How Mercedes Benz's strategic patience made it India's largest luxury carmaker

Even as its competitors were folding up operations in India, the German automaker persisted. Three decades after it first came to India, the gamble has paid off and Mercedes is now moving from chasing volumes in the growing luxury segment to focusing on the top end of the pyramid

Santosh Iyer, MD & CEO, Mercedes-Benz India Pvt. Ltd.

Image: Anirudha Karmarkar for Forbes India

Santosh Iyer, MD & CEO, Mercedes-Benz India Pvt. Ltd.

Image: Anirudha Karmarkar for Forbes India

They say patience is a virtue. And it most certainly has been for German luxury automaker Mercedes Benz in India.

The carmaker is among the oldest in the Indian automobile landscape, having come to Indian shores some 30 years ago, as the country opened up its economy. Mercedes's obvious bet then was to appeal to the monied and newly minted millionaires in the country, who had long been deprived of global luxury automakers, having to make do with the likes of Maruti Suzuki and Hindustan Motors’ Ambassador.

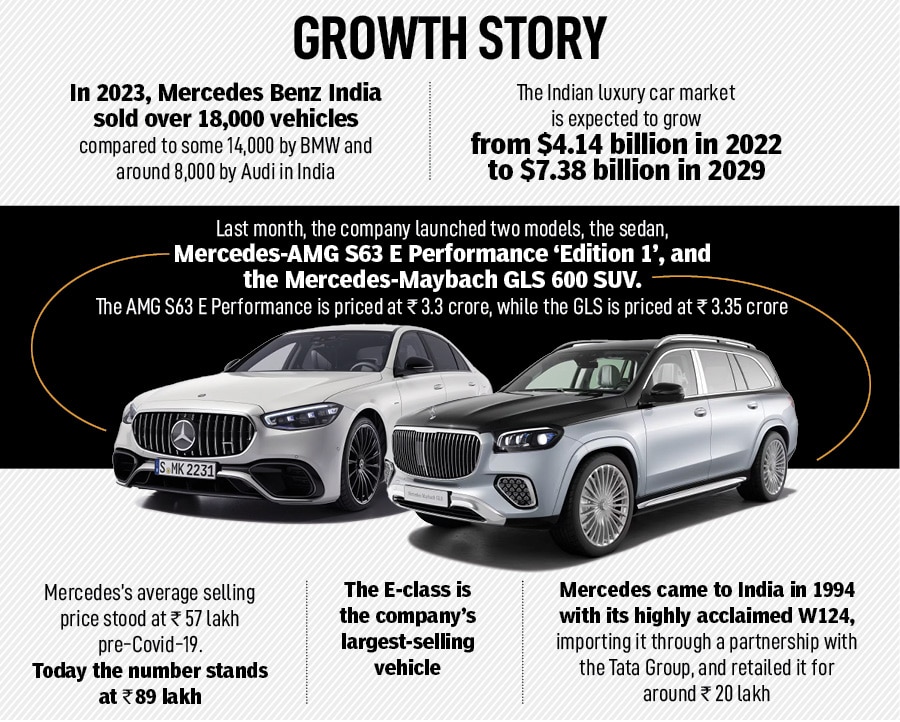

The Stuttgart-headquartered automaker brought its globally acclaimed W124 in 1994, importing it through a partnership with the Tata Group, and retailed it for around Rs 20 lakh, a princely sum then.

Then, even as many of its compatriots, including those from the US, Germany, and South Korea, who came around the same time as Mercedes in India folded up, the German automaker held its ground choosing instead to set up an assembly plant in the country. It’s another story that the carmaker's chief rivals, BMW and Audi, took another decade to understand the growing potential in India before it set foot in the country.

“We use a term called strategic patience and the 30 years in India is a clear reflection of our strategic patience in India,” Santosh Iyer, the first Indian CEO to head Mercedes Benz India, tells Forbes India. “We believed in India and between 1994 to 2009, it was more of flat growth. But we invested in our plant and that shows the clear commitment to the market.”