- Home

- UpFront

- Take One: Big story of the day

- IPL 2022: Will Rajasthan Royals 2.0 slay goliath again?

IPL 2022: Will Rajasthan Royals 2.0 slay goliath again?

Beset by middling performances and off-field woes, RR has remained the perennial underdogs. Now, with both its administration and team in order, it has set its eyes on the title

Kathakali has been a journalist for a decade and a half, working previously with The Telegraph and Times of India. An MA in political science and a Chevening Fellow, she writes on various themes--the business of sports, pop culture, startups, innovation--and co-produces the video series, From the Field. She is also part of the desk, editing, rewriting and putting the print edition to bed. Kathakali is a sports nut and collects autographs as a hobby. She enjoys travelling and music, and you'll often find her humming completely out of tune.

- Inside the Rajasthan Royals high-performance centre that groomed Sanju Samson, Yashasvi Jaiswal, Dhruv Jurel

- In 10 years, RCB should be a global brand beyond just cricket: Rajesh V Menon

- Beyond cricket: How brand RCB is being built

- Why Adidas is betting big on Indian cricket

- In tough times, stay positive: Pawan Sehrawat

Despite being the underdogs, Rajasthan Royals won the first edition of the IPL in 2008, but they haven't been able to repeat the feat ever since

Image: Santosh Harhare / Hindustan Times via Getty Images

Despite being the underdogs, Rajasthan Royals won the first edition of the IPL in 2008, but they haven't been able to repeat the feat ever since

Image: Santosh Harhare / Hindustan Times via Getty Images

In January 2008, uber-posh limousines lined outside Mumbai’s Wankhede Stadium as their owners arrived at the office to submit their bids for eight Indian Premier League (IPL) teams. Manoj Badale, a venture capitalist who was based in the UK and was representing Emerging Media, a consortium of bidders, reached in a Honda and snuck past the throng of jousting journalists and photographers—his wasn’t a recognisable face and he hardly looked the part of an aspiring cricket mogul. “They assumed we were from the press,” says Badale.

Related stories

In the boardroom later that afternoon, where the sealed bid envelopes were being opened, Badale had a sinking feeling as Mukesh Ambani’s Reliance Group emerged as the highest bidder with an astronomical $111.9 million, nearly double of what Emerging Media had offered. Colossal numbers rolled in one after the other, seven franchises were allotted, and Badale had almost given up, when his name was called out. Jaipur remained the only unpicked franchise yet and Emerging Media’s bid of $67 million managed to scrape through as the last of the winning bids.

Badale, born in India and brought up in the UK, doesn’t like to talk much about himself. It’s the one question the co-founder of Blenheim Chalcot, a leading tech venture builder in the UK, skirts during the 45-minute Zoom call. In the melee of top industrialists and film stars who own IPL teams, he remains the most low-key and unassuming. In an unhappy coincidence, similar adjectives could define his team Rajasthan Royal’s (RR) performance in the world’s foremost franchise T20 cricket league.

In a glorious repeat of the David-beats-Goliath story, RR won the title in the first season in 2008, led by the incomparable Shane Warne who had, by then, retired from international cricket. But the team has never come close to repeating the feat again, having made it to the playoffs only thrice since, and never another final. Its Moneyball philosophy—one that was famously scripted by Oakland Athletics’ general manager Billy Beane—that banked on a data-driven selection of low-cost, high-return players didn’t yield dividends thereafter. In 2020, it finished bottom of the heap, and did only one better in 2021, justifying the underdog tag that the team has been bearing since forever.

But Badale and his team have been hard at work to make these statistics a thing of the past. Consider that in the recently-concluded mega auction, RR spent Rs 89.05 crore to buy players, which is 98.9 percent of the mandated Rs 90 crore purse: Its spend hovers in the Rs 89-plus crore bracket along with top teams like Mumbai Indians, and eclipsing the likes of Royal Challengers Bangalore (RCB, Rs 88.4 crore) and Chennai Super Kings (CSK, Rs 87.5 crore). Compare this with the mere 74 percent of the mandated purse it had spent to buy players in the first IPL auction in 2008.

In the early days, says Badale, when the franchises were loss-making, his clear strategic imperative was to break even. “A franchise’s biggest cost is players, so we were particularly value-conscious with our players,” he says.

The look and feel of the balance sheet began to change from the middle of the last decade, when the central revenue pool, which comprises the title and the media rights, and is shared between the Board of Control for Cricket in India (BCCI) and all the franchises, began to surge. In 2018, the last time the media rights were sold, Star India paid Rs 16,347.5 crore for broadcasting the tournament for five years—50 percent of which was split between the eight franchises. Tenders for the 2023-27 cycle will be floated any day now and the rights are expected to fetch anywhere between Rs 40,000 and Rs 50,000 crore, bringing in a windfall for the 10 franchises to play during that period.

