times via Getty Images

Finance Minister Nirmala Sitharaman is expected to focus on giving a boost to manufacturing jobs and income generation and assist consumption demand, in the upcoming budget.

Image: Sanjeev Verma/Hindustan Times via Getty Images

As the BJP-led alliance attempts to fulfill its mandate after a victory in the recently-concluded general elections, the focus shifts on how finance minister (FM) Nirmala Sitharaman will—in the upcoming Union Budget—strike a balance between pushing for sustained economic growth, arresting fiscal deficit and provide the impetus to jobs and rural demand.

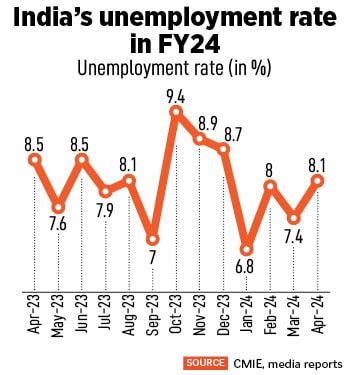

India’s pace of growth is a startling 8.2 percent for FY24, but unemployment continues to rise and private consumption expenditure is at a multi-year-low. An erratic monsoon in 2024 could threaten crop sowing and output.

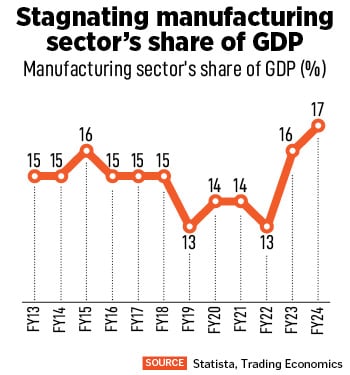

Sitharaman, in her second full term as the FM, besides providing the impetus to capital expenditure, will try to address the concerns of increasing manufacturing jobs, rural demand and income generation to help improve private final consumption expenditure (PFCE), which is at a multi-year low.

Much of the focus will shift to the government-led capital expenditure, which the BJP has been driving, to ensure that corporate India increases its hiring to build roads, railways, ports, telecom, aviation and construction activity.

Sitharaman is likely to present the budget in July-end.

“The finance minister has done a commendable job both in consolidating the fiscal deficit and ensuring a better quality of fiscal consolidation. The expenditure mix is better with rising share of capex versus revenue expenditure, and subsidies are better targeted. The rising tax to GDP ratio, driven by better compliance, better integration of GST is also notable,” she said.

“The finance minister has done a commendable job both in consolidating the fiscal deficit and ensuring a better quality of fiscal consolidation. The expenditure mix is better with rising share of capex versus revenue expenditure, and subsidies are better targeted. The rising tax to GDP ratio, driven by better compliance, better integration of GST is also notable,” she said. This means the outlay towards housing, water, sanitation and healthcare is likely to be increased. It is most likely that the government “could use resources to divert funds towards the PM-KISAN or also the MGNREGA schemes. The government could continue their focus towards addressing some of the structural issues and announcing reforms which are more pro-cyclical in nature,” Gupta told Forbes India.

This means the outlay towards housing, water, sanitation and healthcare is likely to be increased. It is most likely that the government “could use resources to divert funds towards the PM-KISAN or also the MGNREGA schemes. The government could continue their focus towards addressing some of the structural issues and announcing reforms which are more pro-cyclical in nature,” Gupta told Forbes India. The murmur from industry bodies to expand the scope and base of PLI schemes is getting louder. So far, incentives worth Rs 6,800 crore were disbursed among eligible beneficiaries of PLI schemes in FY24, according to official data from the Department for Promotion of Industry and Internal Trade (DPIIT).

The murmur from industry bodies to expand the scope and base of PLI schemes is getting louder. So far, incentives worth Rs 6,800 crore were disbursed among eligible beneficiaries of PLI schemes in FY24, according to official data from the Department for Promotion of Industry and Internal Trade (DPIIT).