IPOs heat up again; issues worth Rs39,000 cr to test market's appetite

28 companies are aiming to raise a total of Rs38,690 crore through public listings. Is weakness in the markets prepared to absorb such liquidity now?

A total of 28 companies aiming to raise a cumulative sum of Rs38,690 crore have already received approval of market regulator Securities and Exchange Board of India (Sebi), according to a Forbes India analysis based on Prime database.

Image: Shutterstock

A total of 28 companies aiming to raise a cumulative sum of Rs38,690 crore have already received approval of market regulator Securities and Exchange Board of India (Sebi), according to a Forbes India analysis based on Prime database.

Image: Shutterstock

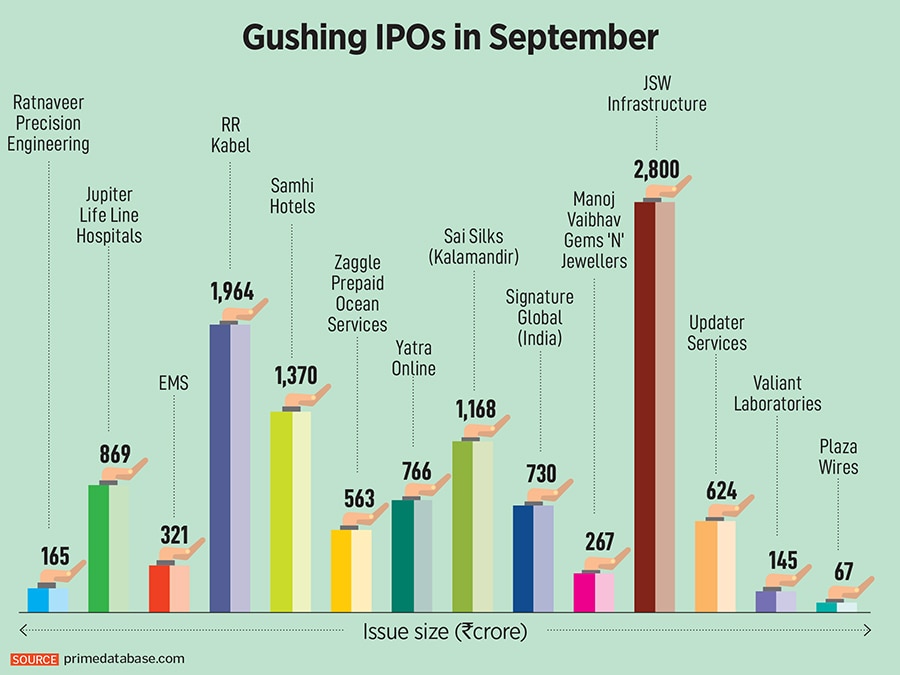

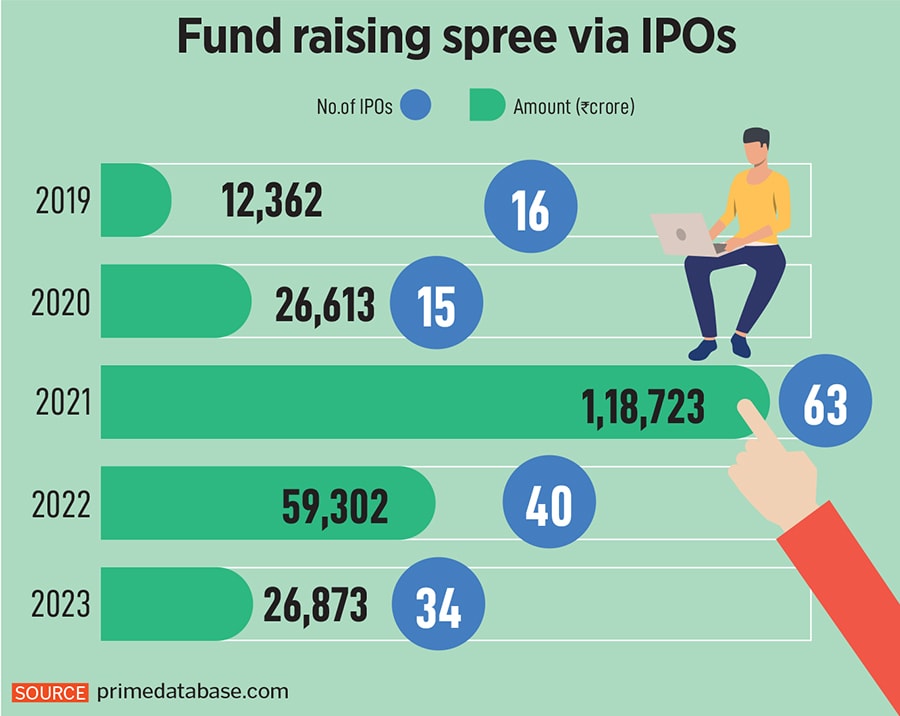

Who says IPO markets have cooled off or have lost their charm? A glance at the primary markets in September will show a picture that is just the contrary. In September, 14 companies launched their initial public offerings (IPOs) to cumulatively raise Rs11,821 crore, in one of the busiest months of the primary markets in 2023. However, the stock markets were weak, with the Sensex declining around 300 points in September.

Typically, strong secondary markets follow a gush of IPOs, when promoters remain confident of their companies’ valuations and their ability to raise funds. Healthy markets in July and August boosted that confidence, but the rally fizzled out soon, puzzling investors and promoters of companies, and may further pose a threat to the slew of IPOs waiting to open for subscriptions and subsequent listings.

A total of 28 companies are aiming to raise a cumulative sum of Rs38,690 crore and have received approval from the Securities and Exchange Board of India (Sebi), according to a Forbes India analysis based on Prime Database. Some of the big companies in the fray are EbixCash (Rs6,000 crore), Tata Technologies (Rs5,000 crore), Indegene (Rs3,200 crore), Tata Play (Rs2,500 crore), IndiaFirst Life Insurance (Rs2,000 crore) and Honasa Consumer, owner of MamaEarth (Rs400 crore).

Another 32 companies have filed offer documents with Sebi and are awaiting its approval. Some marque companies awaiting approval are Oravel Stays, owner of Oyo Hotels (Rs 8,430 crore), NSDL (Rs4,500 crore), Fincare Small Finance Bank (Rs1,000 crore), Muthoot Microfin (Rs1,350 crore), Fedbank Financial Services (Rs1,700 crore) and Jana Small Finance Bank (Rs1,100 crore).

However, unfavourable factors such as crude oil nearing $100 per barrel, which may weigh on inflation toppling the fiscal maths, are already threatening the rise of Indian equities. Foreign institutional investors (FIIs) have also started withdrawing money from equities, with the net outflow at $1.66 billion in September.