Freshworks and the age of efficiency for India's SaaS sector

The current environment calls for growing sustainably, experts say, and Indian software companies may have some advantages

Girish Mathrubootham, Founder and CEO, FreshWorks

Girish Mathrubootham, Founder and CEO, FreshWorks

The broad stock market fall in the US on August 15 didn’t spare Freshworks either, as the tech-heavy Nasdaq fell more than one percent for the first time since May.

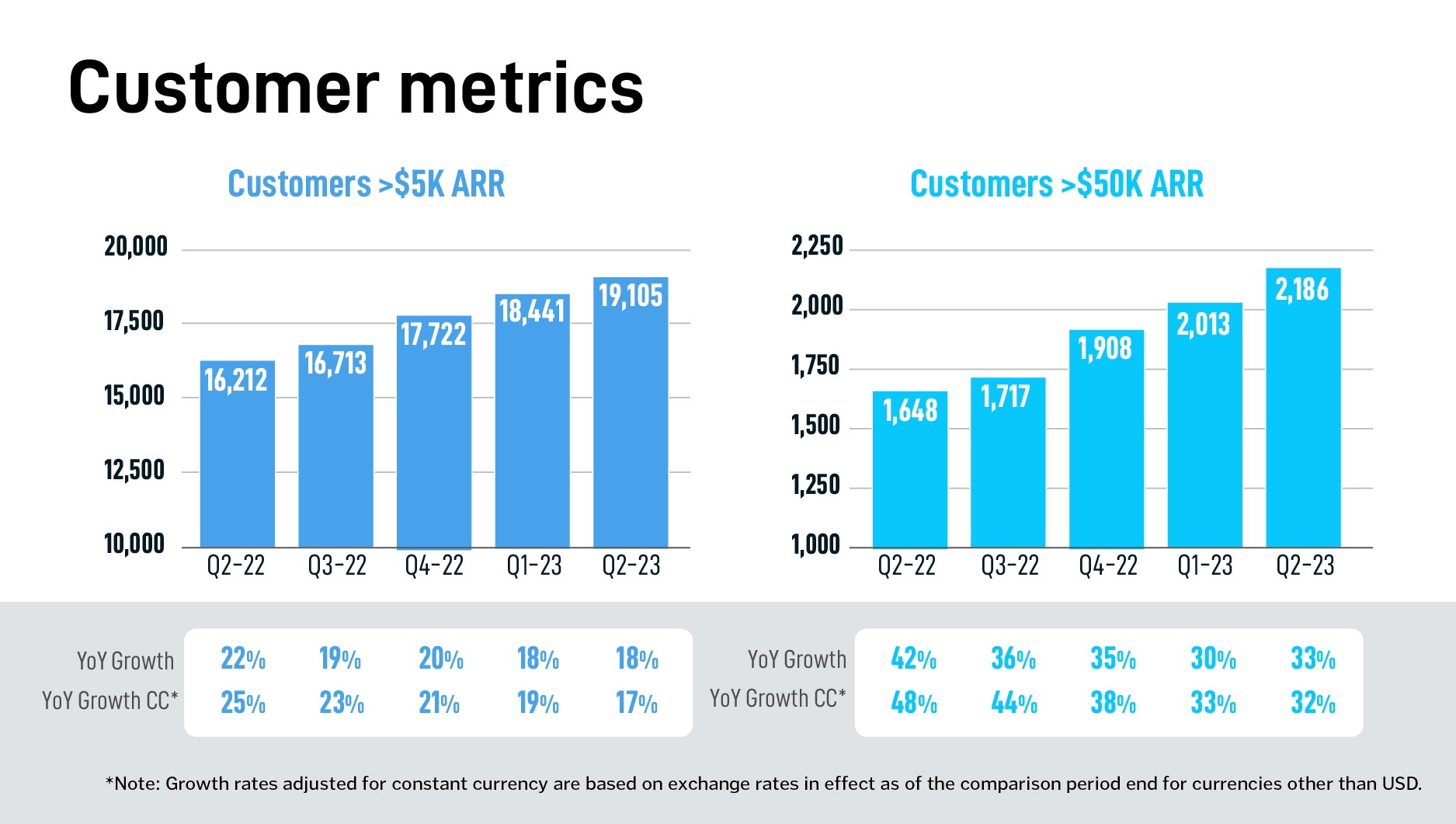

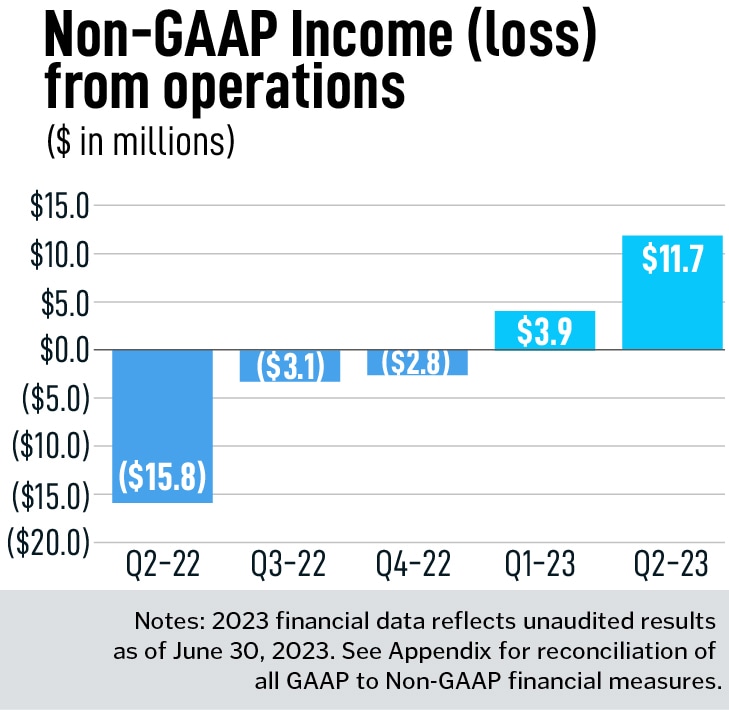

However, the Chennai-to-San Mateo software company retains most of its gains since the beginning of May when it reported its first quarter of profits as a listed entity. Two weeks ago on August 1, when Freshworks reported its Q2 or June-quarter earnings, the software company improved on its Q1 numbers, posting higher profits on a non-GAAP basis.

This was also the first time Freshworks posted profits in back-to-back quarters since listing in the US two years ago. The company also exceeded analysts’ expectations on revenue and earnings and even raised its outlook a little bit for the full year 2023 from its May 2 estimate.

The day after its Q2 numbers came out on August 1, Freshworks stock jumped to as much as $23.09 from the previous day’s close of $18.24 – a 12-month high, nearly doubling from the low of $11.92 in early November.

CFO Tyler Sloat, was among the directors and top executives who sold some of the stock they’d been previously awarded. Sloat sold these shares, for the first time since the company went public, in accordance with a pre-established plan adopted in December 2022. The plan, referred to as the 10b5-1 trading plan, allows insiders of public companies in the US to buy or sell shares in a manner that ensures they don’t benefit by privileged information and remain compliant with the securities rules in the US.