The look and feel of the balance sheet began to change from the middle of the last decade, when the central revenue pool, which comprises the title and the media rights, and is shared between the Board of Control for Cricket in India (BCCI) and all the franchises, began to surge. In 2018, the last time the media rights were sold, Star India paid Rs 16,347.5 crore for broadcasting the tournament for five years—50 percent of which was split between the eight franchises. Tenders for the 2023-27 cycle will be floated any day now and the rights are expected to fetch anywhere between Rs 40,000 and Rs 50,000 crore, bringing in a windfall for the 10 franchises to play during that period.

The multiplying profits have had a bearing on RR’s player selections, with the franchise channelling more money towards roping in illustrious names. “In the last mega auction, in 2018, we did well for our overseas player selections. Look at players like Jos Buttler, Jofra Archer, who have now become world-beaters in the format,” says Badale. “But we under-invested in two areas: The Indian stars who were the emerging short-format specialists; and the second thing we got wrong was that we were building a squad for a time that was years away, thereby missing out on the first team of the here and now.”

Which is where Team RR has skewed the ratio this year, taking big, bold bets in an attempt to extricate themselves from the also-rans and join the league of serious contenders. About 85 percent of RR’s players’ salary this year has gone towards buying those who will likely form its first XI, and over 80 percent for an Indian backbone that includes formidable spinning duo of R Ashwin and Yuzvendra Chahal, prolific opener Devdutt Padikkal, and young quicks Prasidh Krishna and Navdeep Saini. “If you look at our auction strategy this year, it’s the first time we are going into an IPL with seven players that have represented India,” says Badale.

Says Ayaz Memon, sports columnist and commentator, “In T20s, everyone is ultimately looking for impact players. And RR was quite adventurous this time in picking those players who could win them the title. They’ve been very imaginative in certain departments, and the Ashwin-Chahal combine on paper looks to be a winning formula.”

Badale, though, doesn’t completely write off the playing achievements of RR 1.0. “People talk about our mediocre performances. But if you look at the team between 2008 and 2014, we won one, made three playoffs and missed two others narrowly. Even though we didn’t reach the top, we were consistent,” he says. “But we had a number of off-field distractions which forced us to invest a lot of time away from the game.”

In 2010, for instance, RR received a termination notice for having among its investors Suresh Chellaram, the brother-in-law of now-ousted IPL commissioner Lalit Modi. The case was squashed later. But the fire that singed RR the worst was the spot-fixing scandal in 2013 in which co-owner Raj Kundra, husband of Bollywood actor Shilpa Shetty and a 10 percent shareholder in the franchise, was accused of betting during the tournament. After a protracted legal wrangle that went on till 2015, the franchise was banned for two years.

“The first thing you do when such things happen to you is reflect,” says Badale. “And the second thing is to look at what are the uncontrollables that have created those issues, and how do you make them controllable.”

When the team returned to the IPL fold in 2018 after serving its ban, one of Badale’s first priorities was to “pick a side that would be competitive, but also make sure we had a controversy-free time”, he says. In terms of shareholding, it meant buying out the stakes of both Chellaram and Kundra by 2019, while internally he brought in an administrative structure that would restore accountability, governance and control.

Enter the likes of Jake Lush McCrum, a Young Turk from Blenheim Chalcot, who first joined as a consultant in end-2017, and has since been elevated as CEO; iconic cricketer Kumar Sangakkara, who was roped in as director of cricket operations in 2021; Sri Lankan great Lasith Malinga, who recently joined the team as the fast bowling coach—all of whom are part of a group that has come together to give shape to Badale’s vision of building a cricket franchise that will play with panache on the field and build commercial imperatives off it that are bigger and more ambitious than what RR has seen in the last 10 years.

RR was a franchise that Sangakkara had keenly followed ever since their victory in the first season after Warne. “It did have its ups and downs in consequent years, but it always had a good, exciting young team. They’ve developed a lot of good players and then released them into other franchises. They also always attempted to get players of good value without paying high prices. It was a really interesting and quirky way of looking at the IPL and building teams. It didn't always work, but there was a lot of promise,” says Sangakkara.

For Lush McCrum, on the other hand, the priority was to bring in a structure and process to the business, “and, importantly, have a controversy-free season”. To that end, the franchise set up an advisory council in 2018—comprising senior lawyers, bankers, marketeers—that worked with them on a quarterly basis, resolving compliance and governance issues. “We also brought in ex-ATS chief KP Raghuvanshi as our chief security officer, and deployed two security officers, one inside the bubble and one outside, in addition to the integrity officer BCCI appoints for each franchise, to ensure robust security and governance structures,” adds Lush McCrum.

