Hydroponics' coming of age: Tech-enabled ventures with an eye on profits, and investor interest

Hydroponic farming in India is coming of age with large-scale ventures that use efficient and indigenised technology, and claim to be profitable. The sector is also attracting investor interest

Nutrifresh Farms co-founder & CEO Sanket Mehta and co-founder Ganesh Nikam at Nutrifresh farms, Pune

Image: Swapnil Sakhare for Forbes India

Nutrifresh Farms co-founder & CEO Sanket Mehta and co-founder Ganesh Nikam at Nutrifresh farms, Pune

Image: Swapnil Sakhare for Forbes India

When you think of Rajasthan, you will probably imagine sand dunes, camels and women carrying pots of water over long distances. This year, it has been raining very heavily for the last two months, and the last two weeks have been the worst,” says Tusshar Aggarwal, co-founder of Rise Hydroponics, during a conversation in early August. “Climate change is real.”

That the monsoon this year has been unusual in its onset, severity and distribution has been in the news, given the severe damage to life, property and infrastructure it has caused in the northern and northwestern regions of the country, while falling short of normal in the eastern regions. In the short term, erratic rainfall affects the sowing of crops and consequent prices of food commodities, and in the longer term, it raises the question of food security.

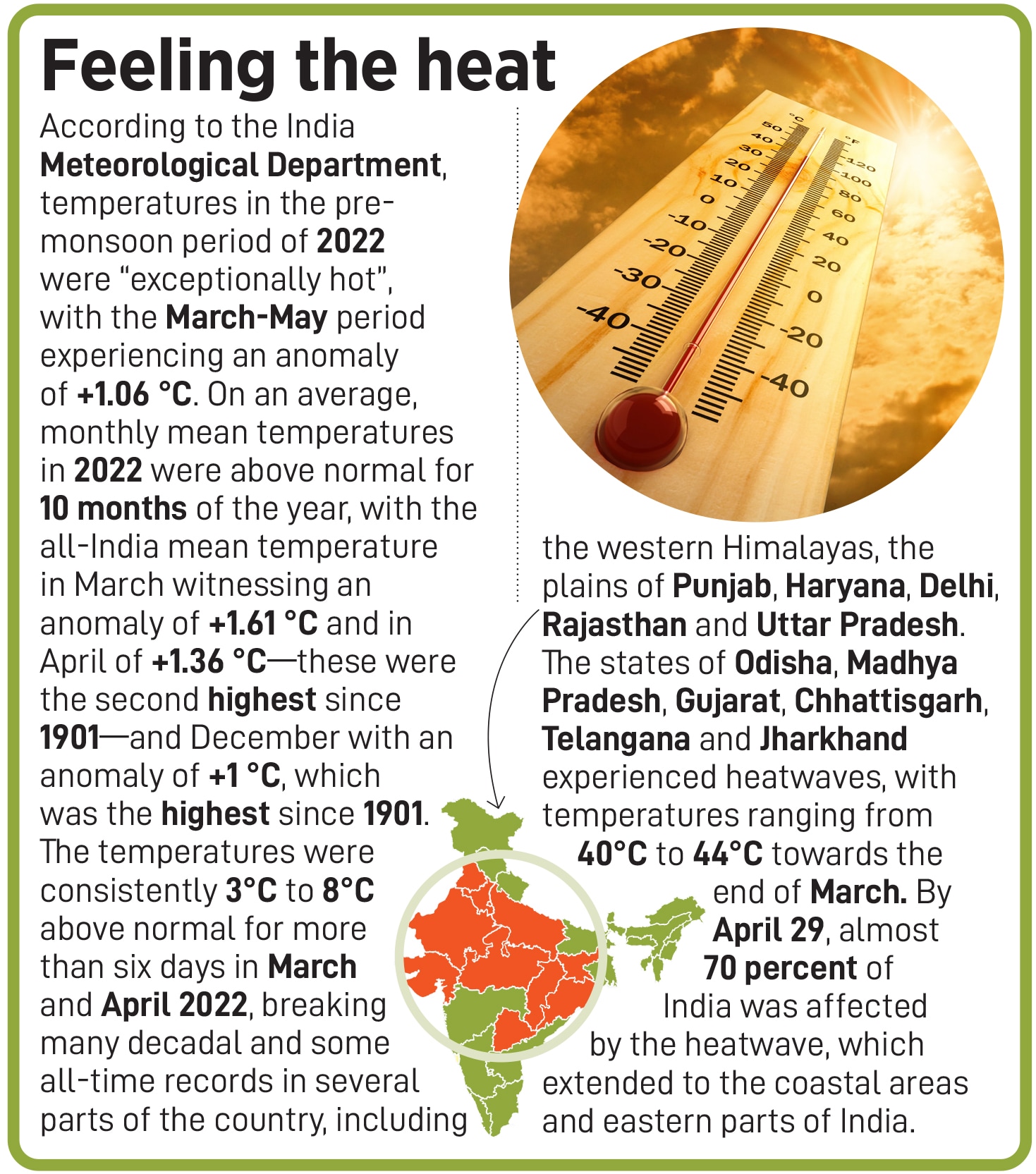

And it is not just rainfall that is at play: Extreme temperatures pose an equal threat. In a report titled Statement on Climate of India during 2022, India’s Ministry of Earth Sciences and India Meteorological Department (IMD) highlight in detail the extreme heat conditions affecting the country (see box) in the pre-monsoon months. The report concludes: “Anomalously high temperatures during these months adversely affected grain filling and caused early senescence, thus reducing crop yields, especially wheat.”

