India tech startup funding in 2023: Takeaways from a five-year low

It was a year in which the slowdown that started the previous year hit a new low, and making money became important again, versus burning it

India’s tech startup ecosystem continues to face the effects of the funding slowdown throughout 2023, with $7 billion in total funding, as of December 6.

Image: Shutterstock

India’s tech startup ecosystem continues to face the effects of the funding slowdown throughout 2023, with $7 billion in total funding, as of December 6.

Image: Shutterstock

“While the funding slowdown in 2023 presents challenges for the Indian tech startup ecosystem, we remain optimistic about the future,” Neha Singh, co-founder of Tracxn, says in the private markets intelligence provider’s latest report on the funding scene in India’s startup ecosystem. In a year when large global names that drove the funding frenzy of previous years were absent, favourable government policies and a fast-growing local economy will help India’s startups succeed, Singh says.

Here are the top takeaways from Tracxn’s recent report on funding in India’s tech startup landscape in 2023:

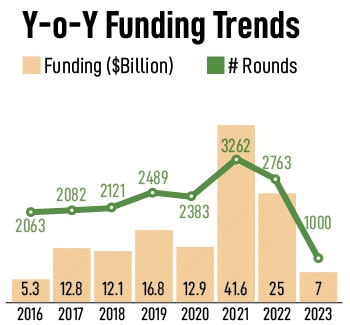

Lowest funding in five years

India’s tech startup ecosystem continues to face the effects of the funding slowdown throughout 2023, with $7 billion in total funding, as of December 6. This is a 72 percent drop over $25 billion in 2022, and the fall made 2023 the lowest-funded year in the last five years.The October-to-December three-month period has received a total funding of $957 million, making it the lowest funded quarter since September 2016. The decline is primarily due to the biggest drop in late-stage funding, by over 73 percent to $4.2 billion in 2023 from $15.6 billion in 2022. At 17, the number of $100 million-plus rounds this year, is 69 percent lower than in 2022.

India fell one position to end 2023 as the fifth-most funded geography globally, from rank four in 2022 and 2021.

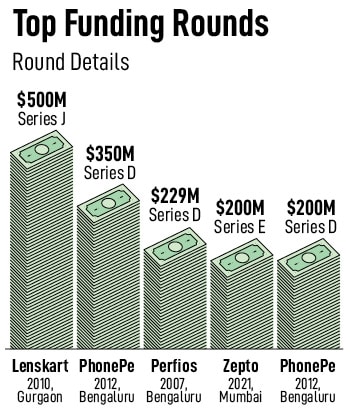

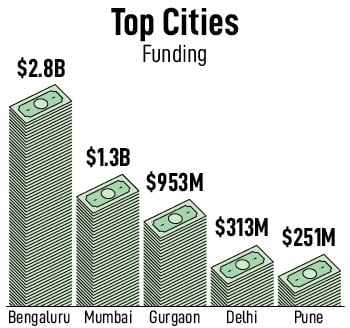

The Indian tech ecosystem saw only 17 investments that were more than $100 million in value in 2023 versus 55 last year, a 69 percent drop. Lenskart, PhonePe, Perfios and Zepto are some of the top funded companies in India in 2023.

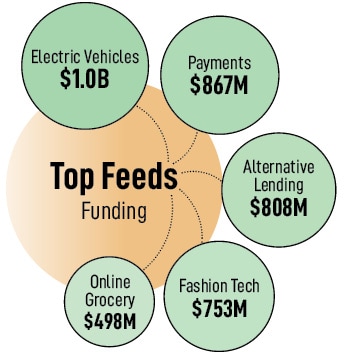

The Indian tech ecosystem saw only 17 investments that were more than $100 million in value in 2023 versus 55 last year, a 69 percent drop. Lenskart, PhonePe, Perfios and Zepto are some of the top funded companies in India in 2023. In 2023 the sector received $2.1 billion in funding versus $5.8 billion in the same period last year. PhonePe was the top-funded company in the sector in 2023, receiving a total of $750 million in four Series D rounds. This alone accounted for 38 percent of the total funding received by the sector. Perfios, InsuranceDekho and KreditBee were some of the other top funded companies in the sector this year.

In 2023 the sector received $2.1 billion in funding versus $5.8 billion in the same period last year. PhonePe was the top-funded company in the sector in 2023, receiving a total of $750 million in four Series D rounds. This alone accounted for 38 percent of the total funding received by the sector. Perfios, InsuranceDekho and KreditBee were some of the other top funded companies in the sector this year. The liberalised privatisation policies announced by the government have made space tech more attractive to VCs as well as strategic investors. The funding in 2023 for the sector rose a modest 6 percent versus $115 million in 2022. Google’s investment in satellite-based imaging company Pixxel was a highlight in 2023 in Indian space tech.

The liberalised privatisation policies announced by the government have made space tech more attractive to VCs as well as strategic investors. The funding in 2023 for the sector rose a modest 6 percent versus $115 million in 2022. Google’s investment in satellite-based imaging company Pixxel was a highlight in 2023 in Indian space tech. At a global level, economies were able to perform better than anticipated at the start of 2023, global inflation is easing slowly and the effects of the Russia-Ukraine war are also expected to slowly fade in 2024, which will help inflation cool off even further, according to Tracxn.

At a global level, economies were able to perform better than anticipated at the start of 2023, global inflation is easing slowly and the effects of the Russia-Ukraine war are also expected to slowly fade in 2024, which will help inflation cool off even further, according to Tracxn.