Lush McCrum’s other priority, as the team returned to the IPL fold in 2018, was to re-engage the fan base leveraging the power of digital. “To understand our fan base and deliver them the best personalised content possible,” he says. “Once you have that, you can commercialise it across all your revenue streams.”

It began with chiselling its social media presence into a cheeky personality that fans across IPL teams would connect with—RR’s social media was that friend who could crack a joke and take one as well. Throw a biryani banter at Sunrisers Hyderabad (SRH) when the latter loses, but stomach the dal-baati-churma ribbing when they beat you in the return leg.

Its ability to laugh at itself has earned RR a social media following, bucking the trend of winner-takes-it-all, fan bases following performances that is. Despite its middling show on the field, RR has recorded 149 percent more engagement on social media in 2021 than in 2020, and increased its reach by 83 percent. “RR’s social media handles don’t talk at people, they talk to them,” says Hitesh Rajwani, founder and CEO of Social Samosa, social media analysts. “This year they posted a meme asking followers to retweet them beyond a certain number if they wanted Chahal to open with Buttler. Such measures break the wall of being just a team and turn them into humans. A social media following can’t win them matches, but it makes the franchise more sustainable.”

Badale admits he was slow to warm up to the power of digital, but has now realised that the world of sport has moved closer to the world of tech, a field he has been working in for the last 25 years, than ever before, with initiatives that transcend mere social media following to range from edtech to NFTs (non-fungible tokens). RR started playing catch-up to other franchises when they returned in 2018, but were quick to build a database, content capabilities and CRM (customer relationship management) to commercialise them across revenue streams—be it ticketing, merchandise, or even for online education for courses in leadership and performance, for which the franchise has tied up with Insead and Deakin University.

“But education isn’t just a commercial asset for us,” says Lush McCrum. “It is a vehicle to give back to the IPL players who can upskill themselves when they retire and join the industry.”

The structural changes are now visible from the outside, evident in RR’s deportment not just on the field, but off it too. Consider their partnership with sanitary napkin brand Nine two years ago. The association not only brought Nine visibility and a 3 percent increase in market share pan-India, but also helped RR start a conversation on a taboo subject. “The team was brave enough to take the sponsorship and create a noise in the market,” says Paroksh Chawla, CEO of ITW Catalyst, the consulting arm of ITW. “Imagine the impact of bringing a female-centric brand on the biggest male-authoritative platform.” Chawla also recalls that when helmet brand Studds chose to be associated with IPL for the first time in 2021, it picked RR for its breadth and quality of content.

Now that the house is finally set in order, and structures put in place to ensure it has a clean sheet off the field, RR’s focus is back on field. And they believe they have the team for it, beginning this year. “We started a transition in 2018, and that has been done. Now on-field performance is No 1. Everything else comes second,” says Lush McCrum.

Besides winning that trophy, he has his eyes set on emulating the brand success of global sports franchises, like Liverpool or the San Francisco 49ers. “My target is for us to become one of the leading sports franchises in the world. We will continue to learn a lot from teams and groups in various countries, but I think the western world will look more and more actively at India and South Asia as a growth destination, and I believe we can be the perfect platform to optimise their expansion plans,” says Lush McCrum. "In the long run, my vision is for the Royals Sports Group to be seen alongside the likes of the City Football Group and FSG."

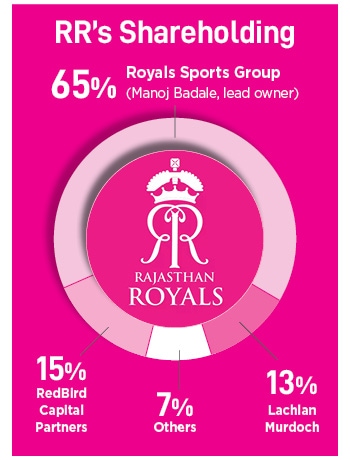

To that end, RR, in 2021, sought out a co-investor in US-based RedBird Capital Partners, which has interests in the parent company of Liverpool, and Boston Red Sox. Badale’s Emerging Media now has a 65 percent stake in the group, with RedBird picking up 15 percent for an undisclosed amount. Badale wants to deploy the capital in its international business (last August, it bought the Barbados Royals franchise in the Caribbean Premier League), in leveraging the fan base and transforming the technology platforms.

“In the first 5-7 years, we were so cost-conscious that we didn’t make adequate investments in brand-building, kits and merchandise, social media presence, and general, local and generic marketing,” says Badale. “We are now trying to fix that, and we are probably just two years into our five-year journey.”