IT services: Expect strong growth and a brutal talent war ahead

India's biggest IT services companies face an intensifying talent war, even as demand momentum for tech services sustains

A view of Tata Consultancy Services Ltd. offices in the Electronic City area of Bengaluru, India, on Monday, Feb. 28, 2022.

Image: Dhiraj Singh/Bloomberg via Getty Images

A view of Tata Consultancy Services Ltd. offices in the Electronic City area of Bengaluru, India, on Monday, Feb. 28, 2022.

Image: Dhiraj Singh/Bloomberg via Getty Images

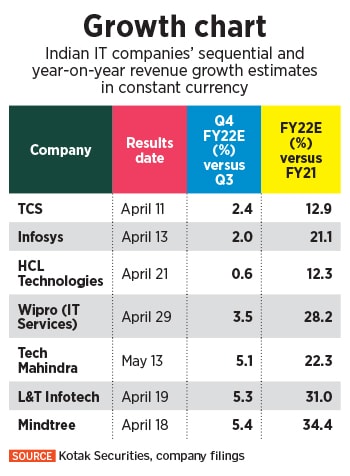

India’s top IT services companies head into another earnings season starting next week, with Tata Consultancy Services, the biggest of them, set to go first on April 11, with its fiscal fourth-quarter and full-year results. Second-ranked Infosys will release its numbers on April 13.

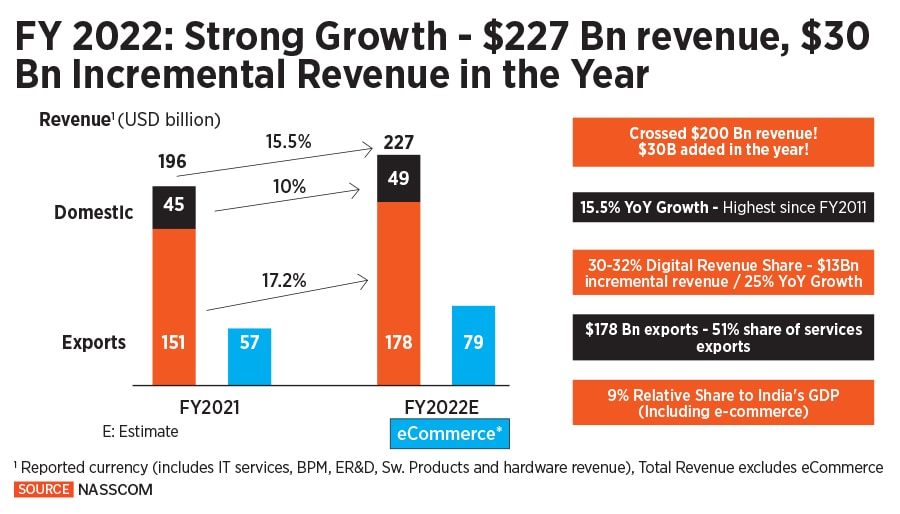

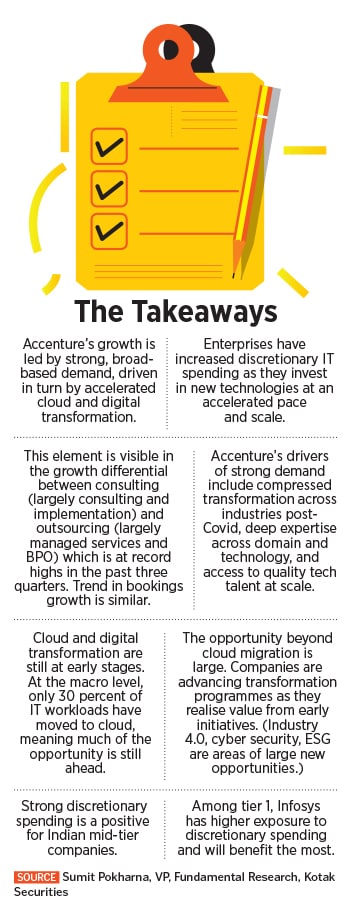

Industry lobby Nasscom estimates that the sector’s growth for the year ended March 31, 2022, will be the highest in more than a decade. And the strong numbers and aggressive forecast from Accenture, the world’s biggest consultancy and software services provider, last month, has heightened expectations that the top Indian competitors too will do well in the year ahead.

TCS, Infosys, HCL Technologies, and Wipro lead the $227 billion Indian IT sector, which is expected to continue to benefit as more companies in the world’s biggest economies look to move a greater share of their information technology workloads to the cloud, and adopt digital transformation projects.

As the rest of this year unfolds, “we expect the demand outlook to remain strong in FY23,” wrote Mukul Garg and Raj Prakash Bhanushali, research analysts at Mumbai brokerage Motilal Oswal, in a recent note to clients. “Companies will continue to post strong growth numbers on the back of tailwinds for the industry on account of digital and cloud transformation initiatives with enterprise clients.”

A combination of macro factors, including the fallout of the war in Ukraine, rising inflation in the US, which is the world’s biggest tech market, and the growing sense of urgency over climate change are headwinds. They may also, however, force the world’s biggest corporations to further step up the adoption of technology in pursuit of cyber security, and more sustainable operations, while keeping costs in check.

Accenture, the world’s largest consultancy and software services provider, reported fiscal Q2 revenues of $15 billion, an increase of 24 percent in US dollars—and 28 percent in local currency—for the three months through February, compared with the same period a year ago. The company follows a September-August fiscal year. This performance is broad-based and in every segment of the market the company competes in, says Bendor-Samuel.

Accenture, the world’s largest consultancy and software services provider, reported fiscal Q2 revenues of $15 billion, an increase of 24 percent in US dollars—and 28 percent in local currency—for the three months through February, compared with the same period a year ago. The company follows a September-August fiscal year. This performance is broad-based and in every segment of the market the company competes in, says Bendor-Samuel. Among the top five companies, analysts expect Tech Mahindra, the smallest, to report the fastest growth for the January-March quarter—5.3 percent quarter-on-quarter—on the back of the multiple acquisitions made by the company.

Among the top five companies, analysts expect Tech Mahindra, the smallest, to report the fastest growth for the January-March quarter—5.3 percent quarter-on-quarter—on the back of the multiple acquisitions made by the company.