IT services companies Q1 margins show early signs of impact of slowdown

India's top IT companies are going after growth amid a global economic slowdown, and they are willing to give themselves more elbow room by loosening up on margins

Salil Parekh, CEO and MD, Infosys

Image: Jason Alden/Bloomberg via Getty Images

Salil Parekh, CEO and MD, Infosys

Image: Jason Alden/Bloomberg via Getty Images

While making gung-ho claims about continued growth opportunities ahead, CEOs of India’s top IT companies aren’t leaving anything to chance as the world prepares for a slowdown and a recession in the US, the biggest technology market.

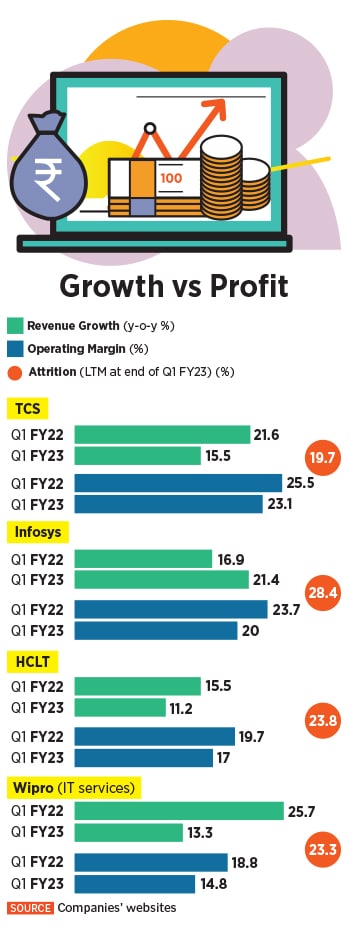

In fact, the current fiscal year’s first quarter’s numbers show that Tata Consultancy Services, Infosys and others are willing to trade some profit margins if it wins them large contracts and keeps the cash flow going.

“Right now it’s a smart strategy to grow revenues to take market share and accept lower margins, for now,” Ray Wang, founder and principal analyst at Constellation Research tells Forbes India in an email. “There is a labour market shortage and if you have the contracts, you have the work guaranteed to bring on new staff and train them so you can achieve a lower cost for delivery in the longer run,” Wang explains.

“Right now it’s a smart strategy to grow revenues to take market share and accept lower margins, for now,” Ray Wang, founder and principal analyst at Constellation Research tells Forbes India in an email. “There is a labour market shortage and if you have the contracts, you have the work guaranteed to bring on new staff and train them so you can achieve a lower cost for delivery in the longer run,” Wang explains.