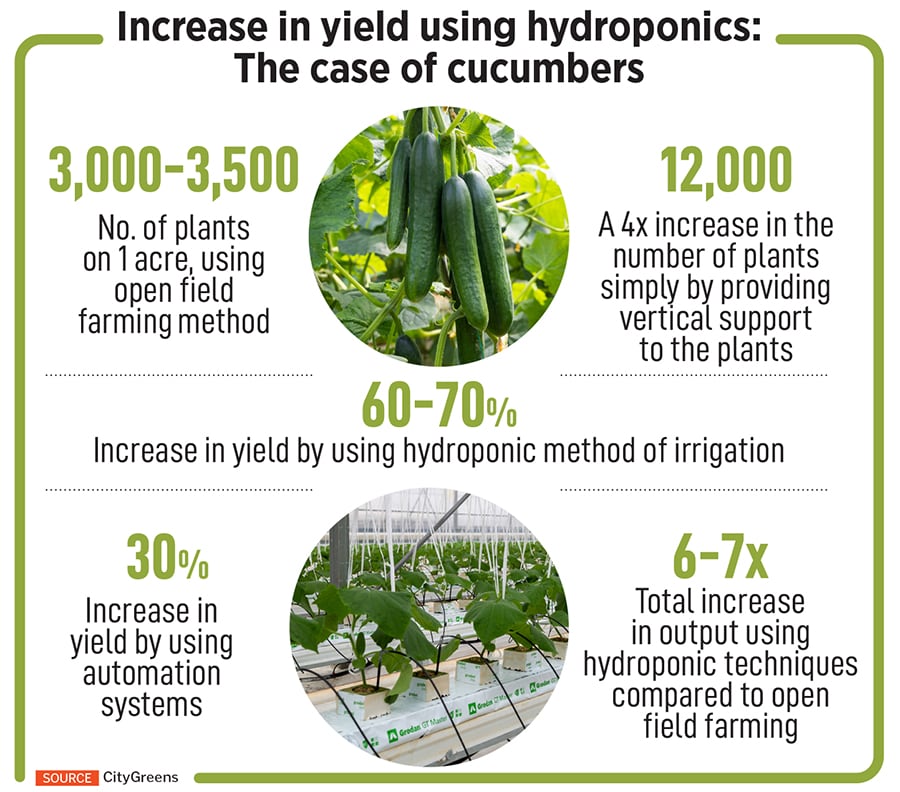

In a country where agriculture and allied sectors, according to the government, contributed 18.3 percent of GDP in 2022-23, and the farm sector employed 45.5 percent of its labour force in 2021-22, the impact of climate change on food security and employment cannot be stressed enough. In order to adapt to unpredictable weather and soil conditions, the agriculture sector is witnessing the growth of ventures that are adopting various technologies to mitigate the impact of erratic rainfall and heat, while increasing yield manifold (see box) and decreasing the use of harmful chemicals.

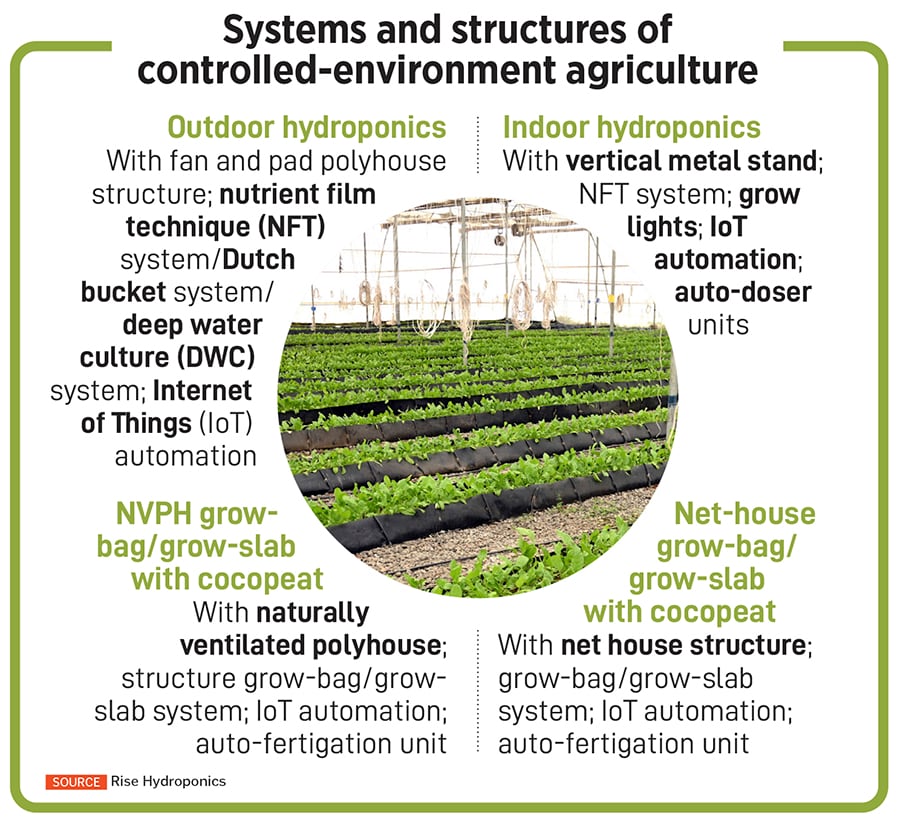

As entrepreneurs implement various controlled-environment agriculture (CEA) technologies, including hydroponic, vertical farming, nutrient film technique (NFT), Internet of Things (IoT) and polyhouses, investors too are showing increased interest and involvement in the sector. It is also true that while all investors are not yet convinced about the scalability and profitability of CEA ventures, for others these ventures fulfil their environment, social and governance (ESG) investing criteria.