India stares at higher food prices with fears of weak monsoon

After a good start, the 'pause' in rains across most regions has led to a delay in the sowing of kharif crops, stoking concerns of food inflation and higher-for-longer interest rates

Nearly 50 percent of India’s agricultural land depends solely on the monsoon for irrigation. A poor monsoon can lower agricultural output and stoke higher food prices and inflation.

Image: Amit Dave / Reuteres

Nearly 50 percent of India’s agricultural land depends solely on the monsoon for irrigation. A poor monsoon can lower agricultural output and stoke higher food prices and inflation.

Image: Amit Dave / Reuteres

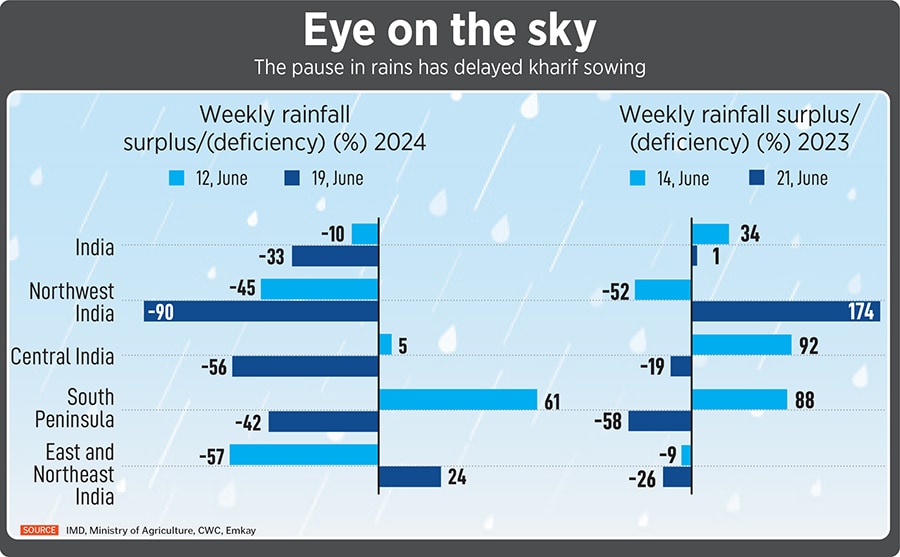

Early forecasts of a normal and above normal rainfall seem to have gone awry in June. The India Meteorological Department’s (IMD) and Skymet’s prediction for this year had fanned expectations of a strong rural recovery and some respite from rising food prices. However, the progress of monsoon has dashed hopes of abundant rainfall. June witnessed below normal rainfall, which was 17 percent below the long-term average (LTA).

Monsoon trackers also note a high spatial divergence: The northern and western regions of India witnessed a shortfall of 61 percent, central India a shortfall of 28 percent, east and northeastern regions saw 7 percent deficient rainfall; but the southern peninsula has received 10 percent surplus rains so far. IMD, however, stands by its forecast of above normal rainfall this calendar year, although it has downgraded its June forecast to ‘below normal’ from ‘normal’ rainfall due to slow progress of the monsoon.

Nearly 50 percent of India’s agricultural land depends solely on the monsoon for irrigation. A poor monsoon can lower agricultural output and stoke higher food prices and inflation.